Daily Review for July 13, 2022

Traders are watching the U.S. inflation report. Analysts expect at least 8.8% annually. However, investment funds expect a higher figure.

The managers of the crypto fund Three Arrows Capital did not appear before the court in the USA. The fund filed for bankruptcy in the crypto-winter.

Oil inventories rose 4.8 million barrels according to API. The increase in supply is having a major impact on the price, which is currently correcting 8.18% and is trading at USD$95.58 per barrel.

Companies are starting to report financial results for Q2 2022. Traders continue to watch the CPI in the United States, which is expected to be higher than expected.

| GOLD -0.46% |

| Traders are watching the U.S. inflation report. Analysts expect at least 8.8% annually. However, investment funds expect a higher figure. Wall Street is beginning to discount the above, generating declines in the three stock market indexes. Investors are looking for hedging alternatives for their portfolios, through gold, silver and bonds. At this moment the price of gold is falling 0.46% and is trading at USD$1,723 per Troy ounce. Traders are also keeping an eye on the Reserve Bank of New Zealand’s interest rate decision, which is expected to be raised by 50 basis points. |

|

| Support 1: 1,721.99 Support 2: 1,720.12 Support 3: 1,717.54 Resistance 1: 1,726.44 Resistance 2: 1,729.02 Resistance 3: 1,730.89 Pivot Point: 1,724.57 |

| The price is below the 200-day moving average, between resistance 1 and support 3. Expected trading range between USD$1,717 and USD$1,730. Pivot point for trend change at USD$1,724. RSI neutral, so the price could remain sideways before the inflation report. |

| BITCOIN -4.49% |

| The managers of the crypto fund Three Arrows Capital did not appear before the court in the USA. The fund filed for bankruptcy in the crypto winter. The liquidating firm, Teneo, will seek to recover USD$3 billion in assets. The fund had USD$10 billion in assets under management in March. However the high exposure in Terra Luna, and the devaluation of crypto, affected the fund’s liquidity. The bankruptcy of Three Arrows capital also generated the bankruptcy of the crypto platform Voyager Digital, when it defaulted on a payment of USD$670 million. Bitcoin is currently down 4.49% and is trading at USD$19,372. Traders are keeping an eye on the inflation report. If it is lower than expected, Bitcoin could rebound. Otherwise it could correct further. |

|

| Support 1: 19,209.6 Support 2: 19,040.8 Support 3: 18,792.6 Resistance 1: 19,626.6 Resistance 2: 19,874.8 Resistance 3: 20,043.6 Pivot Point: 19,457.8 |

| The price is below the 200-day moving average, between resistance 1 and support 2. Expected trading range between USD$18,792 and USD$20,043. Pivot point for trend change at USD$19,457. RSI in oversold zone, so it could generate some interest in the Bulls at this level. At the moment the trading volume is low, so traders are waiting for the US CPI. |

| WTI -8.18% |

| Oil inventories increased by 4.8 million barrels according to API. The increase in supply is having a major impact on the price, which is currently correcting 8.18% and is trading at USD$95.58 per barrel. Hedge funds continue to sell oil futures, due to the analysis on the recession, which would take the price to lower levels, even at levels below USD$60 per barrel. OPEC is 1 million barrels per day below its production target. |

|

| Support 1: 95.45 Support 2: 95.23 Support 3: 95.09 Resistance 1: 95.81 Resistance 2: 95.95 Resistance 3: 96.17 Pivot Point: 95.59 |

| Price is below the 200-day moving average, between resistance 1 and support 3. Expected trading range between USD$95.09 and USD$96.17. Pivot point for trend change at USD$95.59. RSI in oversold zone, which could attract traders’ attention, however, the increase in supply and fear of recession, may cause prices to fall further. |

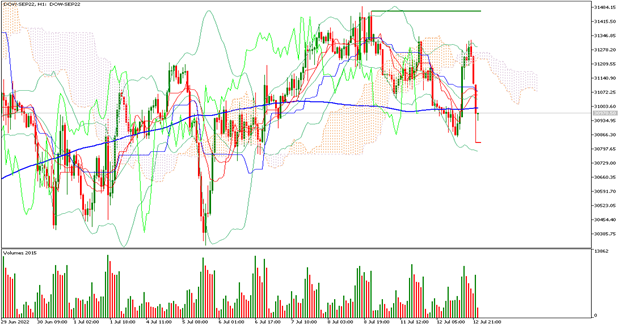

| DOW JONES -0.57% |

| Companies are starting to report financial results for Q2 2022. Traders continue to watch the CPI in the U.S., which is expected to be higher than expected. Depending on the above, the Fed could take a more aggressive monetary policy strategy, with steady interest rate hikes. The Treasury yield curve is inverted between long-term and short-term yields, indicating economic contraction. However, the decline in commodity prices may indicate that we have reached a peak in inflation, and inflation could begin to decline. |

|

| Support 1: 30860.7 Support 2: 30719.3 Support 3: 30578.5 Resistance 1: 31142.9 Resistance 2: 31283.7 Resistance 3: 31425.1 Pivot Point: 31001.5 |

| Price is below the 200-day moving average, between support 1 and resistance 1. Expected trading range between 30,578 and 31,425. Pivot point for trend change at 31,001. RSI neutral, so the price could continue to correct towards support 1. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risikohinweis

Alle von Capitalix bereitgestellten oder auf seiner Webseite angezeigten Informationen/Artikel/Materialien/Inhalte sind ausschließlich zu Bildungszwecken bestimmt und stellen keine Anlageberatung oder Beratung darüber dar, wie der Kunde handeln sollte.

Obwohl Capitalix sich vergewissert hat, dass der Inhalt dieser Informationen korrekt ist, haftet Capitalix nicht für Auslassungen/Fehler/Fehlkalkulationen und kann nicht für die Richtigkeit des Materials oder der hierin enthaltenen Informationen garantieren.

Wenn Sie sich auf dieses Material verlassen, geschieht dies daher ausschließlich auf Ihr eigenes Risiko. Bitte beachten Sie, dass die Verantwortung für die Nutzung von oder das Vertrauen auf dieses Material beim Kunden liegt und Capitalix keine Haftung für Verluste oder Schäden übernimmt, einschließlich, aber nicht beschränkt auf, Gewinnverluste, die direkt oder indirekt aus der Nutzung oder dem Vertrauen auf diese Informationen entstehen können.

Risikowarnung: Der Handel mit Devisen/CFDs birgt erhebliche Risiken für Ihr investiertes Kapital. Bitte lesen Sie unsere Risikoaufklärung und vergewissern Sie sich, dass Sie sie vollständig verstanden.

Sie sollten sich vergewissern, dass Sie je nach Land, in dem Sie wohnen, mit Capitalix.com-Produkten handeln dürfen. Bitte vergewissern Sie sich, dass Sie mit der Risikoaufklärung des Unternehmens vertraut sind.