Daily Review for May 04, 2022

The market is watching the FED’s interest rate decision. Traders expect a hike of 50 basis points.

According to ARK Investments, the price of Bitcoin could increase more than 25 times its current value in the next 8 years.

According to API, weekly crude oil stocks in the USA decreased by 3.4 million barrels. For today, analysts expect a decrease of 800,000 barrels in crude inventories.

Greece and Bulgaria are planning a new LNG terminal in order to cut dependence on natural gas from Russia.

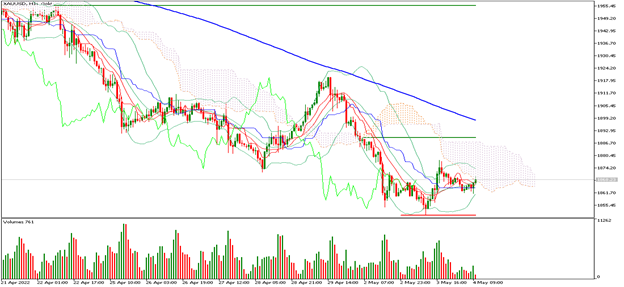

| GOLD -0.14% |

| The market is watching the Fed’s interest rate decision. Traders are expecting a 50 basis point hike, which could generate significant volatility in the equity and fixed income markets. Fed Chairman Jerome Powell will hold a press conference on the Fed’s analysis of the economy. The European Central Bank will also hold a meeting on the economic outlook. Gold is currently trading sideways above USD$1,867 per Troy ounce, as traders evaluate purchases to mitigate volatility in portfolios. |

|

| Support 1: 1,863.02 Support 2: 1,859.19 Support 3: 1,857.28 Resistance 1: 1,868.76 Resistance 2: 1,870.67 Resistance 3: 1,874.50 Pivot Point: 1,864.93 |

| The price is below the 200-day moving average, staying between support 3 and resistance 1. Expected trading range between USD$1,857 and USD$1,874. Pivot point for trend change at USD$1,864. RSI neutral, so the trend could remain sideways, before generating a significant trading volume. |

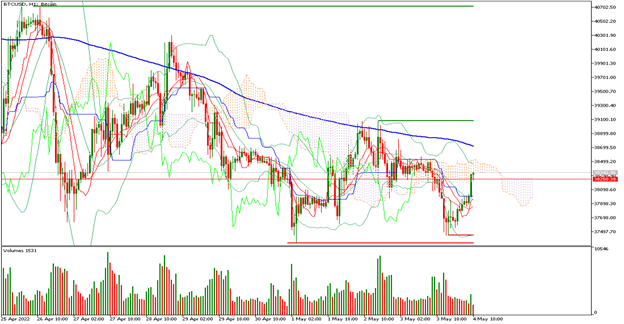

| BITCOIN -0.38% |

| According to ARK Investments, the price of Bitcoin could increase more than 25 times its current value in the next 8 years. According to the investment fund, Bitcoin would be used as digital gold, corporate reserves and institutional investments. The fund estimates that by 2030, companies listed on the S&P500 will hold 5% of their cash in Bitcoin. Companies such as MicroStrategy and Tesla hold part of their cash in crypto. Tesla explained the long-term potential of the cryptocurrency. Today, traders are watching the Fed’s rate decision. |

|

| Support 1: 38,209.4 Support 2: 38,010.7 Support 3: 37,901.4 Resistance 1: 38,517.4 Resistance 2: 38,626.7 Resistance 3: 38,825.5 Pivot Point: 38,318.7 |

| The price rebounded from support 1, at USD$37,497. However, it remains below the 200-day moving average. Expected trading range between USD$37,901 and USD$38,825. Pivot point for trend change at USD$38,318. Traders have started buying in anticipation of the FED. RSI neutral, so the upward movement can be maintained. |

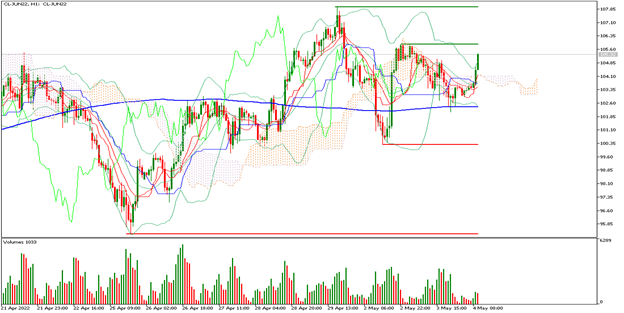

| WTI +2.75% |

| According to API, weekly crude oil reserves in the US decreased by 3.4 million barrels. For today, analysts expect a decrease of 800,000 barrels in crude inventories. Meanwhile, the European Union is preparing new sanctions against Russia, including the O&G sector. Meanwhile, some German refineries continue to buy crude oil and natural gas from Russia, even paying in rubles. At the moment WTI is up 2.75% and is trading at USD$105.21 per barrel. |

|

| Support 1: 103.85 Support 2: 103.26 Support 3: 102.86 Resistance 1: 104.84 Resistance 2: 105.24 Resistance 3: 105.83 Pivot Point: 104.25 |

| The price is above the 200-day moving average, reaching near resistance 1. Expected trading range between USD$102.86 and USD$105.83. Pivot point for trend change at USD$104.25. Neutral RSI approaching the overbought zone. Bulls target is at USD$107.95. |

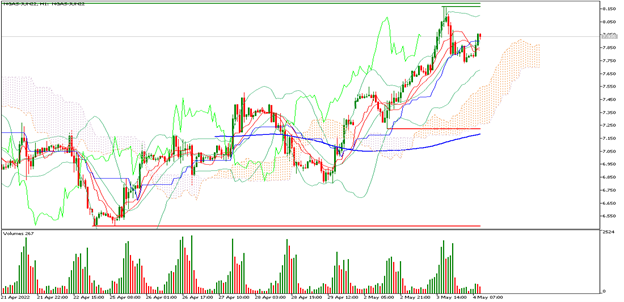

| NATURAL GAS -0.29% |

| Greece and Bulgaria are planning a new LNG terminal in order to cut dependence on natural gas from Russia. Germany’s Uniper refinery has expressed interest in buying the commodity from Russia in rubles. Natural gas is currently down 0.29% and is trading at USD$7.92 per BTU. Meanwhile, China started to buy commodities from Russia in Yuans. The European Union is preparing an energy embargo on Russia, which could lead to a supply shock. |

|

| Support 1: 7.891 Support 2: 7.825 Support 3: 7.789 Resistance 1: 7.993 Resistance 2: 8.029 Resistance 3: 8.095 Pivot Point: 7.927 |

| The price is above the 200-day moving average. It is close to resistances 2 and 3. Expected trading range between USD$7.78 and USD$8.09. Pivot point for trend change at USD$7.92. RSI neutral, so the upward movement could be maintained despite the profit taking of traders. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.