Daily Review for June 17, 2022

The Bank of Japan left interest rates unchanged at -0.10%, indicating that the bank is maintaining its monetary policy of economic stimulus.

Traders are keeping an eye on inflation data in the Euro Zone. With analysts expecting an increase of 8.1% y/y, the market is anticipating an interest rate accommodation by the European Central Bank.

Bitcoin continues its downtrend, this time trading in a range between USD$23,000 and USD$20,000. The world’s major Bitcoin holders, including investment funds, are starting to lose money.

OPEC+ is at 2.7 million barrels per day of the production below its target.

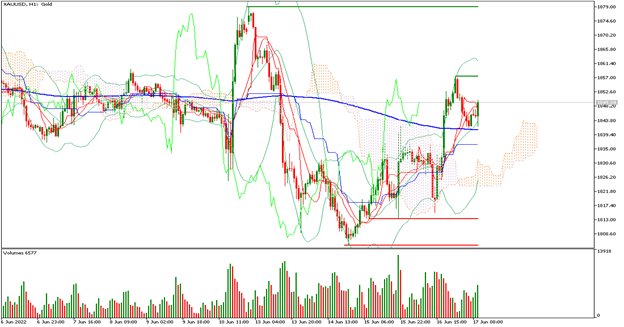

| GOLD +0.07% |

| The Bank of Japan left interest rates unchanged at -0.10%, indicating that the bank is maintaining its monetary policy of economic stimulus. The Bank also stated that it will maintain its purchase of 10-year Japanese government bonds. In this way, it is one of the first central banks globally to maintain a monetary policy strategy focused on market growth rather than inflation. Gold prices are currently up 0.07% and are trading at USD$1,851 per Troy ounce. Traders are looking forward to the Fed’s monetary policy report and Jerome Powell’s statements. |

|

| Support 1: 1846.60 Support 2: 1845.50 Support 3: 1843.90 Resistance 1: 1849.30 Resistance 2: 1850.90 Resistance 3: 1852.00 Pivot Point: 1848.20 |

| The price is above the 200-day moving average, between resistance 1 and support 1. Expected trading range between USD$1,843 and USD$1,852. Pivot point for trend change at USD$1,848. RSI neutral, so the price could continue the uptrend, towards USD$1,879 per Troy ounce. |

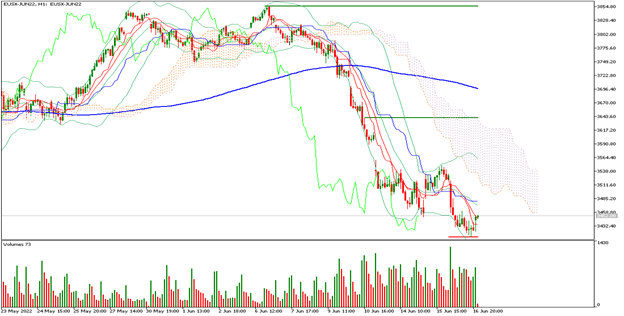

| EUROSTOXX 50 +0.41% |

| Traders are watching the Euro Zone inflation data. With analysts expecting an increase of 8.1% y/y, the market is anticipating an interest rate hike by the European Central Bank. This would be the first rate hike of the year. Meanwhile, the Eurostoxx 50 is up 0.41% and is trading at 3,436 points. Europe is maintaining inflation at a level very similar to that of the United States. The ECB is expected to raise rates at its July 2022 meeting. |

|

| Support 1: 3414 Support 2: 3395 Support 3: 3384 Resistance 1: 3444 Resistance 2: 3455 Resistance 3: 3474 Pivot Point: 3425 |

| Price is below the 200-day moving average, between resistance 1 and support 1. Expected trading range between 3,384 and 3,474. Pivot point for trend change at 3,425. RSI neutral, so the index could continue the uptrend towards the level of 3,455 and 3,474. |

