Daily Review for January 6, 2021

Stock exchanges react to Georgia election. European markets attentive to the results

Significant rise in oil prices following the OPEC+ agreement to not increase production until March 2021

Crude oil inventories decreased by 1.6 million barrels in the USA

DAX is trying to break the 13,900 resistance and the Bulls are aiming at 15,000

Gold as a safe-haven asset takes center stage after the onset of market volatility in 2021

FTSE 100 +1.06%

Despite the new UK lockdown, the British index is currently up 1.06% and traders are aware of the PMI data. Similarly, the market is awaiting the results of the election in Georgia, which could generate volatility for the index and the market in general.

The companies in the index that are rising are Shell and BP, due to the impulse taken by oil price, as a consequence of the OPEC+ strategy to slightly increase production only until March 2021.

- Support 1: 6,597.7

- Support 2: 6,586.1

- Support 3: 6,572.7

- Resistance 1: 6,622.7

- Resistance 2: 6,636.1

- Resistance 3: 6,647.7

- Pivot Point: 6,611.1

The index continues to form a ascending triangle with a resistance of 6,700. Price continues to rise above the 25 and 50 day moving average and the RSI continues to increase. Bulls are going to try to move the index up to the mentioned resistance. Main support at 6,600.

DAX 30 +0.40%

For the time being, lockdowns in Europe do not affect the German index. The DAX 30 is currently up 0.40% and the Bulls insist on breaking the resistance of 13,900.

This resistance has been very important and strong, so if the index were to exceed it, the next target would be 15,000 points. Similarly, investors are waiting for the Georgia count and result in the USA, to set the trend in the markets.

- Support 1: 13,699.9

- Support 2: 13,676.7

- Support 3: 13,651.4

- Resistance 1: 13,748.4

- Resistance 2: 13,773.7

- Resistance 3: 13,796.9

- Pivot Point: 13,725.2

At the end of 2020 the index reached its peak and marked an upward trend, mainly due to events such as the Brexit agreement, covid vaccine and the Christmas rally. Today, a trading range between 13,651 and 13,769 is expected with a pivot point for trend change at 13,725. The challenge for the Bulls is to overcome the resistance of 13,900 and drive the index above 14,000.

CRUDE OIL -0.24%

At yesterday’s meeting, OPEC+ determined that oil production will only start to increase slightly from March 2021, and under constant observation of market demand; which led to prices to reach USD$50/barrel.

At this time the WTI price is falling by 0.24%, giving up some of yesterday’s rise. Another event in favour of yesterdays price rise, was the decrease in US crude oil inventories by 1.6 million barrels according to the API report.

- Support 1: 49.76

- Support 2: 49.66

- Support 3: 49.45

- Resistance 1: 50.07

- Resistance 2: 50.28

- Resistance 3: 50.38

- Pivot Point: 49.97

Higher resistance in 50.38 with support at 49.45. Pivot point for change of trend at 49.97. Upward force is presented according to the technical ratios, mainly braced by the crossing of the 5 and 30 day moving average. Next Bulls target is at the 50.38 resistance.

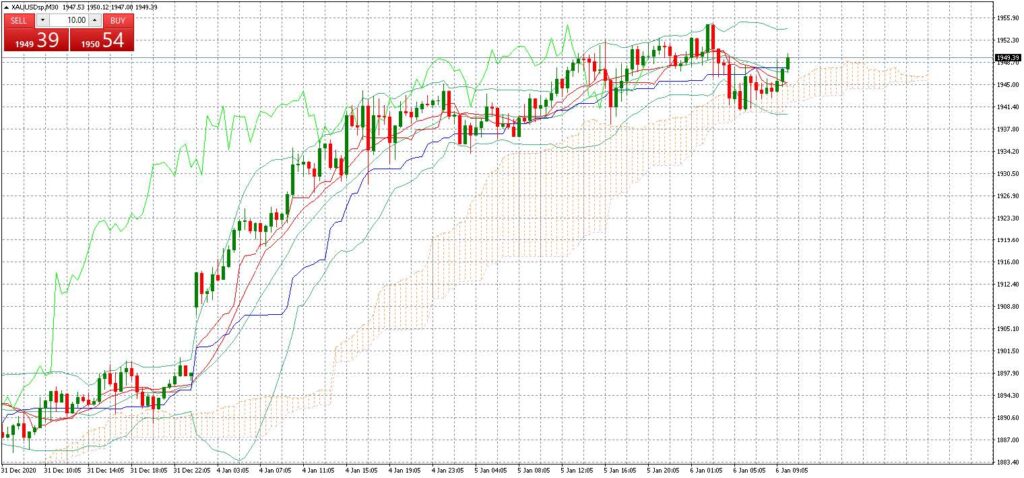

Gold -0.07%

Gold is trading at USD$1,948 per troy ounce, which is 10.50% higher than the December 2020 low where the metal reached USD$1,765 per troy ounce. During the first two days of this week, the market has shown interesting volatility, mainly generated by the return of hedge funds and market optimism.

Yesterday, the market corrected some of the gains of the first days of 2021 and after that, gold prices rebounded. Today, the volatility is going to be concentrated in the elections in Georgia.

- Support 1: 1,948.85

- Support 2: 1,946.45

- Support 3: 1,945

- Resistance 1: 1,952.70

- Resistance 2: 1,954.15

- Resistance 3: 1,956.55

- Pivot Point: 1,950.30

The price of gold has moved above the short- and medium-term moving average. It is below the 1,966 resistance. Expected trading range between 1,945 and 1,956. Pivot point at 1,950. The Bulls current target is USD$2,000 per troy ounce.

Sources

- Reuters

- Market watch

- Bloomberg

- Capitalix Market Research

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.