Daily Review for July 22, 2022

Tesla managed to maintain the uptrend of the Nasdaq 100. Although the company sold 70% of its Bitcoin investments, the company financially outperformed market expectations.

The European Central Bank raised interest rates by 50 basis points, beating market estimates by 25 basis points.

Tesla sold 75% of its Bitcoins, equivalent to 32,000 Bitcoins. The total sale was for USD$936 million. The company holds investments in the crypto for USD$210 million.

Russia continues to announce its interest in the total supply of natural gas to Europe. The United States announced the shipment of more weapons to Ukraine, due to Russia’s rapprochement to the Donbas region.

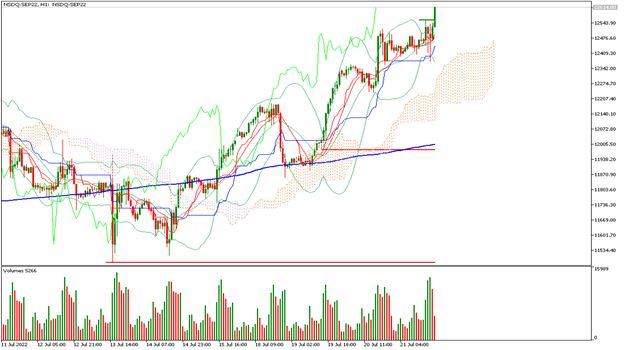

| NASDAQ 100 +1.14% |

| Tesla managed to maintain the Nasdaq 100 uptrend. Despite the company selling 70% of its Bitcoin investments, the company financially outperformed market expectations. Tesla’s earnings rose 5.5% in Q2 2022, driven by the increase in the selling price of its vehicles. Traders continue to evaluate rate hike scenarios for the next Fed meeting, which will be held next week. Analysts expect a 75-basis point hike. At the moment the Nasdaq 100 is up 1.14% and is trading at 12,612 points. |

|

|

| The price is above the 200-day moving average, between support 1 and resistance 2. Expected trading range between 12,383 and 12,607. Pivot point for trend change at 12,486. RSI entering the overbought zone, so the rally could hold and overcome resistance 2, or give up some points. |

| GOLD +0.56% |

| The European Central Bank raised interest rates by 50 basis points, beating market estimates by 25 basis points. Following the decision and press conference by ECB President Christine Lagarde, gold prices rebounded from USD$1,680 to USD$1,718, a rebound of 2.22%. Positions in the metal could continue as investors continue to look ahead to the Fed’s interest rate hike, which could come as early as July 27, 2022. Analysts maintain the argument that inflation could already be at its peak, so the Fed rate hike is not expected by 100 basis points. |

|

|

| Price is below the 200-day moving average, between support 3 and resistance 1. Expected trading range between USD$1,698 and USD$1,725. Pivot point for trend change at USD$1,712. RSI neutral, near the overbought zone. Possible sideways movement above this level until the FED rate decision. |

| BITCOIN -1.89% |

| Tesla sold 75% of its Bitcoins, or 32,000 Bitcoins. The total sale was for USD$936 million. The company holds investments in the crypto for USD$210 million. According to Elon Musk, the sale occurred due to regulation in China. The CEO did not rule out buying Bitcoins again. After Tesla’s sales volume, the price of Bitcoin corrected 5%. At the moment the crypto is correcting 1.89% and is trading at USD$23,006. |

|

|

| The price is above the 200-day moving average, between resistance 2 and support 1. Expected trading range between USD$22,178 and USD$23,809. Pivot point for trend change at USD$22,956. RSI neutral, so the price could continue recovering levels. The uptrend remains despite the fundamental events. The Bulls target is at USD$32,000. For this, the price will have to consolidate resistance 2. |

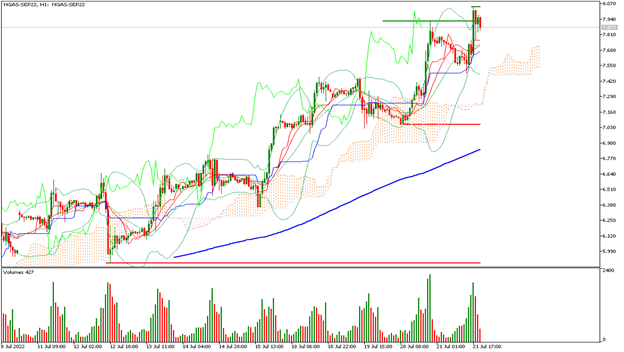

| NATURAL GAS -0.02% |

| Russia continues to announce its interest in the full supply of natural gas to Europe. The United States announced the shipment of more weapons to Ukraine, due to Russia’s rapprochement to the Donbas region. In the USA, refineries estimate a 652% increase in profits. The Chinese government announced a cut in its LNG imports. Spain, for its part, did not approve the European Union’s proposal to reduce gas consumption by 15%. Fundamental events are mixed, but with a clear tendency of supply shock, so prices could continue to rise. |

|

|

| Price is above the 200-day moving average, between resistance 3 and support 1. Pivot point for trend change at USD$8.03. Neutral RSI coming out of the overbought zone, so technically the price could continue rising. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.