Daily Review for March 18, 2022

The Bank of Japan left interest rates unchanged.

European and Wall Street stock markets fall due to interest rates hike. Traders are looking forward to Joe Biden’s call with Xi Jinping.

Cryptos correct as a result of the equity correction. However, Ethereum remains in positive territory due to the benefits of its upgrade.

Natural Gas corrects. However, supply continues to present disruptions. An increase in Liquified Gas exports from the United States to Europe is expected, following the approval of the Department of Energy.

Traders are evaluating the possible change of trend and rebound of gold. The price has remained down and sideways during the week. In spite of this, equities are starting to correct, which could lead to a rebound in metals.

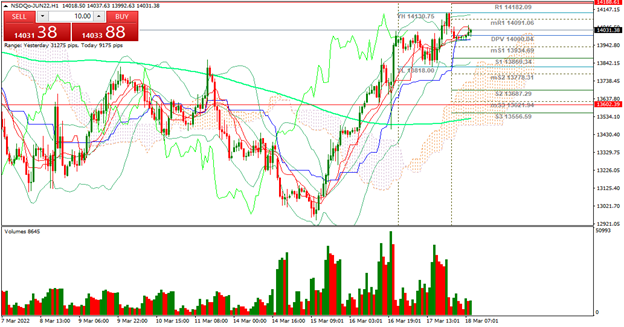

| NASDAQ 100 -0.58% |

| European and Wall Street stock indices are in negative territory, due to the rate hike by the FED and the Bank of England and also to the continuation of the war in Ukraine. At the moment the Nasdaq 100 is down 0.58% and is trading at 14,027. Traders are paying attention to the call between Joe Biden and Xi Jinping, where the focus is on the positions on the war in Ukraine. In addition, today several FOMC members will present their views on the economic outlook. |

|

| Support 1: 13,998.0 Support 2: 13,969.3 Support 3: 13,937.6 Resistance 1: 14,058.4 Resistance 2: 14,090.1 Resistance 3: 14,118.8 Pivot Point: 14,029.7 |

| The price is between the pivot point and resistance 1. The Ichimoku cloud projects the trading range between 13,937 and 14,118. Pivot point for trend change at 14,029. RSI neutral. The index remains above the 200-day moving average. |

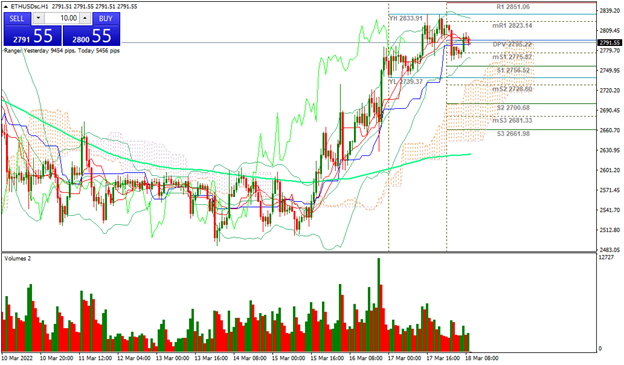

| ETHEREUM +1.43% |

| The crypto presented a technological update and generated a complete change of its protocol. Meanwhile, traders are evaluating the USD$2,500 support level which would be the most acid scenario in the face of a fall. At the moment, the crypto market is correcting due to the impact of rising rates and the war in Ukraine. However, Ethereum manages to stay in positive territory, rising 1.43% at the moment and trading at USD$2,794. |

|

| Support 1: 2,793.93 Support 2: 2,788.28 Support 3: 2,780.48 Resistance 1: 2,807.38 Resistance 2: 2,815.18 Resistance 3: 2,820.83 Pivot Point: 2,801.73 |

| The price remains above the 200-day moving average, which is a bullish signal for Ethereum. Expected trading range between USD$2,780 and USD$2,820. Pivot point for trend change at USD$2,802. Neutral RSI. Possible continuation of the uptrend, despite the market correction. |

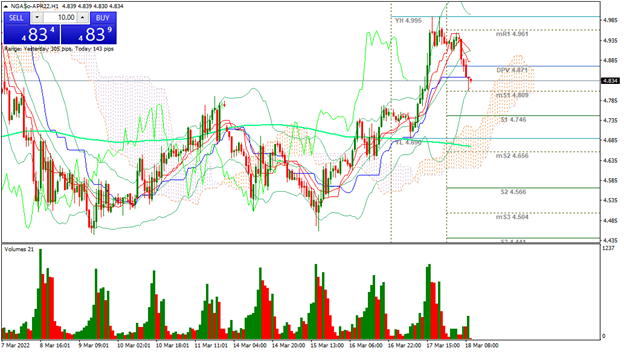

| NATURAL GAS -3.09% |

| The U.S. Department of Energy authorized an increase in Liquefied Gas exports to Europe. However, the pressure on the global supply of the commodity continues. At this moment Natural Gas is falling 3.09% and is trading at USD$4.82 per BTU. On the other hand, Russia is looking for new markets to supply energy commodities. |

|

| Support 1: 4.820 Support 2: 4.799 Support 3: 4.785 Resistance 1: 4.855 Resistance 2: 4.869 Resistance 3: 4.890 Pivot Point: 4.834 |

| The price is between the pivot point and support 1. Expected trading range between USD$4.78 and USD$4.89. Pivot point for trend change at USD$4.83. RSI neutral. Possible bounce zone at support 1. The price remains above the 200-day moving average. |

| GOLD -0.46% |

| Interesting week for metals traders. Three interest rate announcements have been presented during the week. First the FED, raising interest rates by 0.25%. Then the Bank of England, also raising rates by 0.25%, and finally the Bank of Japan, which decided to leave rates unchanged. In this sense, the price of gold has not presented a significant rebound for the moment, so traders are looking for the best support level, even sideways, to break the trend and generate volume towards USD$2,000 per Troy ounce. |

|

| Support 1: 1,932.45 Support 2: 1,929.90 Support 3: 1,927.70 Resistance 1: 1,937.20 Resistance 2: 1,939.40 Resistance 3: 1,941.95 Pivot Point: 1,934.65 |

| The price is below the 200-day moving average. Expected trading range between USD$1,927 and USD$1,941. Pivot point for trend change at USD$1,934. RSI neutral. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.