Daily Review for May 03, 2022

The Reserve Bank of Australia raised interest rates in 0.35%, higher than market expectations.

The Fed meeting begins. Investors are watching the interest rate hike.

Traders are watching the financial results of Pfizer, AMD and Aribnb.

Divided opinions among businessmen have been presented in recent days about Bitcoin. Among them Warren Buffet and Elon Musk.

Russia insists international Natural Gas customers to pay in rubles. The European Union will meet to determine what can be done under sanctions regulation.

| GOLD -0.32% |

| The Fed meeting begins. Investors are on the lookout for an interest rate hike. Last week Jerome Powell announced that he had 50 basis points to analyze as a possible hike. The decision on the same will be made tomorrow. At the moment traders are looking for the best buying level in gold, silver and Bitcoin to mitigate portfolios from market risk. Gold is currently down 0.32% and is trading at USD$1,859 per Troy ounce. |

|

| Support 1: 1,857.58 Support 2: 1,855.42 Support 3: 1,853.99 Resistance 1: 1,861.17 Resistance 2: 1,862.60 Resistance 3: 1,864.76 Pivot Point: 1,859.01 |

| The price is at support 3, so a rebound from this area could be possible. Gold is below the 200-day moving average. Expected trading range between USD$1,853 and USD$1,864. Pivot point for trend change at USD$1,859. RSI near the oversold zone. |

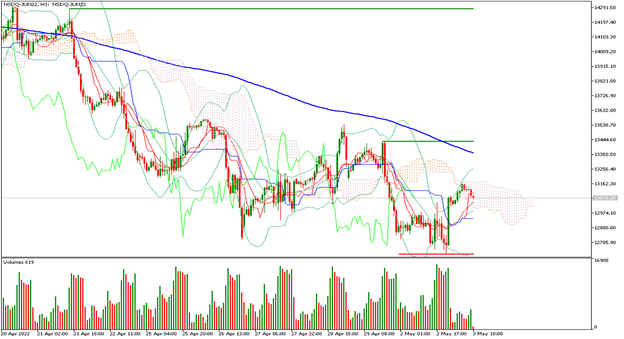

| NASDAQ 100 -0.14% |

| Traders are keeping an eye on the financial results of companies reporting today. Among them are Pfizer, AMD and Aribnb. Pfizer is expected to report earnings per share of 1.52, sales of $24.1 billion and a market capitalization of $271.83 billion. On AMD, the interest on chip production continues, so it is expected an EPS of 0.91; sales of USD$5.01 Billion and a Market Cap of USD$145.55 Billion. Finally, Airbnb is expected to have an EPS of -0.24, sales of USD$1.45 billion and a Market Cap of USD$97.24 billion. |

|

| Support 1: 13,064.8 Support 2: 13,043.8 Support 3: 13,011.8 Resistance 1: 13,117.8 Resistance 2: 13,149.8 Resistance 3: 13,170.8 Pivot Point: 13,096.8 |

| Price is between support 3 and resistance 1. The index remains below the 200-day moving average. Expected trading range between 13,011 and 13,170. Pivot point for trend change at 13,096. RSI neutral, so the index may correct some additional points possibly towards support 3. |

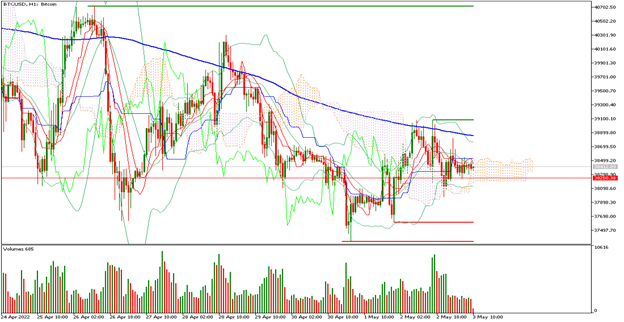

| BITCOIN -0.93% |

| Divided opinions among entrepreneurs have been presented in recent days about the Bitcoin. Among them Warren Buffet and Elon Musk. The former has negative opinions about the cryptocurrency market, while Musk defends the industry. In Russia, the Ministry of Finance is working on a law that allows Bitcoin mining under the self-employed mode. At the moment, traders are watching the Fed’s interest rate decision and the impact scenarios on the Bitcoin price. They are also watching today’s ECB statement. |

|

| Support 1: 38,445.6 Support 2: 38,393.8 Support 3: 38,321.6 Resistance 1: 38,569.6 Resistance 2: 38,641.8 Resistance 3: 38.693,6 Pivot Point: 38,517.8 |

| The price is below the 200-day moving average, which is a bearish signal. The price is between resistance 1 and support 1. Expected trading range between USD$38,321 and USD$38,693. Pivot point for trend change at USD$38,517. RSI neutral, so the Bitcoin may correct some additional points, possibly towards support 1. |

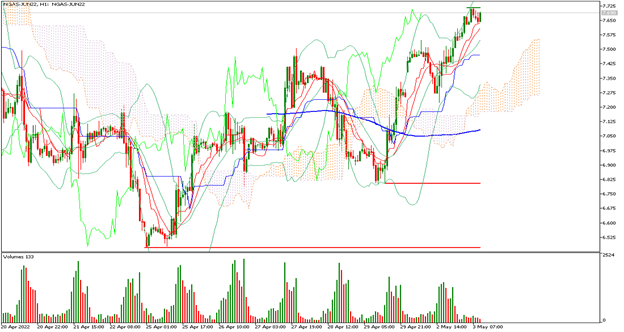

| NATURAL GAS +1.86% |

| Russia insists international Natural Gas customers to pay in rubles. The European Union will meet to determine what can be done under the sanction’s regulation. India continues to buy raw materials from Russia. Analysts expect a supply shock of Russian natural gas, which would generate a continued price rally. Finland has cancelled its nuclear agreement with Russia and is considering joining NATO. |

|

| Support 1: 7.623 Support 2: 7.603 Support 3: 7.568 Resistance 1: 7.678 Resistance 2: 7.713 Resistance 3: 7.733 Pivot Point: 7.658 |

| The price is at resistance 2, staying above the 200-day moving average. Expected trading range between USD$7.56 and USD$7.73. Pivot point for trend change at USD$7.65. RSI near the overbought zone, so some traders may begin to take profits. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.