Daily Review for May 26, 2022

According to the Fed minutes, the bank is focusing its strategy on attacking inflation more aggressively, so a tight monetary policy is expected for the rest of 2022.

Crypto continues with downward pressure, this time falling 2.94% and trading at USD$1,922.

The European Union needs at least USD$1 trillion investment to reduce its energy dependence on Russia.

Bitcoin remains sideways near USD$30,000. At the moment, investors are paying attention to the ECB statement where it said that the collapse of TerraUSD could trigger a Bitcoin crash.

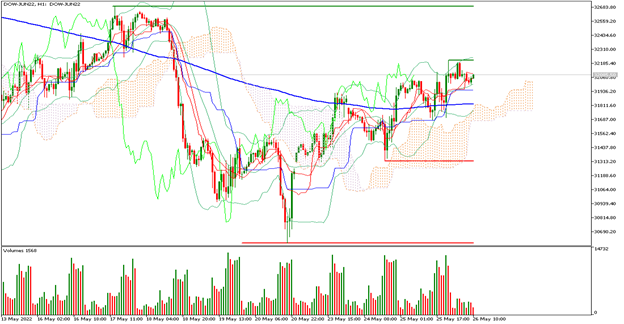

| DOW JONES +0.01% |

| According to the Fed minutes, the bank is focusing its strategy on more aggressively attacking inflation, so a restrictive monetary policy is expected for the rest of 2022. Fed Chairman Jerome Powell stated that he will raise interest rates as much as necessary to control inflation and reach the 2% annual target. Wall Street is currently sideways. The Dow Jones is up 0.01% and is trading at 32,124 points. |

|

| Support 1: 32,056.7 Support 2: 32,013.9 Support 3: 31,987.0 Resistance 1: 32,126.4 Resistance 2: 32,153.3 Resistance 3: 32,196.1 Pivot Point: 32,083.6 |

| Price is above the 200-day moving average, between resistance 1 and support 1. Expected trading range between 31,987 and 32,196. Pivot point for trend change at 32,083 points. RSI neutral, so the price could continue the sideways trend towards resistance 1. |

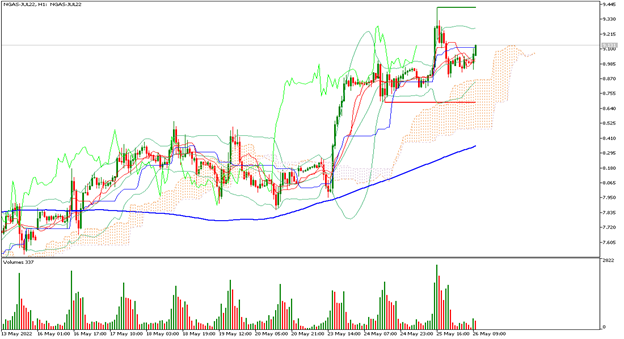

| ETHEREUM -2.94% |

| The crypto continues with downward pressure, this time falling 2.94% and trading at USD$1,922. Traders however continue to trade the Ethereum 2.0 update. The developers have stated its possible market launch in June 2022. At the moment the crypto continues sideways for more than two weeks. Institutional investors have been staying away from the crypto until the bear market ends. |

|

| Support 1: 1,914.19 Support 2: 1,904.89 Support 3: 1,898.49 Resistance 1: 1,929.89 Resistance 2: 1,936.29 Resistance 3: 1,945.59 Pivot Point: 1,920.59 |

| Price is below the 200-day moving average, between resistance 1 and support 2. Pivot point for trend change at USD$1,920. RSI neutral, so the crypto could continue correcting towards the next support levels, even could go down towards USD$1,690. |

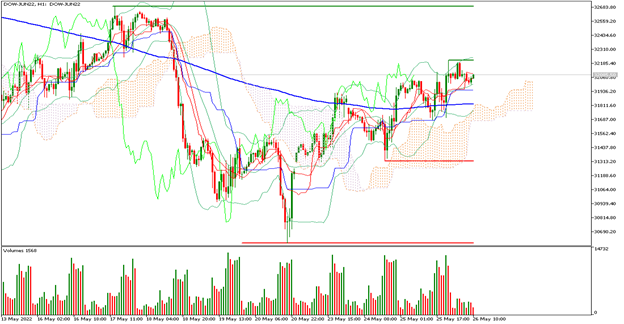

| NATURAL GAS +1.58% |

| The European Union needs at least USD$1 trillion to reduce its energy dependence on Russia. This is generating more interest from private equity funds to invest and finance deals in the energy segment. On the other hand, Russia’s Yamal LNG has declared force majeure on some shipments to Europe. Meanwhile, the European Union is evaluating a gas pipeline project between Spain and Italy to reduce dependence on Russian supplies. |

|

| Support 1: 8,973 Support 2: 8.879 Support 3: 8.811 Resistance 1: 9.135 Resistance 2: 9.203 Resistance 3: 9.297 Pivot Point: 9.041 |

| The price is above the 200-day moving average, between support 1 and resistance 3. Expected trading range between USD$8.81 and USD$9.29. Pivot point for trend change at USD$9.04. RSI neutral, so the bullish continuity could be maintained and head towards USD$9.44 and then reach USD$10 per BTU. |

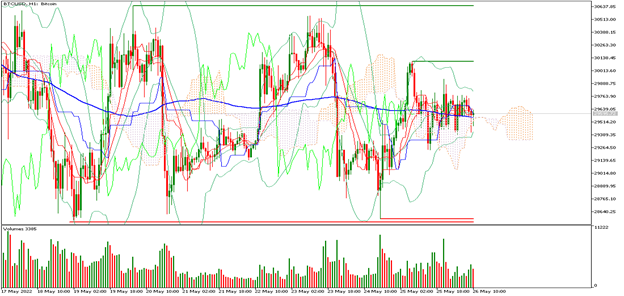

| BITCOIN -0.01% |

| The cryptocurrency remains sideways near USD$30,000. At the moment, investors are paying attention to the ECB statement where it said that the collapse of TerraUSD could cause a Bitcoin crash. Meanwhile, the investment bank JP Morgan announced that Bitcoin is at a 28% discount to its target price, so the price could reach USD$38,000 in the short term. According to the research team of the company, cryptos could present an interesting rebound after this period of capitulation. |

|

| Support 1: 29,560.4 Support 2: 29,447.9 Support 3: 29,366.9 Resistance 1: 29,754.0 Resistance 2: 29,835.1 Resistance 3: 29,947.6 Pivot Point: 29,641.5 |

| The price is slightly above the 200-day moving average, which is a bullish sign for Bitcoin. Expected trading range between USD$29,366 and USD$29,947. RSI neutral, so the price could start to gain some bullish positions, mainly looking for the USD$30,138 area. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.