Daily Review for January 4, 2021

Global stock market indices with upward trend due to the buying power caused by the return of hedge funds from holidays

Dow Jones manages to stay above 30,600 points and target 31,000

DAX at historical high and nears resistance at 13,916

Crude oil with strength due to the weakening of the USD, and awaiting today’s OPEC+ meeting

Gold as a traditional safe-haven asset, with bullish momentum from traders buying it to reduce portfolios volatility in the face of a possible market correction

DOW JONES +0.37%

Global stock market indices are in green, continuing the good performance of the stock market in 2020. In the Asian markets, the Hang Seng index is rising as investors estimate that many of the Chinese companies that will be delisted in New York will finance their operations through the Hong Kong Stock Exchange. Hedge funds are returning to the market, and with it greater volume being traded. On the other hand, in the United States, the market is awaiting the elections in Georgia, where if the Democrats take control of the Senate, greater economic stimulus packages are expected, but also higher taxes.

- Support 1: 30,598

- Support 2: 30,574.5

- Support 3: 30,562.5

- Resistance 1: 30,633.5

- Resistance 2: 30,645.5

- Resistance 3: 30,669

- Pivot Point: 30,610

Expected trading range between 30,562 and 30,669 with pivot point for trend change at 30,610. Ichimoku’s cloud projects 30,492. Price of the index continues to rise with an upward outlook, driven by the volume of the market.

DAX +0.85%

European hedge funds start the year with buying power in the market, driving European indexes upwards. Meanwhile, the USD continues to weaken and gold and other commodities continue their upward trend due to this effect.

Traders are watching global manufacturing PMI data. In Asia, China and India didn’t exceeded market forecast; however, Japan was better than expected. In Europe, vaccines are still advancing, but at a lower level than expected. Logistics issues and maintaining the right temperature for vaccines have slowed the process. Therefore, possible new lockdowns could arise.

- Support 1: 13,769.46

- Support 2: 13,731.28

- Support 3: 13,654.91

- Resistance 1: 13,884.01

- Resistance 2: 13,960.38

- Resistance 3: 13,998.56

- Pivot Point: 13,845.83

Technical indicators indicate that the German index is starting the year strong, and the Bulls are targeting the resistance at 13,884 points. If they manage to break through this level, the next target is at 13,906 level. Main supports are between 13,769 and 13,654 points. Pivot point for change in trend at 13,845.

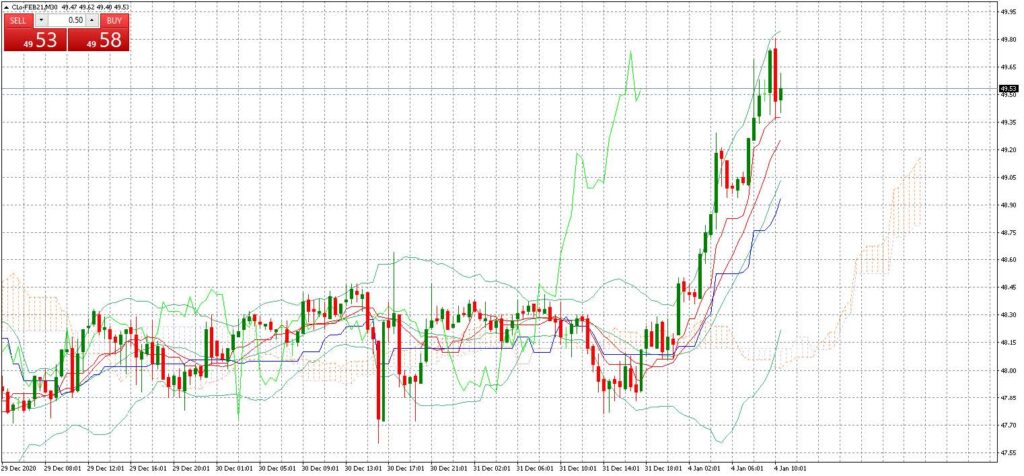

CRUDE OIL +2.08%

The oil market is currently up 2.08% and overall commodities are up as a result of a weakening USD. Crude oil production will be reviewed today by OPEC+. The cutback strategy is expected to continue, with slight increases in supply on a monthly basis, depending on the reaction of demand to the global industrial engine at the beginning of the year.

- Support 1: 49.33

- Support 2: 49.13

- Support 3: 48.88

- Resistance 1: 49.78

- Resistance 2: 50.03

- Resistance 3: 50.23

- Pivot Point: 49.58

Bulls target is to bring the price of oil to USD$50/barrel. Main support for this is USD$48.88/barrel. Expected trading range between 48.88 and 50.23 with pivot point for a change in trend at 49.58. Upward trend, as long as the USD continues to fall.

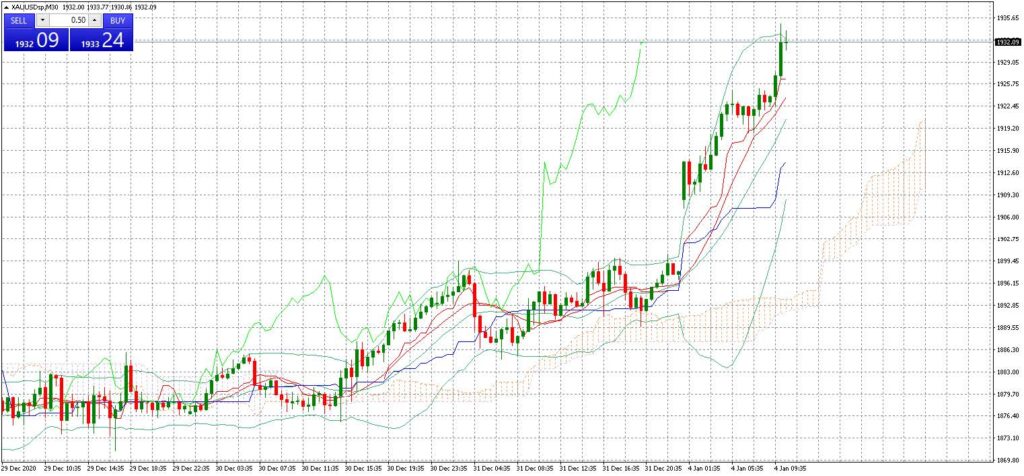

GOLD +2.19%

Gold continues to strengthen, reaching a price of USD$1,931 per troy ounce. Bulls forecast that gold may return to the USD$2,600 per ounce level this year. Everything depends on the performance of the global economy, the movement of benchmark interest rates, mainly from the FED and ECB, and the performance of the stock market.

The market has seen a strong upward trend in crypto-currencies, with Bitcoin mainly becoming a safe-haven asset. However, its speculative trend has allowed traditional assets such as gold to show new buying power by the beginning of the year.

- Support 1: 1,931.84

- Support 2: 1,925.17

- Support 3: 1,921.69

- Resistance 1: 1,941.99

- Resistance 2: 1,945.47

- Resistance 3: 1,952.14

- Pivot Point: 1,935.32

Expected trading range between 1,921 and 1,952 with a pivot point for a change in trend at 1,935. Ichomoku cloud estimates that gold may fall slightly above USD$1,919. Traders are watching for larger stimulus packages in the US, which may cause the USD to continue to fall and Gold to rise.

Sources

Reuters

Market watch

Bloomberg

Capitalix Market Research

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.