Daily review for October 25, 2021

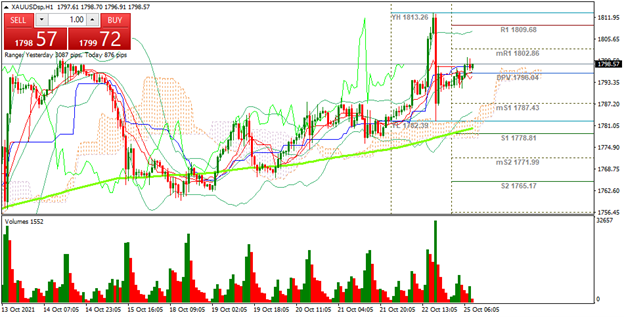

Weekly summary of corporate results:

Traders start the week with bullish positions in commodities.

Mutual funds increase long positions in USDTRY. Geopolitical tensions increase with Turkey.

Crude Oil close to reach USD$85 per barrel. La Niña phenomenon could generate a stronger than expected winter.

Investors are on the lookout for corporate results. Wall Street stock indexes start the week in positive territory.

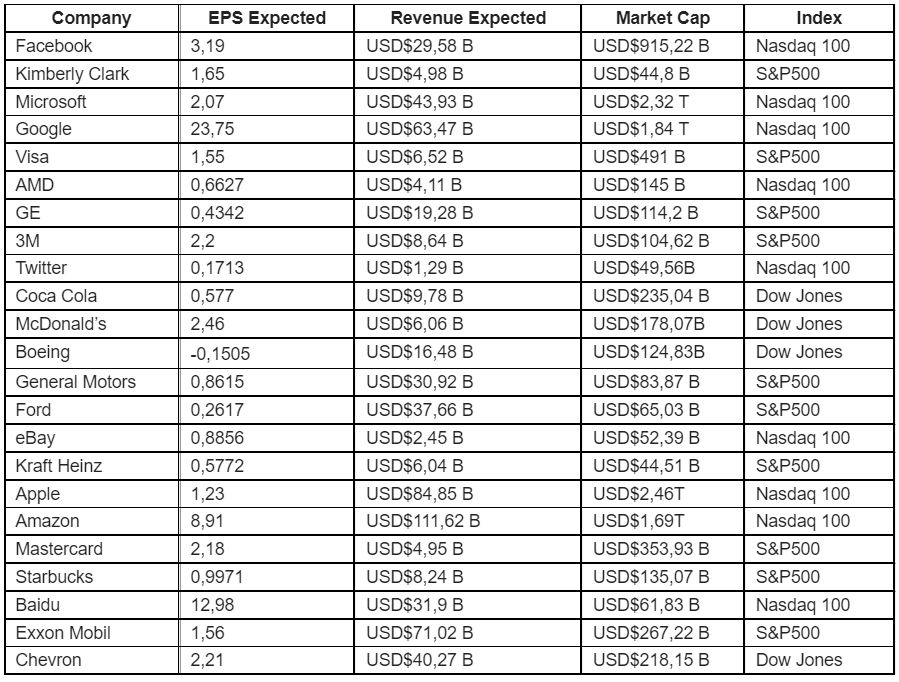

| SILVER +0.59% |

| Commodity prices start the week with upward movements. Metals show an upward momentum, mainly in copper +1.29%. Gold prices are up 0.26%. Silver is currently up 0.59% and is trading at USD$24.57. The momentum in commodities is due to the volatility of the Turkish pound, and geopolitical tensions. Traders continue to hold bullish positions in commodities as well at the USDTRY. |

|

| Support 1: 24.546 Support 2: 24.499 Support 3: 24.468 Resistance 1: 24.624 Resistance 2: 24.655 Resistance 3: 24.702 Pivot Point: 24.577 |

| The price is still above the 200-day moving average. The price is at resistance 1. If the upward momentum continues, the next target level is USD$24.92. Expected trading range between USD$24.46 and USD$24.70. Pivot point for trend change at USD$24.57. RSI neutral, so the upward movement could be maintained. |

