Daily Review for July 13, 2022

Traders are watching the U.S. inflation report. Analysts expect at least 8.8% annually. However, investment funds expect a higher figure.

The managers of the crypto fund Three Arrows Capital did not appear before the court in the USA. The fund filed for bankruptcy in the crypto-winter.

Oil inventories rose 4.8 million barrels according to API. The increase in supply is having a major impact on the price, which is currently correcting 8.18% and is trading at USD$95.58 per barrel.

Companies are starting to report financial results for Q2 2022. Traders continue to watch the CPI in the United States, which is expected to be higher than expected.

| GOLD -0.46% |

| Traders are watching the U.S. inflation report. Analysts expect at least 8.8% annually. However, investment funds expect a higher figure. Wall Street is beginning to discount the above, generating declines in the three stock market indexes. Investors are looking for hedging alternatives for their portfolios, through gold, silver and bonds. At this moment the price of gold is falling 0.46% and is trading at USD$1,723 per Troy ounce. Traders are also keeping an eye on the Reserve Bank of New Zealand’s interest rate decision, which is expected to be raised by 50 basis points. |

|

| Support 1: 1,721.99 Support 2: 1,720.12 Support 3: 1,717.54 Resistance 1: 1,726.44 Resistance 2: 1,729.02 Resistance 3: 1,730.89 Pivot Point: 1,724.57 |

| The price is below the 200-day moving average, between resistance 1 and support 3. Expected trading range between USD$1,717 and USD$1,730. Pivot point for trend change at USD$1,724. RSI neutral, so the price could remain sideways before the inflation report. |

| BITCOIN -4.49% |

| The managers of the crypto fund Three Arrows Capital did not appear before the court in the USA. The fund filed for bankruptcy in the crypto winter. The liquidating firm, Teneo, will seek to recover USD$3 billion in assets. The fund had USD$10 billion in assets under management in March. However the high exposure in Terra Luna, and the devaluation of crypto, affected the fund’s liquidity. The bankruptcy of Three Arrows capital also generated the bankruptcy of the crypto platform Voyager Digital, when it defaulted on a payment of USD$670 million. Bitcoin is currently down 4.49% and is trading at USD$19,372. Traders are keeping an eye on the inflation report. If it is lower than expected, Bitcoin could rebound. Otherwise it could correct further. |

|

| Support 1: 19,209.6 Support 2: 19,040.8 Support 3: 18,792.6 Resistance 1: 19,626.6 Resistance 2: 19,874.8 Resistance 3: 20,043.6 Pivot Point: 19,457.8 |

| The price is below the 200-day moving average, between resistance 1 and support 2. Expected trading range between USD$18,792 and USD$20,043. Pivot point for trend change at USD$19,457. RSI in oversold zone, so it could generate some interest in the Bulls at this level. At the moment the trading volume is low, so traders are waiting for the US CPI. |

| WTI -8.18% |

| Oil inventories increased by 4.8 million barrels according to API. The increase in supply is having a major impact on the price, which is currently correcting 8.18% and is trading at USD$95.58 per barrel. Hedge funds continue to sell oil futures, due to the analysis on the recession, which would take the price to lower levels, even at levels below USD$60 per barrel. OPEC is 1 million barrels per day below its production target. |

|

| Support 1: 95.45 Support 2: 95.23 Support 3: 95.09 Resistance 1: 95.81 Resistance 2: 95.95 Resistance 3: 96.17 Pivot Point: 95.59 |

| Price is below the 200-day moving average, between resistance 1 and support 3. Expected trading range between USD$95.09 and USD$96.17. Pivot point for trend change at USD$95.59. RSI in oversold zone, which could attract traders’ attention, however, the increase in supply and fear of recession, may cause prices to fall further. |

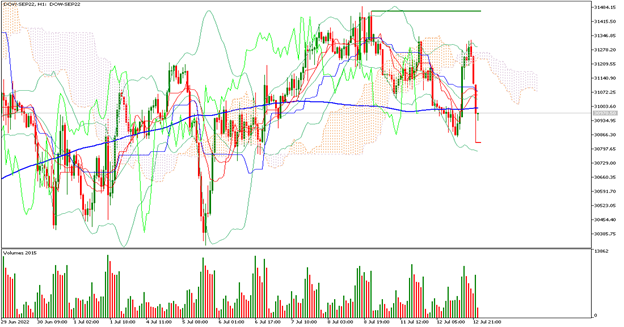

| DOW JONES -0.57% |

| Companies are starting to report financial results for Q2 2022. Traders continue to watch the CPI in the U.S., which is expected to be higher than expected. Depending on the above, the Fed could take a more aggressive monetary policy strategy, with steady interest rate hikes. The Treasury yield curve is inverted between long-term and short-term yields, indicating economic contraction. However, the decline in commodity prices may indicate that we have reached a peak in inflation, and inflation could begin to decline. |

|

| Support 1: 30860.7 Support 2: 30719.3 Support 3: 30578.5 Resistance 1: 31142.9 Resistance 2: 31283.7 Resistance 3: 31425.1 Pivot Point: 31001.5 |

| Price is below the 200-day moving average, between support 1 and resistance 1. Expected trading range between 30,578 and 31,425. Pivot point for trend change at 31,001. RSI neutral, so the price could continue to correct towards support 1. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.