Daily Review for May 02, 2022

Traders are keeping an eye on the development of covid-19 restrictions in China. At the moment, the country’s major cities including Shanghai and Beijing are under lockdowns.

Natural gas futures continue to rise, after Russia continued to cut the commodity to the European Union.

Compared to all global stock market assets, Bitcoin ranks ninth in market capitalization and accounts for 42.36% of the total value of the crypto industry globally.

Analysts expect a 50-basis point interest rate hike at this week’s Fed meeting.

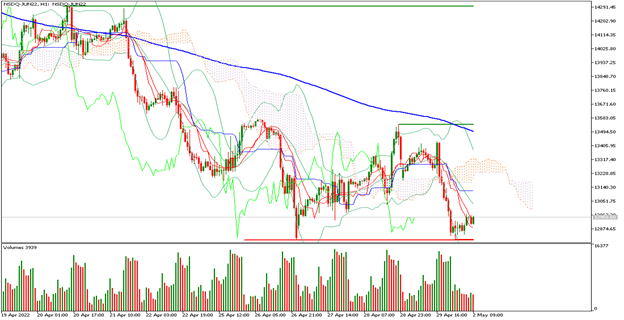

| NASDAQ 100 +0.82% |

| Traders are keeping an eye on the development of covid-19 restrictions in China. At the moment the country’s major cities including Shanghai and Beijing are confined. This could lead to a massive sell-off in the market again, due to the economic impact that confinements have on the industry. Meanwhile, Wall Street stock indexes are starting the week in positive territory. The Nasdaq 100 is up 0.82% and is trading at 12,979 points. Traders are looking to regain 13,000 points. |

|

| Support 1: 12,888.9 Support 2: 12,868.6 Support 3: 12,831.6 Resistance 1: 12,946.2 Resistance 2: 12,983.2 Resistance 3: 13,003.5 Pivot Point: 12,925.9 |

| The index is near support 1, from where it started to bounce; however, the price is still below the 200-day moving average. Expected trading range between 12,831 and 13,003. Pivot point for trend change at 12,925. RSI neutral, so the rebound may continue towards resistance 1. |

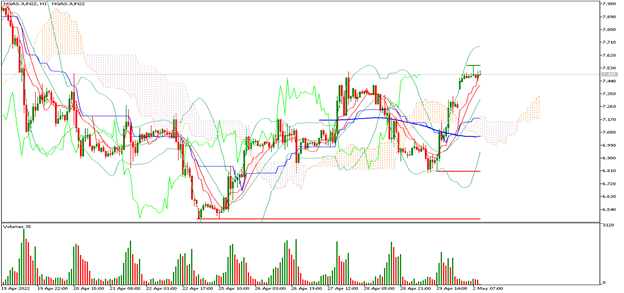

| NATURAL GAS +3.22% |

| Natural gas futures continue to rise after Russia continues to cut commodity supplies to the European Union. As a result, EU energy ministers are holding an emergency meeting. Russia, for its part, demands payment in Rubles, for which it has stated that buyers interested in the gas must deposit Euros or Dollars in an account of the Russian bank Gazprombank, so that it can convert them into Rubles. The EU has told its members that accepting this would violate the sanctions imposed on Russia. At the moment the commodity is up 3.22% and is trading at USD$7.84 per BTU. |

|

| Support 1: 7,451 Support 2: 7,415 Support 3: 7,384 Resistance 1: 7,518 Resistance 2: 7,549 Resistance 3: 7,585 Pivot Point: 7,482 |

| The price is close to resistance 1, so it remains above the 200-day moving average. Expected trading range between USD$7.38 and USD$7.58. Pivot point for trend change at USD$7.48. RSI in overbought zone, so it could present a correction from the current level. |

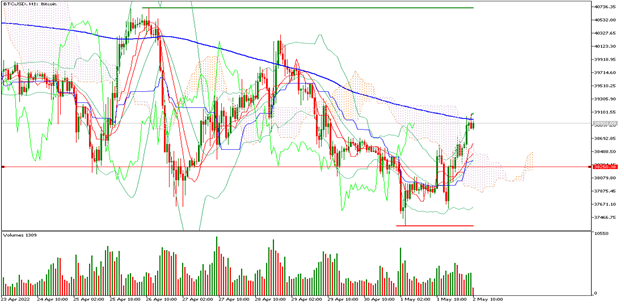

| BITCOIN +2.70% |

| After a tough April for cryptocurrencies, Bitcoin starts May with a 2.70% rise. Compared to all global stock market assets, Bitcoin ranks ninth in market capitalization and represents 42.36% of the total value of the crypto industry globally. On the other hand, traders are focused on this week’s Fed meeting, where the bank is expected to raise interest rates by 50 basis points. In addition, Goldman Sachs started offering a Bitcoin-backed loan to the market. |

|

| Support 1: 38,882.6 Support 2: 38,807.3 Support 3: 38,656.6 Resistance 1: 39,108.6 Resistance 2: 39,259.3 Resistance 3: 39,334.6 Pivot Point: 39,033.3 |

| The price is at the same level of the 200-day moving average. Expected trading range between USD$38,656 and USD$39,334. Pivot point for trend change at USD$39,033. RSI near the overbought zone. The Bulls are looking to recover USD$40,000 in order to climb towards resistance 2. |

| GOLD -1.38% |

| Stock markets are mixed globally. Investors maintain mixed positions, due to this week’s FED meeting. Analysts expect a 50 basis points increase in interest rates. At the moment, gold has dropped below the level of USD$1,900 per Troy ounce. However, a recovery in the area could be expected after the FED meeting. At the moment gold is down 1.38% and is trading at USD$1,885 per Troy ounce. |

|

| Support 1: 1,884.44 Support 2: 1,881.62 Support 3: 1,879.89 Resistance 1: 1,888.99 Resistance 2: 1,890.72 Resistance 3: 1,893.54 Pivot Point: 1,886.17 |

| Price is below the 200-day moving average, right between support 3 and resistance 1. Expected trading range between USD$1,879 and USD$1,893. Pivot point for trend change at USD$1,886. RSI near the oversold zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.