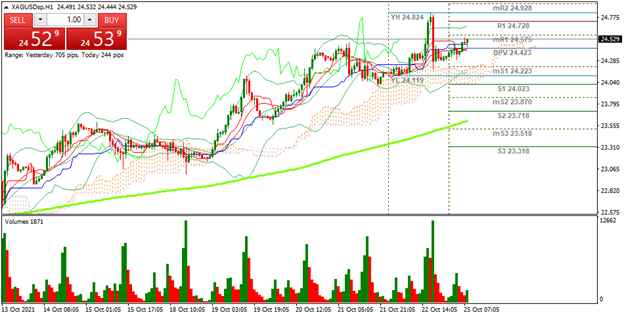

| WTI +0.94% |

| Crude oil price starts the week with a significant increase of 0.94%. It is currently trading at USD$84.55 per barrel. The main factor behind the increase in commodity prices in the energy segment is the possible impact of La Niña phenomenon in winter. It seems that the winter could be stronger than expected, and this boosted spot prices for immediate delivery of energy commodities. On the other hand, geopolitical tensions between Turkey and Western countries could generate a bullish momentum in crude oil. |

|

| Support 1: 84.45 Support 2: 84.36 Support 3: 84.28 Resistance 1: 84.62 Resistance 2: 84.70 Resistance 3: 84.79 Pivot Point: 84.53 |

| Price is at resistance 1. Bulls target level is USD$87.31 per barrel. Expected trading range between USD$84.28 and USD$84.79. Pivot point for trend change at USD$84.53. RSI in overbought zone. |

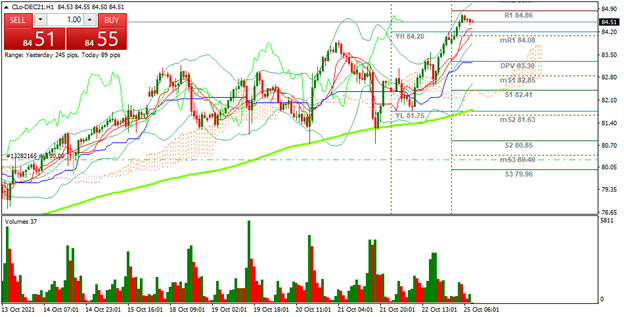

| GOLD +0.17% |

| The week begins with geopolitical tension and significant volatility in the markets. Traders have started to take bullish positions in gold, to hedge portfolios. Investment funds hold bullish positions in USDTRY. Funds are also paying attention to the week’s corporate results, mainly from Facebook, Microsoft, Google, AMD, Twitter, Apple and Amazon. Therefore, there could be an allocation of portfolios including metals, the Nasdaq 100 index, and technology stocks. |

|

| Support 1: 1,798.99 Support 2: 1,796.62 Support 3: 1,795.24 Resistance 1: 1,802.74 Resistance 2: 1,804.12 Resistance 3: 1,806.49 Pivot Point: 1,800.37 |

| During the Asian session, the price dropped to USD$1,787. Then with the geopolitical tensions, the price rebounded approaching USD$1,800 per Troy ounce. Trading range between USD$1,795 and USD$1,806. RSI neutral. |

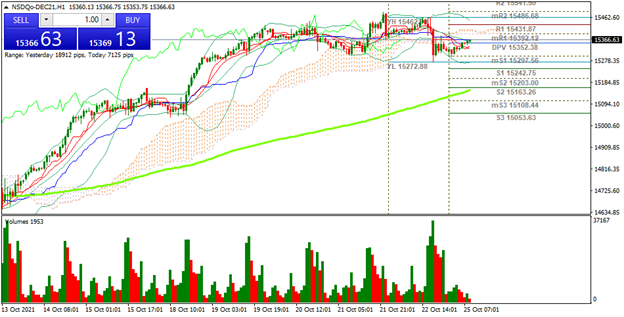

| NASDAQ 100 +0.16% |

| Wall Street indices start the week in positive territory, boosted by investors’ optimism about companies’ financial results for Q3 2021. Traders are looking ahead to today’s results from Facebook and Kimberly Clark. Meanwhile, the Nasdaq 100 is up 0.16% and is trading at 15,366 points. If corporate results beat expectations, the index could continue its uptrend. The Dow Jones and the S&P500 could follow suit. |

|

| Support 1: 15,365.9 Support 2: 15,353.7 Support 3: 15,346.7 Resistance 1: 15,385.1 Resistance 2: 15,392.1 Resistance 3: 15,404.3 Pivot Point: 15,372.9 |

| The index is at resistance 1. If the trajectory continues, it could climb towards 15,541. Pivot point for trend change at 15,372. RSI neutral. Trading range between 15,436 and 15,404. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.