Daily Review for March 16, 2022

The FED will take the first interest rate decision of the year. A rate hike of 0.25% is expected versus the 0.50% initially expected. Gold and silver correct ahead of the announcement.

The WTI price rebounds, after the possible reduction of inventories in the United States, derived from the increase in exports to Europe. Bulls look to regain USD$100 per barrel.

Bitcoin rebounds and rises more than 5%, generated by the interest of new investors, including Bill Gross.

Global stock indices in positive territory. Stock markets rise ahead of the Fed announcement, which could change the trend.

| GOLD -0.67% |

| Traders are looking forward to the Fed’s interest rate announcement. Analysts expect a 0.25% rate hike. Initially, a 0.50% hike was expected. However, the war in Ukraine has led to a change in the Fed’s economic outlook. Meanwhile, Wall Street’s main investment banks estimate 7 rate hikes during the course of the year. For the moment, global stock indices are in positive territory. Metals are correcting. The market trend could change during the interest rate decision. |

|

| Support 1: 1,915.56 Support 2: 1,913.08 Support 3: 1,910.46 Resistance 1: 1,920.66 Resistance 2: 1,923.28 Resistance 3: 1,925.76 Pivot Point: 1,918.18 |

| The price is between support 1 and the pivot point. Bearish channel. Gold is below the 200-day moving average. Expected trading range between USD$1,910 and USD$1,925. Pivot point at USD$1,918. RSI neutral. Possible trend reversal, depending on Jerome Powell’s statements as FED Chairman. |

| WTI +2.05% |

| Today the IEA will present its monthly energy report. At the moment, WTI is up 2.05% and is trading at USD$98.73 per barrel. Traders are also paying attention to crude oil inventories in the United States, where a decrease of 1.37 million barrels is expected, due to the increase in US exports to Europe. On the other hand, crude oil exports from Russia to Europe have come to a standstill. For example, Gazprom’s deliveries to Europe have decreased by 28.5%. |

|

| Support 1: 97.87 Support 2: 97.20 Support 3: 96.79 Resistance 1: 98.95 Resistance 2: 99.36 Resistance 3: 100.03 Pivot Point: 98.28 |

| The price is below the 200-day moving average. Expected trading range between USD$96.79 and USD$100.03. Pivot point for trend change at USD$98.28. Bulls are looking for the USD$100 area again. The outlook remains bullish, as Russian crude oil is leaving the international market and this generates a supply disruption. |

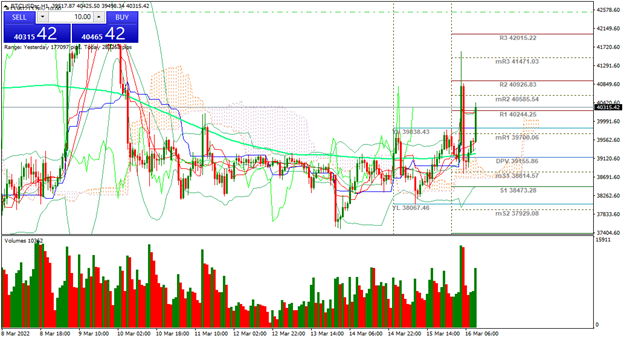

| BITCOIN +5.33% |

| Due to Bitcoin’s correlation with the equity market, it is likely that crypto will present a similar movement to equities at the time of the FED’s interest rate decision. On the other hand, the Bitcoin is presenting bullish movement, rising 5.33% at the moment and trading at USD$40,253. The sideways movement of the cryptocurrency has attracted the attention of large investors such as Bill Gross, who has started to invest in Bitcoin. |

|

| Support 1: 39,436.0 Support 2: 39,279.0 Support 3: 39,153.0 Resistance 1: 39,719.0 Resistance 2: 39,845.0 Resistance 3: 40,002.0 Pivot Point: 39,562.0 |

| The price is above the 200-day moving average, which is a bullish sign for Bitcoin. The crypto reached almost USD$42,000 before turning back towards the USD$40,000 area. If the upward momentum consolidates, the price could reach USD$42,015. Expected trading range between USD$39,153 and USD$40,002. RSI approaching the overbought zone. |

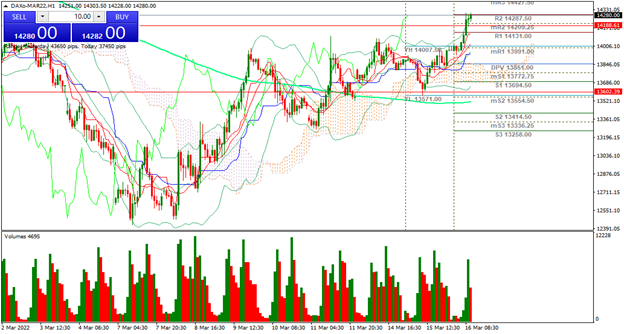

| DAX 40 +2.56% |

| Global stock indexes are bouncing, presenting an interesting rally just before the FED interest rate decision, which could generate a change of trend. At the moment the DAX 40 is up 2.56% and is trading at 14,269 points. China’s indices are showing a strong rebound, with the Hang Seng rising +10.08% and the A50 +8.91%. On the other hand, the market is attentive to the appearance of Ukrainian President Zelensky before the US Congress. |

|

| Support 1: 14,197.6 Support 2: 14,131.8 Support 3: 14,079.6 Resistance 1: 14,315.6 Resistance 2: 14,367.8 Resistance 3: 14,433.6 Pivot Point: 14,249.8 |

| The index is at resistance 2, where buying volume continues, so the price could reach 14,567 points. Expected trading range between 14,079 and 14,433. Pivot point for trend change at 14,249. RSI in overbought zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.