Daily Review for June 20, 2022

The week begins with bullish movements of European stock indexes. Traders are paying attention to Christine Lagarde’s statement as President of the European Central Bank.

The crypto market is bouncing. Ethereum is currently up 13.54% and is trading at USD$1,126. However, the major cryptos, Bitcoin and Ethereum are at 2021 levels.

Despite domestic gasoline prices in the United States averaging USD$5 per gallon, the country continues to export large volumes of energy segment commodities to Europe.

The price of Bitcoin reached USD$17,500. From this level, the volume of cryptocurrency purchases increased, driving the price up 7.96% to USD$20,446.

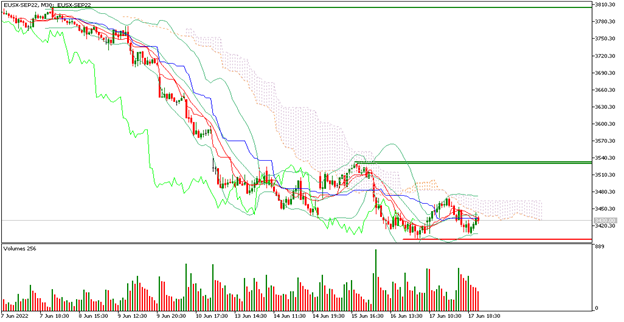

| EUROSTOXX 50 +0.15% |

| The week starts with bullish movements of European stock indexes. Traders are looking forward to Christine Lagarde’s statement as President of the European Central Bank. The market is looking forward to the first-rate hike of the year. We will also have today’s statements from the President of the BUBA (German Central Bank). At the moment the Eurostoxx 50 is up 0.15% and is trading at 3,427 points. At the moment the market has been highly volatile due to the FED rate hike. |

|

| Support 1: 3,418 Support 2: 3,410 Support 3: 3,400 Resistance 1: 3,436 Resistance 2: 3,446 Resistance 3: 3,454 Pivot Point: 3,428 |

| Price is above the 200-day moving average, between resistance 1 and support 3. Expected trading range is between 3,400 and 3,454. The pivot point for trend change at 3,428. RSI neutral, so the short-term trend is bullish for the index. |

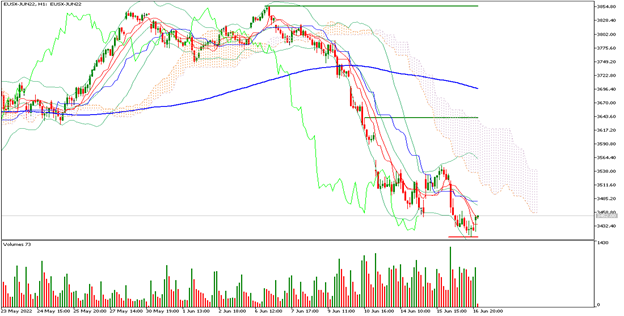

| ETHEREUM +13.54% |

| The crypto market is bouncing back. Ethereum is currently up 13.54% and is trading at USD$1,126. However, the major cryptos, Bitcoin and Ethereum are at 2021 levels. During 2022, cryptocurrencies have entered a bear market. Meanwhile Holders state that they have already lived through and surpassed crypto winters, therefore, expect a major rebound. Meanwhile, Elon Musk, communicated to the market that he is currently buying more Bitcoin and Dogecoin. |

|

| Support 1: 1,128.98 Support 2: 1,116.53 Support 3: 1,106.34 Resistance 1: 1,151.62 Resistance 2: 1,161.81 Resistance 3: 1,174.26 Pivot Point: 1,139.17 |

| Price is below the 200-day moving average, which continues to be a bearish signal for Ethereum. Price is between resistance 2 and support 3. Expected trading range between USD$1,106 and USD$1,174. Pivot point for trend change at USD$1,139. RSI approaching the overbought zone. |

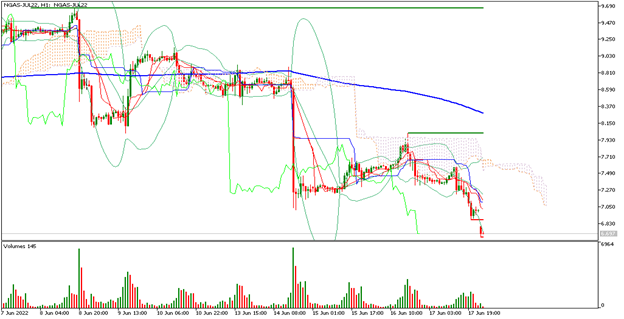

| NATURAL GAS -4.37% |

| Although U.S. domestic gasoline prices are averaging USD$5 per gallon, the country continues to export large volumes of energy commodities to Europe. On the other hand, natural gas prices continue to fall despite the operation of the Freeport LNG plant, which continues to declare force majeure. At this moment the price of natural gas is falling 4.37% and is trading at USD$6.69 per BTU. The Italian government may declare a state of alert if Russia continues to cancel natural gas supplies to the country. |

|

| Support 1: 6.656 Support 2: 6,608 Support 3: 6.557 Resistance 1: 6.755 Resistance 2: 6.806 Resistance 3: 6.854 Pivot Point: 6.707 |

| The price is below the 200-day moving average, between resistance 1 and support 2. Expected trading range is between USD$6.55 and USD$6.85. The pivot point for trend change at USD$6.70. RSI in oversold zone, so the price could begin to find a floor before starting a trend change. |

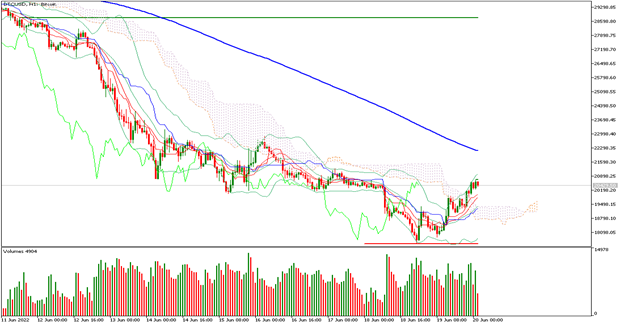

| BITCOIN +7.96% |

| The price of Bitcoin reached USD$17,500. From this level, the volume of purchases in the crypto increased, driving the price up 7.96% to USD$20,446. The current level may continue to attract investors’ attention. Traders are looking to liquidate positions with gains of 20%. Holders continue to maintain and increase their buying positions. The main Bitcoin holders are still in negative territory. Microstrategy and Elon Musk continue buying. Crypto investment funds and brokers are evaluating liquidity levels. |

|

| Support 1: 20,391.4 Support 2: 20,120.7 Support 3: 19,944.4 Resistance 1: 20,838.4 Resistance 2: 21,014.7 Resistance 3: 21,285.4 Pivot Point: 20,567.7 |

| The price is below the 200-day moving average, which is a bearish signal for Bitcoin. The price is between resistance 2 and support 2. Expected trading range between USD$19,944 and USD$21,185. Pivot point for trend change at USD$20,567. RSI neutral, approaching the overbought zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.