Daily review for January 21, 2022

Cryptocurrencies fall sharply, triggered by the Russian Central Bank and its intention to ban Bitcoin trading and mining.

European stock indices correct due to geopolitical tensions between Russia and Ukraine. Traders are looking forward to the ECB monetary policy statement.

Natural Gas seeks to regain the USD$4 per BTU zone. Energy demand continues to increase. The United States consolidates its position as the largest exporter of LNG globally.

Equities fall globally. Metals are also falling. Traders expect a possible rebound in commodities due to the market correction.

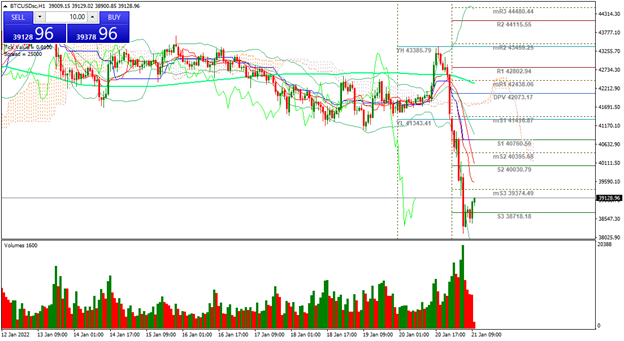

| BITCOIN -6.62% |

| Significant drop in the crypto market. Russia wants to ban crypto mining. Crypto.com Exchange confirmed the hacking, where it lost USD$30 million. Due to the above factors, Bitcoin is falling 6.62% and is trading at USD$39,156 breaking all supports. Ethereum is falling 7.63% and is trading at USD$2,882. The Central Bank of Russia also wants to ban Bitcoin trading. |

|

| Support 1: 38,753.0 Support 2: 38,354.9 Support 3: 38,143.9 Resistance 1: 39,362.1 Resistance 2: 39,573.1 Resistance 3: 39,971.2 Pivot Point: 38,964.0 |

| The price is at support 3, reaching the level of USD$38,966. Possible market rebound, with entry levels at the current price. Trading range between USD$38,143 and USD$39,971. Pivot point for trend change at USD$38,964. RSI in oversold zone. |

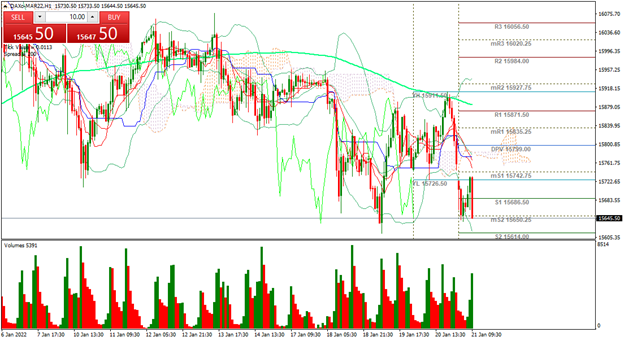

| DAX 40 -1.55% |

| Stock indices in Europe are correcting at the moment. The DAX 40 is down 1.55% and is trading at 15,651 points. Tensions between Russia and Ukraine continue. For their part, the United States and Germany expressed support for Ukraine. Equities are correcting due to the Russian Central Bank and its intention to ban Bitcoin trading and mining. Traders are watching the statements of Christine Lagarde, as president of the ECB. The main topic is inflation and economic projections for the Eurozone. |

|

| Support 1: 15,674.6 Support 2: 15,635.3 Support 3: 15,605.6 Resistance 1: 15,743.6 Resistance 2: 15,773.3 Resistance 3: 15,812.6 Pivot Point: 15,704.3 |

| The index is at support 2, where a double bottom is forming. Possible rebound from this zone. Expected trading range between 15,605 and 15,812. Pivot point for trend change at 15,704. RSI neutral. The price continues below the 200-day moving average. |

| NATURAL GAS +3.55% |

| The price of Natural Gas is rising 3.55% and is trading at USD$3.93 per BTU. Although China is selling LNG at a significant discount, the energy market continues to rise globally. Geopolitical tensions between Russia and Ukraine are driving the price of the commodity. The United States is currently the largest exporter of LNG globally. U.S. inventories of the commodity fell by 206 billion BTU. |

|

| Support 1: 3.913 Support 2: 3.892 Support 3: 3.866 Resistance 1: 3.960 Resistance 2: 3.986 Resistance 3: 4.007 Pivot Point: 3.939 |

| The commodity continues below the 200-day moving average. At the moment the price is at resistance 1. Expected trading range between USD$3.86 and USD$4. Pivot point for trend change at USD$3.93. RSI neutral. |

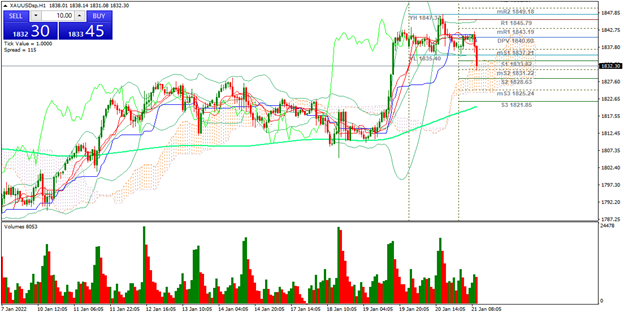

| GOLD -0.53% |

| Despite the fall in the equities market, metals are also correcting. At the moment, the price of gold is down 0.53% and is trading at USD$1,832 per Troy ounce. Traders are watching the ECB statements and also Janet Yellen’s statement. The main topic of discussion is inflation and monetary policy decisions. Traders expect at least 4 interest rate hikes by 2022. The Fed, for its part, remains focused on achieving the 2% annual inflation target. The ECB starts tapering, however, it continues to support the market. |

|

| Support 1: 1,836.71 Support 2: 1,834.73 Support 3: 1,831.51 Resistance 1: 1,841.91 Resistance 2: 1,845.13 Resistance 3: 1,847.11 Pivot Point: 1,839.93 |

| The price is at support 1, correcting from the USD$1,849 area. Possible market rebound, due to the fall of the stock indexes. Trading range between USD$1,831 and USD$1,847. Pivot point at USD$1,839. RSI approaching the oversold zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.