Daily Review for June 27, 2022

The market is awaiting the conclusions of the G7 meeting. One of the most important points of discussion was the sanctions on Russia’s energy sector, and the investments and projects needed by the European Union to achieve energy independence.

The price of gold continues to gain additional points raising 0.39% and trading at USD$1,837 per Troy ounce. The metal has remained stable, mainly due to investors’ interest in the high possibility of a global economic recession.

The Nasdaq 100 is showing an interesting rebound, seeking to consolidate the 12,000 points, and then start to climb towards 13,000 points.

Bitcoin remained above USD$20,000 over the weekend. Analysts are evaluating whether a rebound could occur. The market was attentive on Friday to the liquidation of Bitcoin options.

| WTI +0.48% |

| The market is awaiting the conclusions of the G7 meeting. One of the most important points of discussion was the sanctions on the Russian energy sector, and the investments and projects needed by the European Union to achieve energy independence. At this moment the WTI is up 0.48% and is trading at USD$108.30 per barrel. Four of the G7 members, Great Britain, the United States, Japan and Canada, announced a ban on the import of Russian gold. They are also working together, Britain, France, the United States, Germany, Japan, Italy and Canada, to place a ceiling on the price of oil. |

|

| Support 1: 106.33 Support 2: 105.15 Support 3: 104.47 Resistance 1: 108.19 Resistance 2: 108.87 Resistance 3: 110.05 Pivot Point: 107.01 |

| Price is below the 200-day moving average, between resistance 1 and support 1. Expected trading range between USD$104.47 and USD$110.05. Pivot point for trend change at USD$107.01. RSI approaching the overbought zone, so traders could begin to take profit in the current zone. |

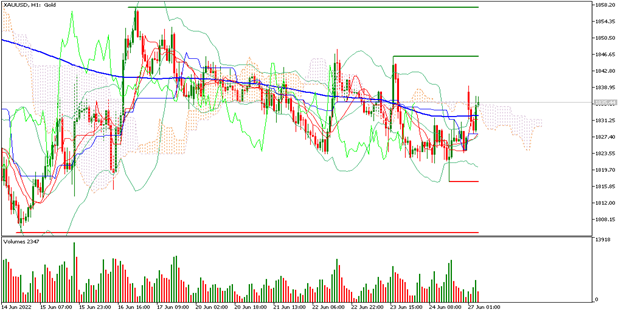

| GOLD +0.39% |

| The price of gold continues to climb additional points, currently up 0.39% and trading at USD$1,837 per Troy ounce. The metal has remained stable, mainly due to investors’ interest in the high possibility of a global economic recession. Another factor that is generating interest is the high inflation globally. One of the main issues over the weekend was the ban imposed by 4 of the G7 members on Russian gold imports. Silver is currently up 1.02% and is trading at USD$21.37 per Troy ounce. |

|

| Support 1: 1831.74 Support 2: 1827.07 Support 3: 1823.64 Resistance 1: 1839.84 Resistance 2: 1843.27 Resistance 3: 1847.94 Pivot Point: 1835.17 |

| The price is above the 200-day moving average, between resistance 1 and support 1. Expected trading range between USD$1,823 and USD$1,847. Pivot point for trend change at USD$1,835. RSI neutral, so the price could continue to rise towards USD$1,846 per Troy ounce. Banks’ gold reserves could start to increase, generating an increase in market demand. |

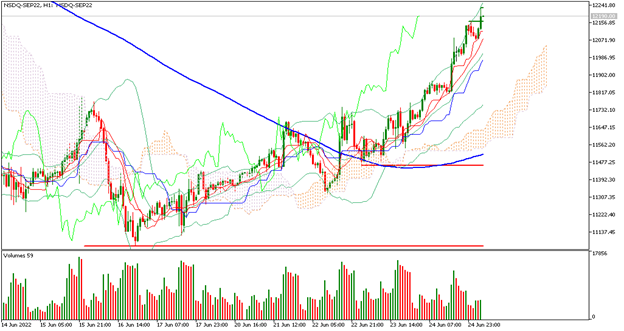

| NASDAQ 100 +0.39% |

| The index is showing an interesting rebound, seeking to consolidate the 12,000 points, and then start to climb towards 13,000 points. At the moment, the index is up 0.39% and is trading at 12,156 points. At the opening of Asia, all technology companies started the week higher. Analysts are assessing whether the floor of the market decline has been reached and a possible rebound has begun. However, the Fed’s continued intervention in the market continues to generate nervousness among investors. |

|

| Support 1: 12099.2 Support 2: 12045.5 Support 3: 12001.0 Resistance 1: 12197.4 Resistance 2: 12241.9 Resistance 3: 12295.6 Pivot Point: 12143.7 |

| The price is above the 200-day moving average, between support 1 and resistance 2. Expected trading range between 12.001 and 12.295. Pivot point for trend change at 12.143. RSI in overbought zone. Possible profit taking by traders at this point. |

