Daily Review for June 28, 2022

Wall Street closed lower due to the underperformance of growth stocks.

Oil prices are up after the EIA’s inventory data has not been reported since last week. Analysts expect that the data will not be released this week either.

The market is looking forward to Christine Lagarde’s statement as President of the European Central Bank. Developments regarding the bank’s rate hike are expected for the July 2022 meeting.

According to Glassnode, institutional investors have sold about USD$453 million in Bitcoin.

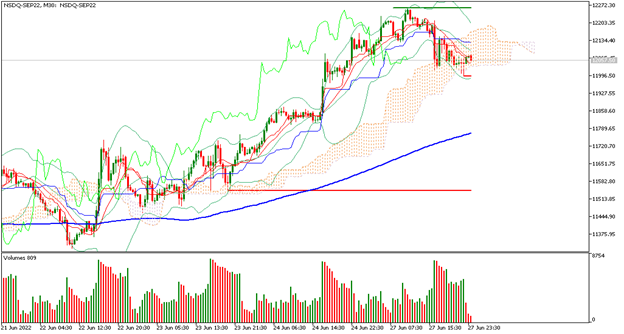

| NASDAQ 100 +0.13% |

| Wall Street closed lower due to the underperformance of growth stocks. Investors continue to be concerned about high inflation, the tightening of monetary policy by the FED and central banks and the fear of an economic recession. Even the Bank for International Settlements issued a communiqué to central banks to take more accurate measures to control inflation. At this moment the Nasdaq 100 is up 0.13% and is trading at 12,028 points. |

|

| Support 1: 12020.8 Support 2: 12001.8 Support 3: 11989.4 Resistance 1: 12052.2 Resistance 2: 12064.6 Resistance 3: 12083.6 Pivot Point: 12033.2 |

| Price is above the 200-day moving average, between support 1 and resistance 2. Expected trading range between 11.989 and 12.083. Pivot point for trend change at 12.033. RSI neutral, so the price could continue rising towards resistance 2. |

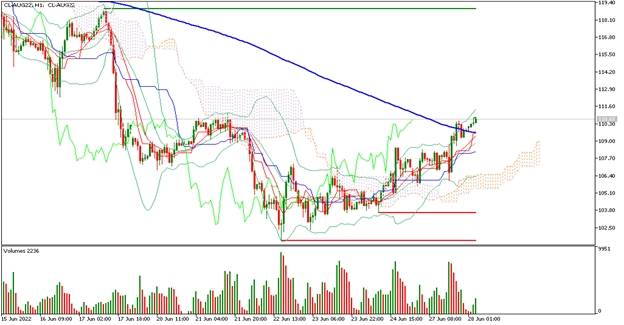

| WTI +1.02% |

| Oil prices are on the rise after the EIA inventories data has not been reported since last week. Analysts expect that the data will not be released this week either. Traders anticipate the increase in inventories, due to the European demand. However, before the resumption of the report, traders have generated a bullish momentum. On the other hand, Russia defaulted on its international debt, and is trying to generate business with Iran and Iraq in order to maintain its presence in the Middle East. |

|

| Support 1: 110.13 Support 2: 109.88 Support 3: 109.57 Resistance 1: 110.69 Resistance 2: 111.00 Resistance 3: 111.25 Pivot Point: 110.44 |

| The price is above the 200-day moving average, between resistance 2 and support 1. Expected trading range between USD$109.57 and USD$111.25. Pivot point for trend change at USD$110.44. RSI approaching the overbought zone. Traders could start taking profit from this level. |

| EUROSTOXX 50 +0.06% |

| The market is watching Christine Lagarde’s statement as President of the European Central Bank. The bank’s rate hike is expected to be announced for the July 2022 meeting. At the moment the Eurostoxx 50 is up 0.06% and is trading at 3,515 points. Traders are watching for a change in the ECB’s strategy, oriented towards market growth, mainly after the impact of business in Europe following the war in Ukraine. |

|

| Support 1: 3504 Support 2: 3497 Support 3: 3484 Resistance 1: 3524 Resistance 2: 3537 Resistance 3: 3544 Pivot Point: 3517 |

| Price is above the 200-day moving average, between resistance 1 and support 1. Expected trading range between 3,484 and 3,544. Pivot point for trend change at 3,517. RSI neutral, so the price could continue towards resistance 1, where traders would evaluate the continuation of the uptrend. |

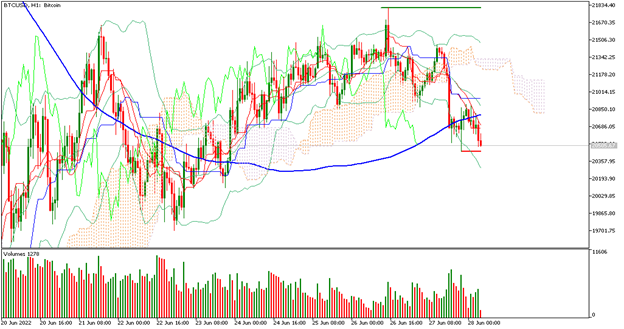

| BITCOIN -2.57% |

| According to Glassnode, institutional investors have sold about USD$453 million in Bitcoin. Miners remain unmotivated at the current price level, as the cost of energy generates narrow profit margins and high risk of loss. Bears are looking for USD$18,000 to gain ground towards USD$10,000. Bulls are looking for a long-term rebound supported by the scarcity effect that the Bitcoin protocol would generate, where currently 19 million have been mined compared to the maximum of 21 million. |

|

| Support 1: 20,497.4 Support 2: 20,402.7 Support 3: 20,250.4 Resistance 1: 20,744.4 Resistance 2: 20,896.7 Resistance 3: 20,991.4 Pivot Point: 20,649.7 |

| Price is below the 200-day moving average, between support 1 and resistance 1. Expected trading range between USD$20,250 and USD$20,991. Pivot point for trend change at USD$20,649. RSI near the oversold zone. Possible buying interest from this level. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.