Daily Review for June 21, 2022

Europe, the United States, the United Kingdom, and Canada are working as a team to place a ceiling on WTI prices, which would decrease Russia’s revenues and, at the same time, restrict the country’s crude oil supply.

European indices are in positive territory, as Christine Lagarde, President of the European Central Bank, managed to calm the markets.

El Salvador’s President, Nayib Bukele, continues to defend the country’s investments in Bitcoin. Analysts say that the problem with Bitcoin is not in the interest of investors, but rather macroeconomics.

Qatar continues to increase its production capacity in order to increase its exports to the European Union.

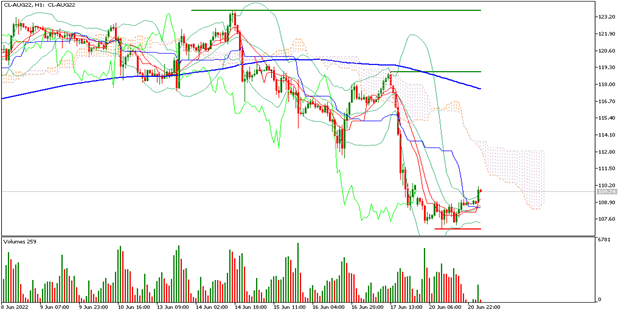

| WTI +0.95% |

| Europe, the United States, the United Kingdom and Canada are working as a team to place a ceiling on WTI prices, which would reduce Russia’s revenues and, at the same time, restrict the country’s crude oil supply. At the moment, the WTI price continues to rise, its up 0.95% and trading at USD$109.78 per barrel. Refineries in Europe continue to buy high volumes of Russian crude. Qatar, for its part, is increasing its natural gas production capacity, in order to replace Europe’s needs from Russia. On the other hand, inflation in the United Kingdom is at its highest level in 40 years. |

|

| Support 1: 109.12 Support 2: 108.38 Support 3: 107.87 Resistance 1: 110.37 Resistance 2: 110.88 Resistance 3: 111.62 Pivot Point: 109.63 |

| The price is below the 200-day moving average, between resistance 1 and support 1. The expected trading range is between USD$107.87 and USD$111.62. Pivot point for trend change at USD$109.63. RSI neutral, so the price could continue bouncing from support 1 to reach the bullish channel towards USD$118.79 per barrel. |

| EUROSTOXX 50 +0.14% |

| European indices are in positive territory, as Christine Lagarde, as President of the European Central Bank, managed to calm the markets. Still, traders see a high probability of an interest rate hike at the July 2022 meeting. The Eurostoxx 50 is currently up 0.14% and is trading at 3,455 points. The ECB reduced its economic growth projection for the European bloc from 3.7% to 2.8% for 2022. Inflation remains above 8%. |

|

| Support 1: 3,448 Support 2: 3,446 Support 3: 3,444 Resistance 1: 3,452 Resistance 2: 3,454 Resistance 3: 3,456 Pivot Point: 3,450 |

| Price is below the 200-day moving average, between support 3 and resistance 1. Expected trading range between 3,444 and 3,456. Pivot point for trend change at 3,450. Pivot point for trend change at 3,450. RSI neutral, so the index could continue rising towards the next resistance level. |

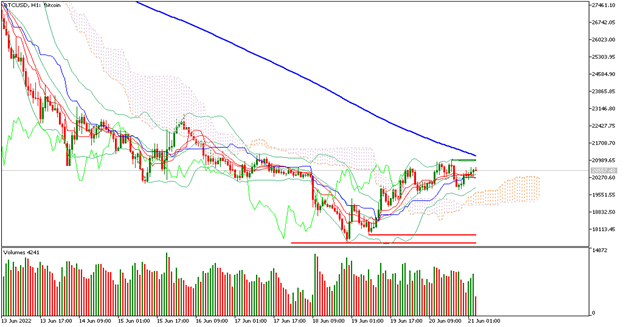

| BITCOIN +3.98% |

| The president of El Salvador, Nayib Bukele, continues to defend the country’s investments in Bitcoin. Analysts say that the problem with Bitcoin is not the lack of interest from investors, but rather macroeconomic problems with the global economy. The market is in a post-pandemic situation, with central banks moving from an expansive monetary policy to a restrictive one. Therefore, the scenario of high interest rates, high inflation and war in Ukraine, generate a high volatility in equity instruments. |

|

| Support 1: 20,459.6 Support 2: 20,273.1 Support 3: 20,168.4 Resistance 1: 20,750.8 Resistance 2: 20,855.5 Resistance 3: 21,041.9 Pivot Point: 20,564.3 |

| Price is below but close to the 200-day moving average. Expected trading range between USD$20,168 and USD$21,041. Pivot point for trend change at USD$20,254. RSI neutral, so the price could exceed the moving average, and thus bounce towards USD$23,000 to USD$25,000. |

| NATURAL GAS +0.76% |

| Qatar continues to increase its production capacity in order to increase its exports to the European Union. The price of natural gas is currently up 0.76% and is trading at USD$6.74 per BTU. Meanwhile, Russia overtook Saudi Arabia as a supplier of oil and gas to China. Traders are waiting for a rebound in prices towards the levels seen at USD$10, under the supply shock analysis that is being presented by Freeport’s force majeure. |

|

| Support 1: 6.697 Support 2: 6.665 Support 3: 6.649 Resistance 1: 6.745 Resistance 2: 6.761 Resistance 3: 6.793 Pivot Point: 6.713 |

| Price is below the 200-day moving average, between support 2 and resistance 1. Expected trading range between USD$6.64 and USD$6.79. Pivot point for trend change at USD$6.71. RSI neutral, so the price could break away from the support 2 line and start looking for the moving average line. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.