Daily Review for July 19, 2022

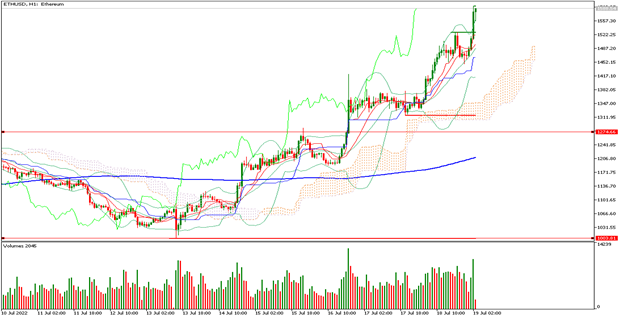

Ethereum is up 62% in a week. At the moment the crypto is up 21.08% and is trading at USD$1,610.

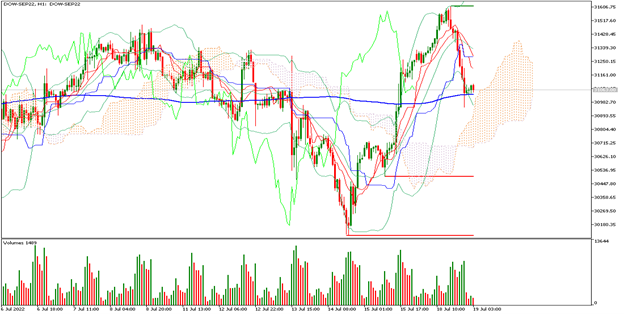

The market on the New York Stock Exchange continues to move sideways, due to the uncertainty generated by announcements from companies such as Apple, who commented that demand for its products may be slowing.

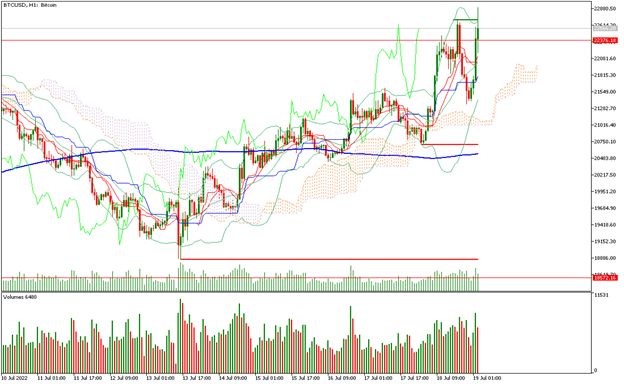

Bitcoin continues to rise. It is currently up 7.50% and is trading at USD$22,417. The price is at an important resistance, which it has failed to overcome on 3 previous occasions.

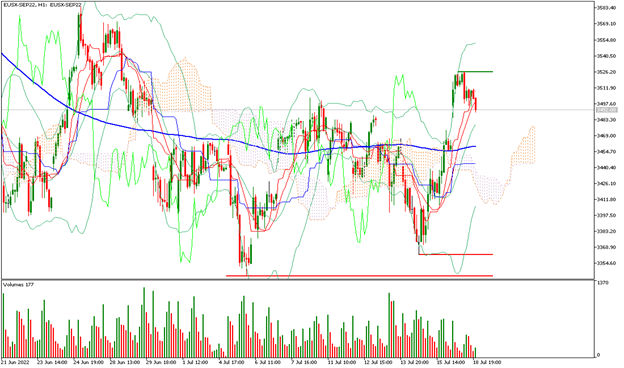

Traders are expecting a technical rebound in the European markets. Analysts expect bullish days until the first interest rate hike by the European Central Bank is known.

| ETHEREUM +21.08% |

| Ethereum is up 62% in a week. At the moment the crypto is up 21.08% and is trading at USD$1,610. The bullish momentum has been generated after a probable date for the crypto’s merger into the new consensus system became known. The estimated date according to the developers is September 19, 2022. Short traders in the market are suffering from the rise, with accumulated losses in the futures market of USD$127 million. Traders continue to watch for news about the platform merger. |

|

| Support 1: 1535.24 Support 2: 1485.70 Support 3: 1457.92 Resistance 1: 1612.56 Resistance 2: 1640.34 Resistance 3: 1689.88 Pivot Point: 1563.02 |

| The price is above the 200-day moving average, between resistance 3 and support 1. Expected trading range between USD$1,457 and USD$1,689. Pivot point for trend change at USD$1,563. RSI in overbought zone, so it is expected an initial profit taking by traders, for the price to go down towards USD$1,329 to resume the uptrend. If the price breaks resistance 3, the price could continue to rise without retracement. |

| DOW JONES +0.05% |

| The market in the New York Stock Exchange continues to move sideways, due to the uncertainty generated by the announcements of companies such as Apple, who announced that the demand for its products may be slowing down. At this moment, the Dow Jones is up 0.05% and is trading at 31,088 points. As for corporate results, Goldman Sachs beat market expectations and the share price rose more than 2.5%. Traders expect a rate hike of 75 basis points, following a 9.1% increase in the U.S. consumer price index, which measures market demand. |

|

| Support 1: 31081.2 Bracket 2: 31046.2 Support 3: 31026.5 Resistance 1: 31135.9 Resistance 2: 31155.6 Resistance 3: 31190.6 Pivot Point: 31100.9 |

| Price is slightly above the 200-day moving average, between support 1 and resistance 2. Expected trading range between 31,026 and 31,190. Pivot point for trend change at 31,100. RSI neutral, so the price may remain sideways waiting for more volatility after corporate and macroeconomic results. |

| BITCOIN +7.50% |

| Bitcoin continues to rise. It is currently up 7.50% and is trading at USD$22,417. The price is at an important resistance, which it has failed to overcome in 3 previous occasions, where the Bulls failed to overcome the USD$22,400 and the price has corrected from there to USD$18,572. On the other hand, Binance has surpassed Coinbase, as the Exchange with the most Bitcoins. |

|

| Support 1: 21954.6 Support 2: 21433.3 Support 3: 21092.6 Resistance 1: 22816.6 Resistance 2: 23157.3 Resistance 3: 23678.6 Pivot Point: 22295.3 |

| Price is above the 200-day moving average, which is a bullish signal for Bitcoin, between support 1 and resistance 2. Expected trading range between USD$21,092 and USD$23,678. Pivot point for trend change at USD$22,295. Neutral RSI, so the price could try to consolidate above resistance 2 to continue climbing. |

| EUROSTOXX 50 -0.66% |

| Traders are expecting a technical rebound in European markets. Analysts expect bullish days until the first interest rate hike by the European Central Bank is known. At the moment the Eurostoxx 50 is up 0.66% and is trading at 3,477 points. Traders are watching the inflation report in the European Union. Analysts expect it to be 8.6% annually and 0.8% for the month of June 2022. |

|

| Support 1: 3466 Support 2: 3458 Support 3: 3449 Resistance 1: 3483 Resistance 2: 3492 Resistance 3: 3500 Pivot Point: 3475 |

| The price is above the 200-day moving average, between support 1 and resistance 1. Expected trading range between 3,449 and 3,500. Pivot point for trend change at 3,475. RSI neutral, so the price could drop a few points, to consolidate the bullish channel, prior to the announcement of inflation and interest rates in Europe. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.