Daily Review for July 5, 2022

Pressure on European bonds as the European Central Bank intends to end a subsidy it had on the banking sector.

The U.S. President expects a decrease in tariffs on Chinese imports. This would reduce inflation on Chinese goods.

Gazprom, a major global commodity trader of Russian origin, is buying Rubles in order to trade LNG.

The third quarter of the year begins, and the whales start to enter the market again. In the first 4 days of the month, 70,086 Bitcoins have been traded.

| EUROSTOXX 50 +0.29% |

| Pressure on European bonds as the European Central Bank intends to end a subsidy it had on the banking sector. European leaders from Germany and Italy meet and assess the economic consequences of the war in Ukraine. Russia is gaining control of the Donbas region. European bank stocks are falling. Germany recorded its first monthly trade deficit in more than 30 years. The main problems facing the country are rising imports, supply chain problems, and rising energy prices. |

|

| Support 1: 3438 Support 2: 3436 Support 3: 3434 Resistance 1: 3442 Resistance 2: 3444 Resistance 3: 3446 Pivot Point: 3440 |

| The price is below the 200-day moving average, between support 2 and resistance 1. Expected trading range between 3,434 and 3,446. Pivot point for trend change at 3,440. RSI neutral, so the price could try to consolidate the bullish channel towards resistance 1. |

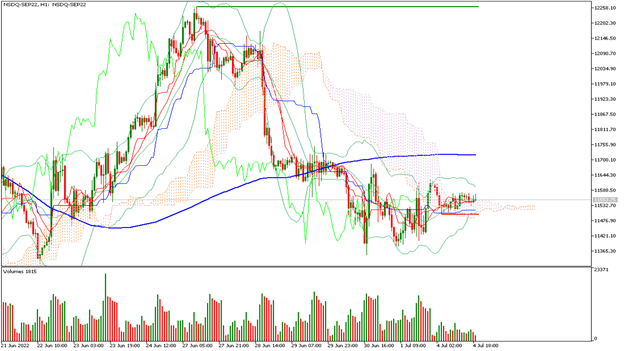

| NASDAQ 100 -0.54% |

| The U.S. President expects a decrease in tariffs on Chinese imports. This would reduce inflation on Chinese goods. On the other hand, the Chinese real estate group Shimao defaulted on its bonds, i.e. its international debt. China’s real estate sector continues to have severe liquidity problems, and the government has not been willing to cut rates to help the sector. Analysts are assessing possible financial contagion. For their part, investors are keeping a close eye on the business generation of technology companies in the US. |

|

| Support 1: 11511.4 Support 2: 11500.6 Support 3: 11487.1 Resistance 1: 11535.7 Resistance 2: 11549.2 Resistance 3: 11560.0 Pivot Point: 11524.9 |

| Price is below the 200-day moving average, between resistance 1 and support 1. Expected trading range between 11,487 and 11,560. Pivot point for trend change at 11,524. RSI neutral, so the price could correct towards support 1, and then evaluate the buying interest of investors. |

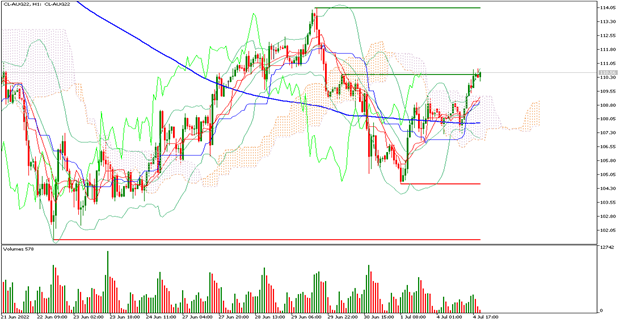

| WTI +1.97% |

| Gazprom, a major global commodity trader of Russian origin, is buying Rubles in order to trade LNG. The Russian government announced the discovery of 82 million tons of recoverable oil in the Arctic. Germany continues to buy gas on the international market, with the new credit line for USD$15 billion. The Canadian government will not fund new LNG terminals. Gasoline prices in the UK are at record highs. At this moment the price of WTI is up 1.94% and is trading at USD$110.53 per barrel. |

|

| Support 1: 110.13 Support 2: 109.96 Support 3: 109.64 Resistance 1: 110.62 Resistance 2: 110.94 Resistance 3: 111.11 Pivot Point: 110.45 |

| The price is above the 200-day moving average, between resistance 2 and support 1. Expected trading range between USD$109.64 and USD$111.11. Pivot point for trend change at USD$110.45. RSI near the overbought zone, so traders could start taking profits at this point. |

| BITCOIN +3.58% |

| The third quarter of the year has begun, and the whales are starting to enter the market again. In the first 4 days of the month, 70,086 Bitcoins have been traded. Bitcoin’s new support is at USD$19,666, so the market is in a restructuring phase. According to Deutsche Bank analysts, the price could continue to correct in the short term, but rebound in the medium and long term, due to the supply limitation that Bitcoin has in its favor. For analysts, the price could end 2022 at USD$27,000. |

|

| Support 1: 19666.6 Support 2: 19599.3 Support 3: 19521.6 Resistance 1: 19811.6 Resistance 2: 19889.3 Resistance 3: 19956.6 Pivot Point: 19744.3 |

| The price is at the same level of the 200-day moving average, between resistance 1 and support 1. Expected trading range between USD$19,521 and USD$19,956. Pivot point for trend change at USD$19,744. RSI near the overbought zone, so traders could have an initial profit taking. While investors will hold positions waiting for a higher rally. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.