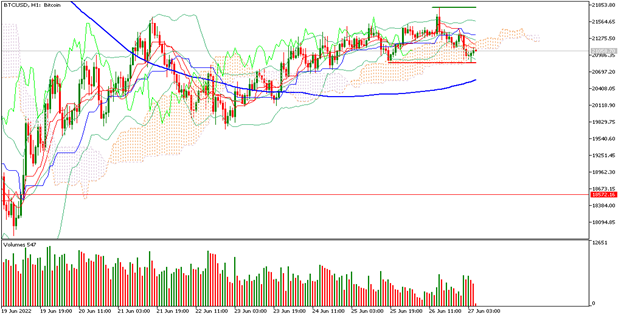

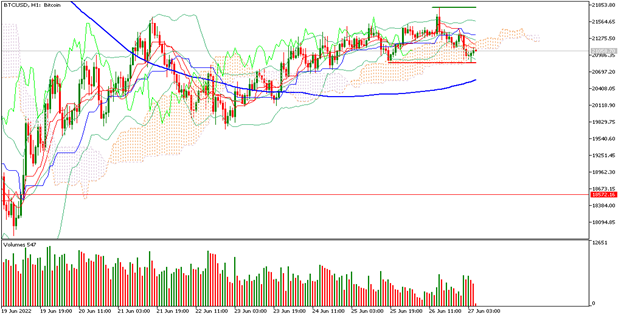

| BITCOIN -1.31% |

| Bitcoin remained above USD$20,000 over the weekend. Analysts are evaluating whether a rebound could occur. The market was on the lookout for Bitcoin options liquidation on Friday. However, they did not cause a major drop in the price. Analysts believe that miners are interested in continuing selling. This would generate a correction that would leave the price close to USD$18,000. Bitcoin is currently down 1.31% and is trading at USD$21,163. |

|

| Support 1: 21,070.2 Support 2: 20,997.9 Support 3: 20,938.5 Resistance 1: 21,201.9 Resistance 2: 21,261.3 Resistance 3: 21,333.6 Pivot Point: 21,129.6 |

| The price is above the 200-day moving average, which is a bullish signal for Bitcoin. The Price is between resistance 2 and support 1. Expected trading range between USD$20,938 and USD$21,333. Pivot point for trend change at USD$21,129. RSI neutral, so the price could correct towards USD$20,000 before changing trend. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Penafian Risiko

Sebarang maklumat/artikel/bahan/kandungan yang disediakan oleh Capitalix atau yang dipaparkan di laman webnya hanya bertujuan untuk digunakan bagi tujuan pendidikan dan tidak membentuk nasihat pelaburan atau perundingan tentang cara pelanggan harus berdagang.

Walaupun Capitalix telah memastikan bahawa kandungan maklumat tersebut adalah tepat, ia tidak bertanggungjawab terhadap sebarang peninggalan/kesilapan/salah pengiraan dan tidak dapat menjamin ketepatan sebarang bahan atau sebarang maklumat yang terkandung di sini.

Oleh itu, sebarang pergantungan yang anda letakkan pada bahan tersebut adalah atas risiko anda sendiri. Sila ambil perhatian bahawa tanggungjawab untuk menggunakan atau bergantung pada bahan tersebut terletak sepenuhnya kepada pelanggan dan Capitalix tidak menerima liabiliti untuk sebarang kerugian atau kerosakan, termasuk tanpa had, sebarang kehilangan keuntungan yang mungkin timbul secara langsung atau tidak langsung daripada penggunaan atau pergantungan pada maklumat tersebut.

Amaran Risiko: Perdagangan Forex/CFD melibatkan risiko yang ketara terhadap modal yang dilaburkan. Sila baca dan pastikan bahawa anda memahami sepenuhnya kandungan Dasar Pendedahan Risiko.

Anda harus memastikan bahawa, bergantung pada negara tempat tinggal anda, anda dibenarkan untuk berdagang produk Capitalix.com. Sila pastikan bahawa anda sudah betul-betul faham dengan pendedahan risiko syarikat.