Daily Review for March 25, 2022

The price of natural gas shows an upward movement, as the European Union and the United States close an agreement for the continuous supply of Liquefied Natural Gas.

Bitcoin continues the rally, this time the Bulls are looking to break above USD$44,000 in order to mark the bullish channel towards USD$50,000. Russians look to trade their commodities with Bitcoin.

Global stock markets correct due to the continuation of the Ukraine war. Russia’s RTS is down over 19% at the moment.

WTI corrects due to profit taking by traders. Possible supply shock from Russia. Physical traders project the price in the USD$200 per barrel by the close of 2022.

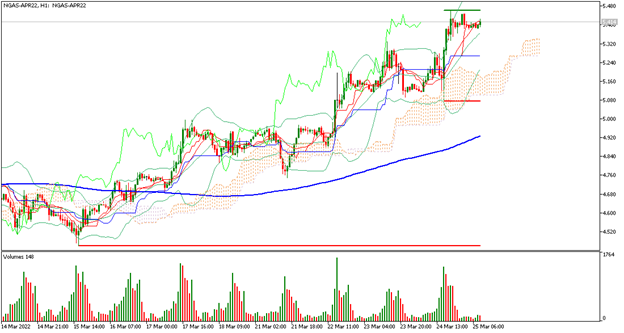

| NATURAL GAS +0.20% |

| The summit of European leaders continues and one of the main topics is the supply of energy commodities to the European Union. For the time being, an agreement has been reached between the EU and the United States for the continued supply of Liquefied Natural Gas. Canada has also shown interest. At the moment Natural Gas is up 0.20% and is trading at USD$5.40 per BTU. The European bloc is analyzing the scenario of zero natural gas imports from Russia. Germany is concerned about supply from other origins. |

|

| Support 1: 5.393 Support 2: 5.380 Support 3: 5.374 Resistance 1: 5.412 Resistance 2: 5.418 Resistance 3: 5.431 Pivot Point: 5.399 |

| The price is above the 200-day moving average. The commodity is at the USD$5.48 resistance, which could indicate the beginning of the sell-off or sideways trend. Expected trading range between USD$5.37 and USD$5.43. Pivot point for trend change at USD$5.39. RSI near the overbought zone. |

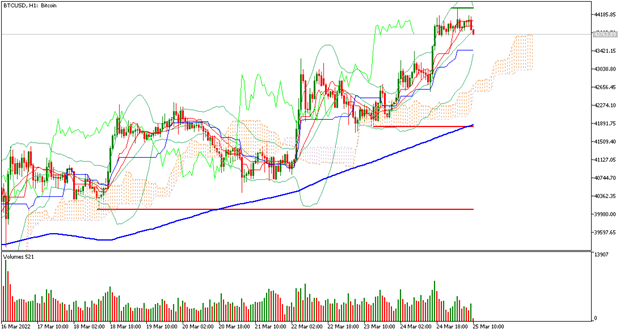

| BITCOIN +1.58% |

| Russian government has expressed its interest in accepting Bitcoin as a means of payment for natural gas, coal, oil and the rest of its raw materials. At the moment the crypto price has managed to overcome the USD$43,000 resistance and is now looking to consolidate above USD$44,000. Bitcoin is currently up 1.58% and is trading at USD$43,688. On the other hand, ExxonMobil presented its interest in supplying Bitcoin miners with natural gas. |

|

| Support 1: 43,823.6 Support 2: 43,732.2 Support 3: 43,551.0 Resistance 1: 44,096.2 Resistance 2: 44,277.4 Resistance 3: 44,368.8 Pivot Point: 44,004.8 |

| The price is above the 200-day moving average, which is a bullish signal for Bitcoin. Expected trading range between USD$43,551 and USD$44,368. Pivot point for trend change at USD$44,004. The price is trying to generate a bullish channel. Now it presents a slight sideways movement, so the Bulls can continue to lead the market. If the trend continues, the long market target is at USD$50,000. |

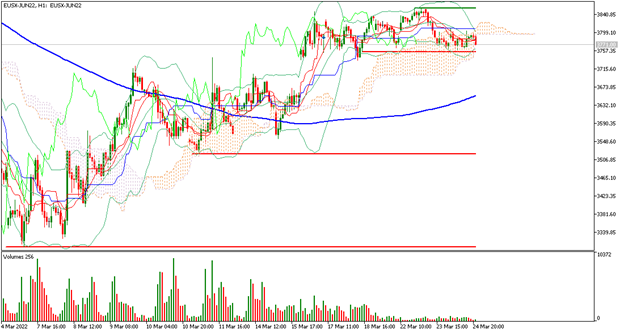

| EUROSTOXX 50 -0.74% |

| Global stock markets are moving into negative territory due to the continuation of the war in Ukraine. The Russian Stock Exchange, the RTS is currently down 19.17%. In Europe, the Eurostoxx 50 shows the main fall with – 0.74%. Discussions on further sanctions on Russia continue. The next package could involve the Russian energy market. As for Wall Street indexes, the Nasdaq 100 is currently correcting 0.37%. |

|

| Support 1: 3,780 Support 2: 3,772 Support 3: 3,762 Resistance 1: 3,798 Resistance 2: 3,808 Resistance 3: 3,816 Pivot Point: 3,790 |

| The price is moving sideways above 3,776. However, it remains above the 200-day moving average. Expected trading range between 3,762 and 3,816. Pivot point for trend change at 3,790. If the price continues to decline, it could reach 3,763. On the other hand, if it changes trend, the Bulls’ target is 3,840. RSI neutral. |

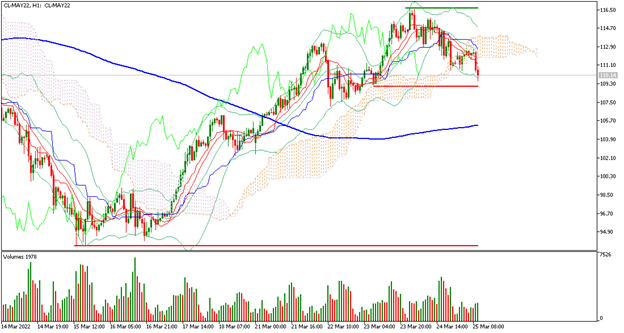

| WTI -2.03% |

| WTI price is currently correcting 2.03% and is trading at USD$109.97 per barrel. With the supply shock due to the sanctions against Russia, other producing countries have presented their plans to increase their production capacity. Among them, Iran, which presented a plan to produce 4 million barrels per day. The United States is also reaching its maximum production capacity. Physical crude oil traders project the price to reach USD$200 per barrel by the end of 2022. |

|

| Support 1: 109.90 Support 2: 109.17 Support 3: 107.86 Resistance 1: 111.94 Resistance 2: 113.25 Resistance 3: 113.98 Pivot Point: 111.21 |

| Despite the price drop, the commodity remains above the 200-day moving average. It is currently at the USD$109.92 support level. If it overcomes this floor, the next level to watch could be USD$105.70. Expected trading range between USD$107.86 and USD$113.98. Pivot point at USD$111.21. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.