Daily Review for May 23, 2022

The week begins with a high volume of purchases in the global stock markets. Traders are attentive to DAVOS, the event that brings together the main business, political and institutional leaders globally.

Yesterday was the anniversary of Bitcoin Pizza Day, which commemorates the day in 2010 when programmer Laszlo Hanyecz bought two pizzas for 10,000 Bitcoins.

The US removed energy sanctions on Venezuela, with the aim of increasing the flow of energy commodities on the international market, thus further stabilizing prices.

Gold is moving higher due to the weak dollar and fears of a global economic recession.

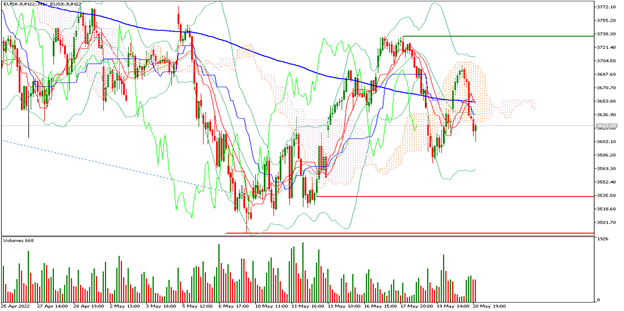

| EUROSTOXX 50 +1.18% |

| The week begins with a high volume of buying on the global stock exchanges. Traders are attentive to DAVOS, the event that brings together the main business, political and institutional leaders at a global level, as they present their views and perspective on the market. At the moment the Eurostoxx 50 is up 1.18% and is trading at 3,690 points. Traders are also watching the Eurogroup meeting and the statements of the delegates of the German BUBA (Central Bank of Germany). |

|

| Support 1: 3,680 Support 2: 3,669 Support 3: 3,660 Resistance 1: 3,700 Resistance 2: 3,709 Resistance 3: 3,720 Pivot Point: 3,689 |

| Price is above the 200-day moving average, between resistance 1 and support 1. Expected trading range between 3,660 and 3,720. Pivot point for trend change at 3,689. RSI neutral, so the uptrend could continue towards resistance 1. |

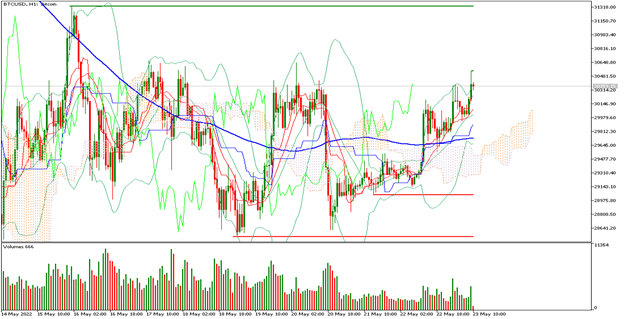

| BITCOIN +3.66% |

| Yesterday was the anniversary of Bitcoin Pizza Day, a day that commemorates the day in 2010 when programmer Laszlo Hanyecz bought two pizzas for 10,000 Bitcoins, which represented the first transaction in cryptocurrencies for a product or service in the real market. On the other hand, the whales (large investors) have slowed down their level of purchases in Bitcoin, and are waiting for the May close. Bitcoin is currently up 3.66% and is trading at USD$30,385. |

|

| Support 1: 30,315.0 Support 2: 30,138.0 Support 3: 29,979.0 Resistance 1: 30,651.0 Resistance 2: 30,810.0 Resistance 3: 30,987.0 Pivot Point: 30,474.0 |

| Price is above the 200-day moving average which is a bullish signal for Bitcoin, between support 1 and resistance 1. Expected trading range between USD$29,979 and USD$30,987. Pivot point for trend change at USD$30,987. RSI in the overbought zone, so the volume of sales or profit taking could increase at the current level, leading the price to correct some points. |

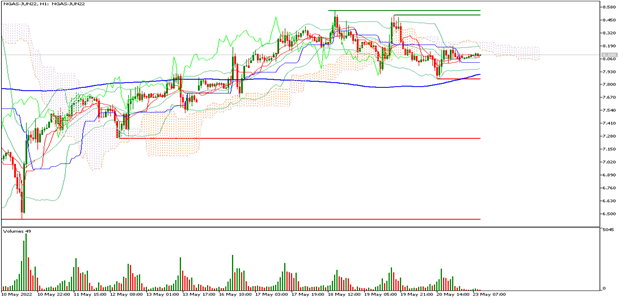

| NATURAL GAS -2.35% |

| The US removed the energy sanctions against Venezuela, with the objective of increasing the flow of commodities in the energy segment in the international market, and thus further stabilizing prices. At the moment the price of natural gas is correcting 2.35% and is trading at USD$8.20 per BTU. However, the U.S. Department of Meteorology announced a reduction in temperatures, which could reduce the demand for natural gas. On the other hand, the European Union announced that companies could open special accounts in Rubles at Gazprombank, in order to pay for Russian natural gas. |

|

| Support 1: 8.176 Support 2: 8.167 Support 3: 8.151 Resistance 1: 8.201 Resistance 2: 8.217 Resistance 3: 8.226 Pivot Point: 8.192 |

| The price is above the 200-day moving average, between support 1 and resistance 1. Expected trading range between USD$8.15 and USD$8.22. Pivot point for trend change at USD$8.19. RSI neutral, so the price could continue correcting towards the next support levels. |

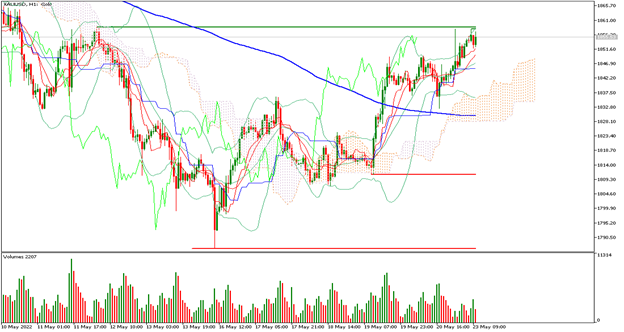

| GOLD +0.62% |

| Gold is moving higher on the back of a weaker dollar and fears of a global economic recession. DAVOS has started and traders are watching for statements from central bankers on monetary policy and also from major industry players and investment banks on the real and credit market. Gold is currently up 0.62% and is trading at USD$1,854 per Troy ounce. |

|

| Support 1: 1,849.79 Support 2: 1,848.09 Support 3: 1,845.68 Resistance 1: 1,853.90 Resistance 2: 1,856.31 Resistance 3: 1,858.01 Pivot Point: 1,852.20 |

| The price is above the 200-day moving average, between resistance 1 and support 1. Expected trading range between USD$1,845 and USD$1,858. Pivot point for trend change at USD$1,852. RSI near the overbought zone, so the price will soon reach the level to take profits. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.