Daily Review for June 16, 2022

The FED raised interest rates by 75 basis points. The institution seeks to halt the escalation of inflation without generating an economic recession.

Traders are watching the Bank of England’s interest rate decision. They are also watching the statements of Luis de Guindos, vice-president of the ECB, who could give indications about the next interest rate hike by the European Central Bank.

Ari Paul, the founder of blockchain investment firm Blocktower Capital, announced that Bitcoin is like the Amazon of cryptocurrencies, as the crypto has managed to survive several market downturns.

Investors continue to take hedge positions in gold and silver. Due to market volatility generated by aggressive global monetary policy, traders are increasing purchases in metals.

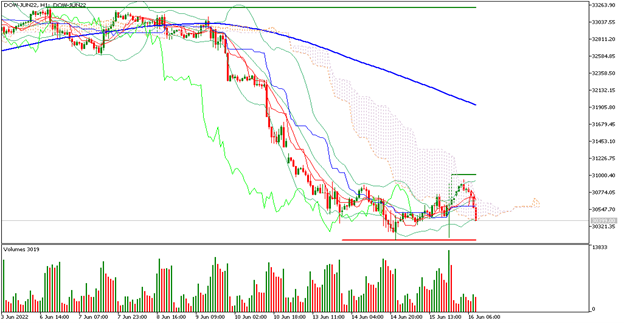

| DOW JONES -0.67% |

| The FED raised interest rates by 75 basis points. The institution seeks to halt the escalation of inflation without generating an economic recession. Therefore, Jerome Powell as Chairman of the FED announced a possible additional 75 basis points rate hike at the next meeting. On the other hand, traders are also watching the Bank of England’s interest rate decision, where a 25 basis point hike is expected to leave rates at 1.25%. At the moment, Wall Street and European stock markets are correcting. |

|

| Support 1: 30514.1 Bracket 2: 30462.0 Support 3: 30357.8 Resistance 1: 30670.4 Resistance 2: 30774.6 Resistance 3: 30826.7 Pivot Point: 30618.3 |

| Price is below the 200-day moving average, between support 1 and resistance 1. Expected trading range between 30,357 and 30,826. Pivot point for trend change at 30,618. RSI neutral, so the index could continue to correct additional points before finding the best support level. |

| EUROSTOXX 50 -1.02% |

| Traders are watching the Bank of England’s interest rate decision. They are also looking forward to the statements of Luis de Guindos, Vice President of the ECB, which could give indications on the next interest rate hike by the European Central Bank. The Eurostoxx 50 is currently up 1.02% and is trading at 3,496 points. Central banks worldwide continue to be pressured by the market on inflation control. At the moment, inflation data from the main global markets are well above the 2% annual target. |

|

| Support 1: 3492 Support 2: 3478 Support 3: 3460 Resistance 1: 3524 Resistance 2: 3542 Resistance 3: 3556 Pivot Point: 3510 |

| Price is below the 200-day moving average, between resistance 1 and support 3. Expected trading range between 3,460 and 3,556. Pivot point for trend change at 3,510. RSI neutral, so the index could correct towards the next support levels. |

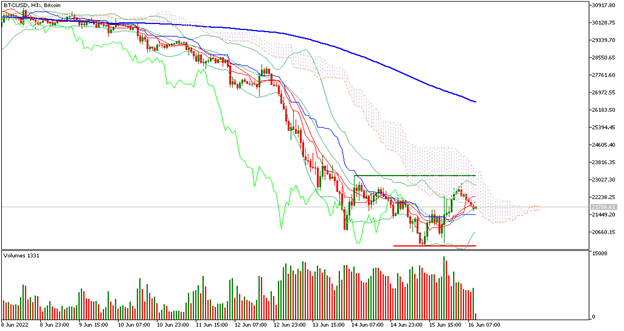

| BITCOIN +2.45% |

| Ari Paul, the founder of blockchain investment firm Blocktower Capital, announced that Bitcoin is like the Amazon of cryptocurrencies, because the crypto has managed to survive several market downturns. Bears meanwhile, are looking for USD$10,000. Bitcoin is currently up 2.45% and is trading at USD$21,804. Traders are evaluating the USD$20,000 floor. If this zone is breached, the next level to watch out for is USD$19,000. The main support in the medium term is at USD$3,411. |

|

| Support 1: 21,685.2 Support 2: 21,566.5 Support 3: 21,406.6 Resistance 1: 21,963.8 Resistance 2: 22,123.7 Resistance 3: 22,242.3 Pivot Point: 21,845.1 |

| The price is below the 200-day moving average which is a bearish signal in Bitcoin. The price is between support 3 and resistance 1. Expected trading range between USD$21,406 and USD$22,242. Pivot point for trend change at USD$21,845. RSI neutral, so the price could try to start recovering some positions. |

| GOLD +0.53% |

| Investors continue to take hedge positions in gold and silver. Due to market volatility generated by an aggressive global monetary policy, traders are increasing purchases in metals. At the moment the price of gold is up 0.53% and is trading at USD$1,828 per Troy ounce. Analysts expect the price to rise towards USD$2,000 in the short term, driven by central banks globally, following their need to control inflation, which will lead to continued interest rate hikes. |

|

| Support 1: 1829.51 Support 2: 1827.33 Support 3: 1824.86 Resistance 1: 1834.16 Resistance 2: 1836.63 Resistance 3: 1838.81 Pivot Point: 1831.98 |

| Price is below the 200-day moving average, between support 2 and resistance 1. Expected trading range between USD$1.834 and USD$1.838. Pivot point for trend change at USD$1.831. RSI neutral, so the price could look for the area of USD$1.880. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risikohinweis

Alle von Capitalix bereitgestellten oder auf seiner Webseite angezeigten Informationen/Artikel/Materialien/Inhalte sind ausschließlich zu Bildungszwecken bestimmt und stellen keine Anlageberatung oder Beratung darüber dar, wie der Kunde handeln sollte.

Obwohl Capitalix sich vergewissert hat, dass der Inhalt dieser Informationen korrekt ist, haftet Capitalix nicht für Auslassungen/Fehler/Fehlkalkulationen und kann nicht für die Richtigkeit des Materials oder der hierin enthaltenen Informationen garantieren.

Wenn Sie sich auf dieses Material verlassen, geschieht dies daher ausschließlich auf Ihr eigenes Risiko. Bitte beachten Sie, dass die Verantwortung für die Nutzung von oder das Vertrauen auf dieses Material beim Kunden liegt und Capitalix keine Haftung für Verluste oder Schäden übernimmt, einschließlich, aber nicht beschränkt auf, Gewinnverluste, die direkt oder indirekt aus der Nutzung oder dem Vertrauen auf diese Informationen entstehen können.

Risikowarnung: Der Handel mit Devisen/CFDs birgt erhebliche Risiken für Ihr investiertes Kapital. Bitte lesen Sie unsere Risikoaufklärung und vergewissern Sie sich, dass Sie sie vollständig verstanden.

Sie sollten sich vergewissern, dass Sie je nach Land, in dem Sie wohnen, mit Capitalix.com-Produkten handeln dürfen. Bitte vergewissern Sie sich, dass Sie mit der Risikoaufklärung des Unternehmens vertraut sind.