Daily review for January 18, 2022

Stock indices are in negative territory globally. The main losses are being generated in the TecDAX, and the Nasdaq 100. The main concern is inflation, and tapering.

Cryptos are accompanying the correction. Bitcoin is down from USD$42,000. Ethereum for its part is falling 3.44%. Vitalik, projects the price of Ethereum at USD$10,000.

WTI continues the uptrend. The price is at a double top. If the Bulls manage to break above this zone, the next target is USD$100 per barrel.

The Eurogroup expressed concern about the level of inflation in the Euro Zone. Budgets are maintained, with analysis in inflation.

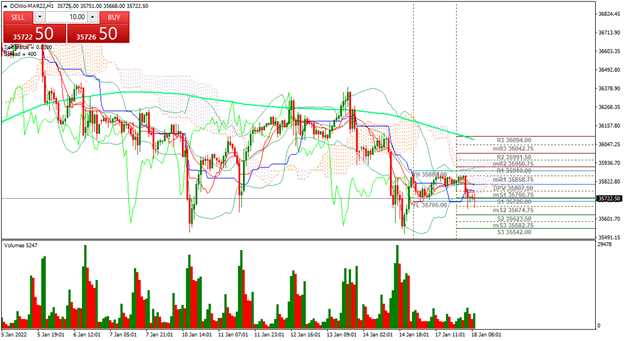

| DOW JONES -0.31% |

| Wall Street indexes are in negative territory. The Dow Jones is down 0.31% and is trading at 35,841 points. Global stock indexes are in negative territory, mainly due to the Bank of Japan’s intention to raise interest rates in order to reach the inflation target of 2% per year. For the time being, the Bank of Japan kept rates stable at -0.10%. The market decline is also evidenced by the central banks’ interest in tapering. Today, Goldman Sachs, Bank of America and BNY Mellon report financial results. |

|

| Support 1: 35,832.0 Support 2: 35,817.0 Support 3: 35,797.0 Resistance 1: 35,867.0 Resistance 2: 35,887.0 Resistance 3: 35,902.0 Pivot Point: 35,852.0 |

| The index is below the 200-day moving average. Expected trading range between 35,797 and 35,902. Pivot point for trend change at 35,852. RSI neutral. Double bottom at the current level, which could lead to a rebound. |

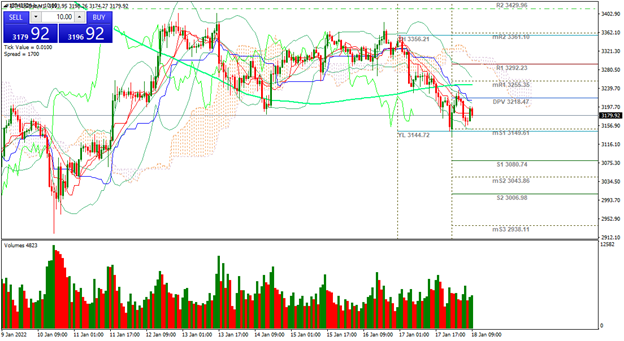

| ETHEREUM -2.52% |

| According to PeckShield, cryptocurrency exchange Crypto.com lost USD$15 million in Ethereum due to a hacker attack. Today the crypto market continues to correct. Ethereum is down 2.52% and is trading at USD$3,181. Bitcoin is down 1.94% and is trading at USD$41,985, breaking the USD$42,000 support. As for holders, the UK is the third country with the largest positions in Ethereum. According to Vitalik Buterin, the price of Ethereum could reach USD$10,000. |

|

| Support 1: 3,182.43 Support 2: 3,163.18 Support 3: 3,151.47 Resistance 1: 3,213.39 Resistance 2: 3,225.10 Resistance 3: 3,244.35 Pivot Point: 3,194.14 |

| The price is below the 200-day moving average. At the moment, it is between support 1 and the pivot point. The Bulls are looking to recover the USD$3,292 level in order to climb towards resistance 3. Pivot point at USD$3,194. RSI neutral. Important resistance at USD$3,429. |

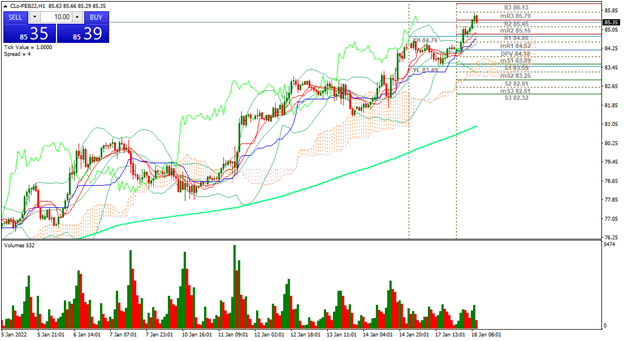

| WTI +1.81% |

| Traders are watching the U.S. reserves report. Analysts expect a decrease of 1 million barrels. The market is also watching OPEC’s monthly report. The cartel continues to be interested in increasing the monthly production level. On the other hand, the United States and its allies are seeking to balance prices by selling part of their strategic reserves. At the moment, WTI is up 1.81% and is trading at USD$84.73 per barrel. |

|

| Support 1: 84.84 Support 2: 84.57 Support 3: 84.41 Resistance 1: 85.27 Resistance 2: 85.43 Resistance 3: 85.70 Pivot Point: 85.00 |

| The price is above the 200-day moving average. At the moment, it is at resistance 3. Pivot point for trend change at USD$85. RSI in overbought zone. Double top at USD$83.34. If the Bulls manage to overcome it, the price could reach USD$100 per barrel. |

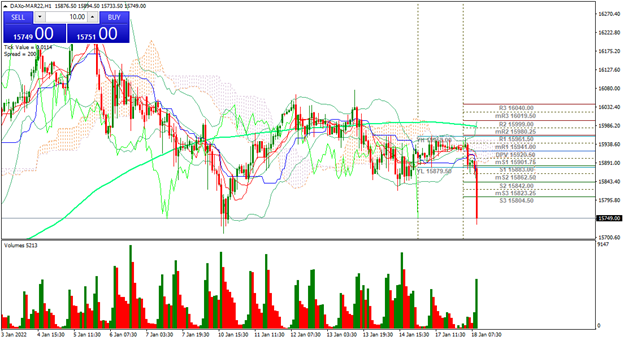

| DAX 40 -1.18% |

| The Eurogroup presented statements of concern about the level of inflation in the Eurozone. According to the report, inflation reached 5% in December 2021. The DAX 40 is currently down 1.18% and is trading at 15,739 points. The Eurogroup concluded that it will maintain fiscal stimulus, keeping a close eye on inflation. So far, the ECB has not communicated. The Eurostoxx 50 is down 1.28%. |

|

| Support 1: 15,856.5 Support 2: 15,841.5 Support 3: 15,822.0 Resistance 1: 15,891.0 Resistance 2: 15,910.5 Resistance 3: 15,925.5 Pivot Point: 15,876.0 |

| Double bottom at 15,742 points. If the bears manage to overcome this level, the next target is 15,461 points. Possible technical rebound. Trading range between 15,891 and 15,925. Pivot point for trend change at 15,876 points. RSI in oversold zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.