Daily Review for July 25, 2022

Wall Street index futures remain sideways, after a week of gains. This week traders are looking ahead to the Fed rate hike and the highest volume of corporate earnings this season.

Natural Gas continues to trend higher at the beginning of the week after continued pressure from Russia to stop supplying the commodity to the European Union.

Bitcoin continues to gain 7.4% in the last 7 days. Analysts continue to focus on the movement of the whales.

Oil & Gas companies’ record earnings could boost dividend payouts.

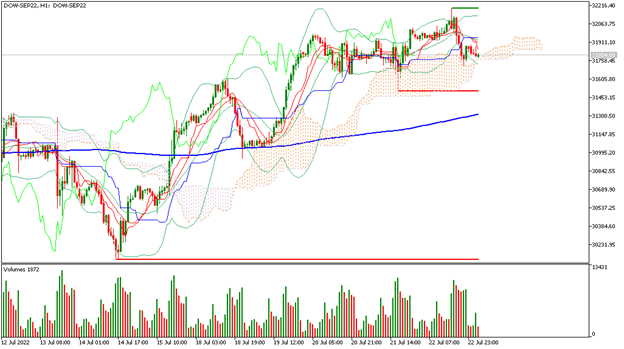

| DOW JONES -0.21% |

| Wall Street index futures remain sideways, after a week of gains. This week traders are looking ahead to the Fed’s interest rate hike and the highest volume of corporate earnings of the season. The Dow Jones is currently down 0.21% and is trading at 31,828. A 75 basis point rise is expected as well as corporate results from Apple, Microsoft, Alphabet, Amazon, Meta, 3M, Boeing and Intel among others. Traders are also on the lookout this week for US GDP results for Q2 2022. Analysts expect a 0.4% expansion. |

|

| Support 1: 12458.3 Support 2: 12412.3 Support 3: 12383.7 Resistance 1: 12532.9 Resistance 2: 12561.5 Resistance 3: 12607.5 Pivot Point: 12486.9 |

| The price is above the 200-day moving average, between support 1 and resistance 2. Expected trading range between 12,383 and 12,607. Pivot point for trend change at 12,486. RSI neutral, so the index may remain sideways before confirming the next trend. |

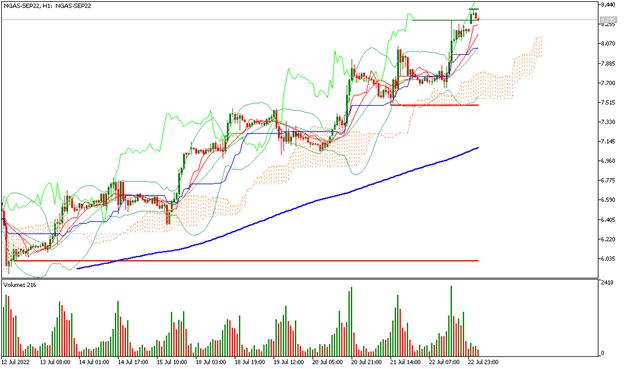

| NATURAL GAS +1.23% |

| Natural Gas continues to trend higher at the beginning of the week, after continued pressure from Russia on not supplying the commodity to the European Union. At the moment natural gas is up 1.23% and is trading at USD$8.29 per BTU. One of the main commodity traders, Pierre Andurand, sees a long-term rise in demand for oil and gas. Demand for thermal coal, used for power generation, is also on the rise. |

|

| Support 1: 8.292 Support 2: 8.268 Support 3: 8.229 Resistance 1: 8.355 Resistance 2: 8.394 Resistance 3: 8.418 Pivot Point: 8.331 |

| The price is below the 200-day moving average, between resistance 3 and support 1. Expected trading range between USD$8.22 and USD$8.41. RSI in overbought zone, so traders could start taking profits in the current zone. Bulls continue to search for USD$9 per BTU. |

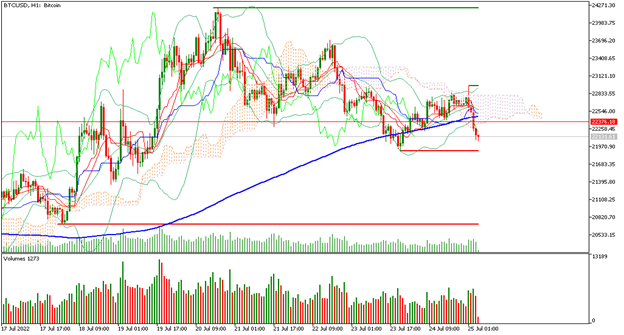

| BITCOIN -1.29% |

| Bitcoin continues to make gains of 7.4% in the last 7 days. Analysts continue to focus on the movement of the whales. Over the weekend, one of the big whales moved 132,000 bitcoins. Technically, bitcoin continues to trade above the USD$22,000 floor. This represents an uptrend. The first technical target is USD$28,000. On the fundamental side, the main driver of the price movement is the expected Fed rate hike. |

|

| Support 1: 22107.4 Support 2: 22007.7 Support 3: 21897.4 Resistance 1: 22317.4 Resistance 2: 22427.7 Resistance 3: 22527.4 Pivot Point: 22217.7 |

| The price is below the 200-day moving average, between support 1 and resistance 1. Expected trading range between USD$21,897 and USD$22,527. Pivot point for trend change at USD$22,217. RSI near the oversold zone, so it is expected a change of trend towards the bullish segment in the short term. |

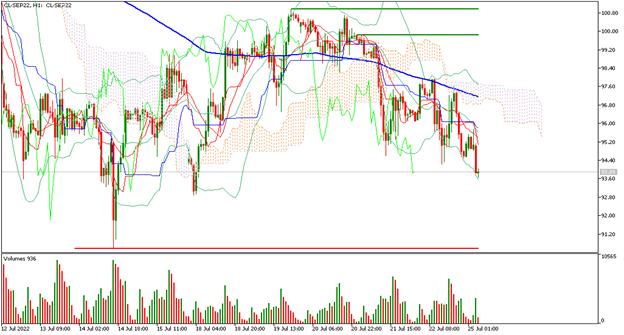

| WTI -1.03% |

| Record profits for Oil & Gas companies could boost dividend payouts. Libya has restarted oil exports. The Swiss government announced the use of part of its strategic reserves. Traders are watching for the price to move above or away from USD$100 per barrel. However, analysts see an increase in demand in the short, medium and long term, which may continue to drive the price higher. WTI is currently down 1.03% and is trading at USD$93.78 per barrel. |

|

| Support 1: 93.45 Support 2: 93.01 Support 3: 92.16 Resistance 1: 94.74 Resistance 2: 95.59 Resistance 3: 96.03 Pivot Point: 94.30 |

| Price is below the 200-day moving average, between resistance 1 and support 3. Expected trading range between USD$92.16 and USD$96.03. Pivot point for trend change at USD$94.30. RSI neutral, so the price could continue correcting towards support 3. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.