| BITCOIN -2.75% |

| Bitcoin continues its downtrend, this time trading in a range between USD$23,000 and USD$20,000. The main Bitcoin holders in the world, including investment funds, are starting to lose money. El Salvador as a country is also losing money on its crypto investments. Some of the holders have started to sell their positions. Meanwhile, experts say that the market is being cleaned up and only long-term investors will be left. Bitcoin is currently down 2.75% and is trading at USD$21,161. |

|

| Support 1: 20,863.2 Support 2: 20,625.4 Support 3: 20,422.0 Resistance 1: 21,304.4 Resistance 2: 21,507.8 Resistance 3: 21,745,5 Pivot Point: 21,066.6 |

| The price is below the 200-day moving average which is a bearish signal in Bitcoin. The price is between resistance 1 and support 2. Expected trading range between USD$20,422 and USD$21,745. RSI neutral, so the bearish pressure could continue. The bears are looking to break the USD$20,000 support to take the price towards USD$3,232. |

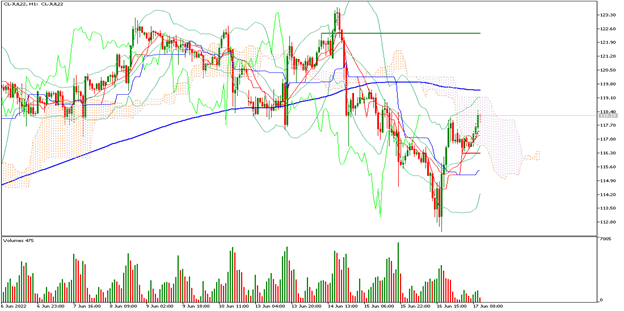

| WTI +0.44% |

| The United States applied new economic sanctions against Iran. On the other hand, OPEC+ is at 2.7 million barrels per day of production below target. Russia expressed its interest in continuing to cooperate with OPEC. The country is increasing its oil and gas production, trying to take advantage of the strong global demand momentum. WTI is currently up 0.44% and is trading at USD$118.10 per barrel. Brent returned to levels above USD$120 per barrel. |

|

| Support 1: 117.48 Support 2: 116.74 Support 3: 116.23 Resistance 1: 118.73 Resistance 2: 119.24 Resistance 3: 119.98 Pivot Point: 117.99 |

| The price is below the 200-day moving average, between support 2 and resistance 1. Expected trading range between USD$116.23 and USD$119.98. Pivot point for trend change at USD$117.99. RSI neutral, so the price could continue the bullish channel towards USD$120 per barrel. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Penafian Risiko

Sebarang maklumat/artikel/bahan/kandungan yang disediakan oleh Capitalix atau yang dipaparkan di laman webnya hanya bertujuan untuk digunakan bagi tujuan pendidikan dan tidak membentuk nasihat pelaburan atau perundingan tentang cara pelanggan harus berdagang.

Walaupun Capitalix telah memastikan bahawa kandungan maklumat tersebut adalah tepat, ia tidak bertanggungjawab terhadap sebarang peninggalan/kesilapan/salah pengiraan dan tidak dapat menjamin ketepatan sebarang bahan atau sebarang maklumat yang terkandung di sini.

Oleh itu, sebarang pergantungan yang anda letakkan pada bahan tersebut adalah atas risiko anda sendiri. Sila ambil perhatian bahawa tanggungjawab untuk menggunakan atau bergantung pada bahan tersebut terletak sepenuhnya kepada pelanggan dan Capitalix tidak menerima liabiliti untuk sebarang kerugian atau kerosakan, termasuk tanpa had, sebarang kehilangan keuntungan yang mungkin timbul secara langsung atau tidak langsung daripada penggunaan atau pergantungan pada maklumat tersebut.

Amaran Risiko: Perdagangan Forex/CFD melibatkan risiko yang ketara terhadap modal yang dilaburkan. Sila baca dan pastikan bahawa anda memahami sepenuhnya kandungan Dasar Pendedahan Risiko.

Anda harus memastikan bahawa, bergantung pada negara tempat tinggal anda, anda dibenarkan untuk berdagang produk Capitalix.com. Sila pastikan bahawa anda sudah betul-betul faham dengan pendedahan risiko syarikat.