Daily Review for July 26, 2022

According to the EIA, the United States was the world’s leading LNG exporter during Q1 and Q2 2022.

Traders are looking forward to one of the most interesting days in earnings reporting. We will then have results from Microsoft and Alphabet, among others.

Cryptos were dragged down by global fears of an economic recession. On Wednesday, the Fed is likely to raise interest rates by 75 basis points.

High expectations on the corporate earnings report of technology companies, has generated a bearish momentum on Wall Street, while reaching the best support levels to form a rebound.

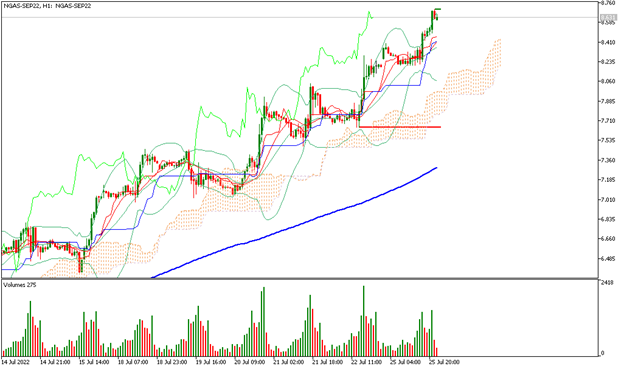

| NATURAL GAS +5.39% |

| According to the EIA, the United States was the world’s leading LNG exporter during Q1 and Q2 2022. On the other hand, Gazprom began supply cuts to Germany, which exacerbates the commodity crisis in the European Union. This generated the continuity of the important price rebound. At the moment, natural gas is up 5.39% and is trading at USD$8.63 per BTU. Likewise, the maintenance of turbines in the gas pipelines in Europe has caused delays in the supply, so the upward trend in the price is maintained. |

|

| Support 1: 8,593 Support 2: 8.565 Support 3: 8.513 Resistance 1: 8.673 Resistance 2: 8.725 Resistance 3: 8.753 Pivot Point: 8.645 |

| The price is above the 200-day moving average, between support 1 and resistance 3. Expected trading range between USD$8.51 and USD$8.75. RSI in overbought zone, so traders could start taking profits. However, the volume of purchases continues, so the uptrend remains. |

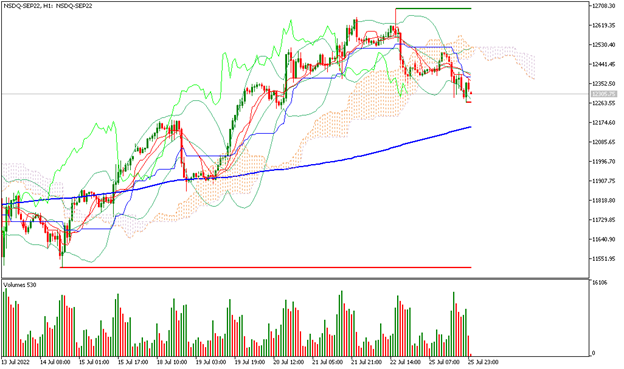

| NASDAQ 100 -0.34% |

| Traders are looking forward to one of the most interesting days in earnings reporting. We will then have results from Microsoft and Alphabet, among others. During yesterday’s trading day, equities corrected due to fears of an economic recession expressed by leading global economists. Also due to the sell-off generated by the possible 75 basis points increase in interest rates by the FED. The Nasdaq 100 is currently down 0.34% and is trading at 12,285 points. |

|

| Support 1: 12278.5 Support 2: 12256.8 Support 3: 12220.8 Resistance 1: 12336.2 Resistance 2: 12372.2 Resistance 3: 12393.9 Pivot Point: 12314.5 |

| Price is above the 200-day moving average, between resistance 2 and support 2. Expected trading range between 12,220 and 12,393. Pivot point for trend change at 12,314. RSI neutral, so the price may correct towards support 2, while traders define strategies in front of the FED rate decision. |

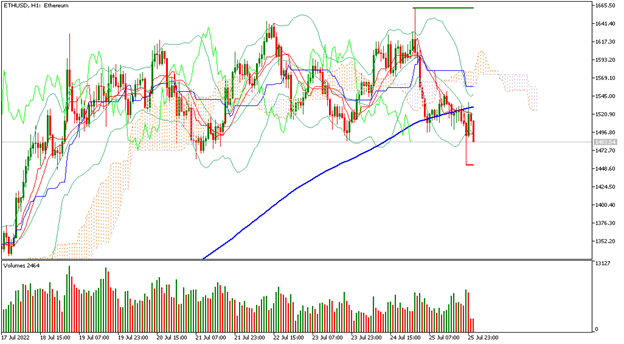

| ETHEREUM -8.78% |

| Cryptos were dragged down by global fears of an economic recession. On Wednesday, the Fed is likely to raise interest rates by 75 basis points. In this sense, this kind of decision generates high volatility in the stock markets. At this moment Ethereum is falling 8.78% and is trading at USD$1,473. According to the crypto founder Vitalik, the project is in an evolution phase, where its protocol will be able to generate a more robust and efficient system. The merger is expected to take place in September 2022. |

|

| Support 1: 1509.47 Support 2: 1504.65 Support 3: 1496.69 Resistance 1: 1522.25 Resistance 2: 1530.21 Resistance 3: 1535.03 Pivot Point: 1517.43 |

| Price is below the 200-day moving average, between support 1 and resistance 2. Expected trading range between USD$1,496 and USD$1,535. Pivot point for trend change at USD$1,517. RSI near the oversold zone, so the bears could make the price fall towards USD$1,448 before generating a possibility of rebound. |

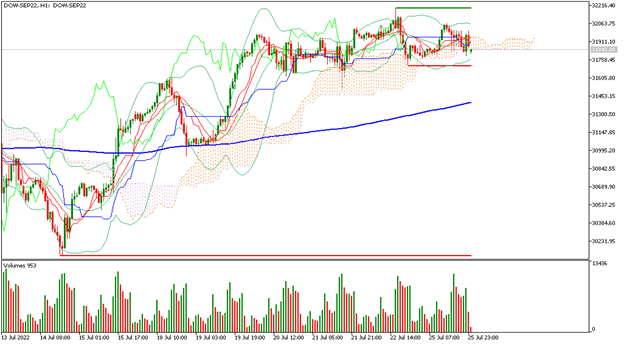

| DOW JONES -0.68% |

| The high expectations on the corporate earnings report of technology companies, has generated a bearish momentum on Wall Street, while reaching the best support levels to form a rebound. Analysts will evaluate the US economic performance by reading the GDP report, which will allow them to assess the performance of domestic demand in the country, which is the most important variable to avoid an economic recession. The Dow Jones is currently down 0.68% and is trading at 31,839 points. |

|

| Support 1: 31,705 Support 2: 30,127 Support 3: 29,631 Resistance 1: 32,056 Resistance 2: 32,187 Resistance 3: 33,453 Pivot Point: 33,847 |

| Price is above the 200-day moving average, between support 1 and resistance 2. Expected trading range between 29,631 and 33,453. Pivot point for trend change at 33,847. RSI neutral, so price may correct towards support 1, then expect sideways and trend change after the FED announcement. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.