Daily review for January 14, 2022

Energy markets in Europe and the Northern Hemisphere continue to see upward demand momentum. However, as traders take profits in natural gas, the commodity continues to correct.

Corporate earnings season begins. Companies at the Financial sector kick off. Good results are expected, driven from the good performance of household spending during Q4 2021.

Stock indices in Europe are in negative territory. Traders are waiting for Christine Lagarde’s statement as ECB President. Announcements on tapering, interest rates and inflation are expected.

Investors take profit on Bitcoin at the level of USD$44,000. The price is at support level 1. Bulls are looking for a rebound.

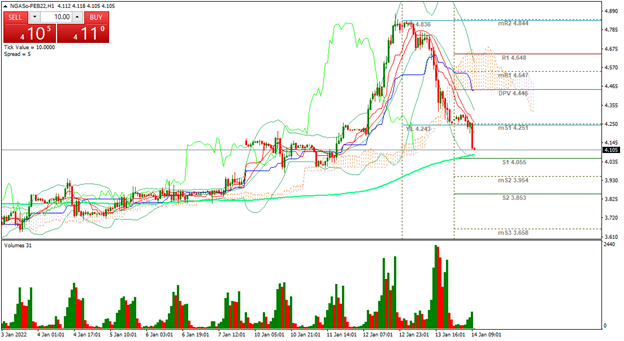

| NATURAL GAS -3.63% |

| Natural gas futures are down 3.63% and are trading at USD$4.11 per BTU. The energy market continues to rise, mainly in Europe and the Northern Hemisphere. Winter temperatures continue to drop. For the moment, traders have started to take profits after the rally seen earlier in the week. Yesterday, natural gas closed with a loss of 12.09%. Traders are evaluating the best support level to re-enter the market. |

|

| Support 1: 4.060 Support 2: 4.005 Support 3: 3.905 Resistance 1: 4.215 Resistance 2: 4.315 Resistance 3: 4.370 Pivot Point: 4.160 |

| The price started to decline from the level of USD$4.84 per BTU. It is currently at support 1, just above the 200-day moving average. Expected trading range between USD$3.90 and USD$4.37 per BTU. Pivot point for trend change at USD$4.16. RSI in oversold zone. |

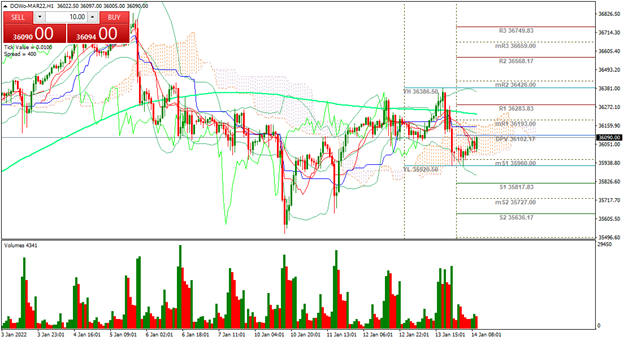

| DOW JONES +0.25% |

| Corporate earnings season begins, with announcements from companies in the financial sector. JP Morgan, Wells Fargo, Citigroup and BlackRock kick off. The Wall Street consensus expects good results, mainly due to the performance of household spending during Q4 2021. At the moment the Dow Jones is up 0.25% and is trading at 36,211 points. At the moment, Wall Street indices are in positive territory, while global indices are in negative territory. |

|

| Support 1: 36,117.5 Support 2: 36,089.0 Support 3: 36,039.7 Resistance 1: 36,195.3 Resistance 2: 36,244.6 Resistance 3: 36,273.1 Pivot Point: 36,166.8 |

| The index is below the 200-day moving average. At the moment the price is at the pivot point, looking to confirm the trend. Expected trading range between 36,039 and 36,273. Pivot point at 36,166 points. RSI neutral. Possible trend reversal. |

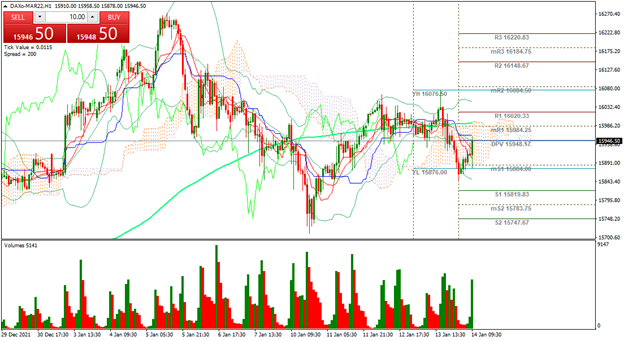

| DAX 40 -0.37% |

| European stock indices are in negative territory. The market is waiting for Christine Lagarde’s statement as ECB President. Traders are waiting for announcements on monetary policy, tapering in Europe, inflation and interest rates. At the moment, the DAX 40 is down 0.37% and is trading at 15,948 points. Investors continue to hold positions in metals and treasury bonds. Traders are keeping an eye on inflation data from the UK, France, Spain and the Euro Zone trade balance. |

|

| Support 1: 15,874.1 Support 2: 15,853.3 Support 3: 15,819.6 Resistance 1: 15,928.6 Resistance 2: 15,962.3 Resistance 3: 15,983.1 Pivot Point: 15,907.8 |

| The index is trying to bounce from support 1. The Bulls are looking to break above the 200-day moving average line. Expected trading range between 15,819 and 15,983. Pivot point for trend change at 15,907. RSI neutral. |

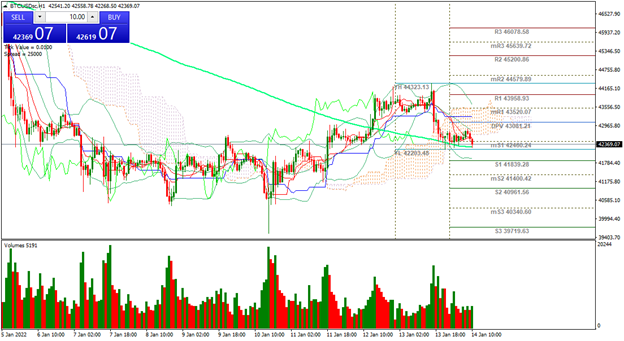

| BITCOIN -2.83% |

| Dogecoin is currently up 11.41% and is trading at USD$0.1943. The crypto’s rally was boosted by Elon Musk’s announcement that Tesla will accept Dogecoins to buy its products. Bitcoin is down 2.83% and is trading at USD$42,474. Bears continue to sell after the rebound to USD$44,000. For the moment, traders are watching for Hedge Funds to start buying. Jack Dorsey, meanwhile, continues to make progress in the development of a Bitcoin mining system. |

|

| Support 1: 42,538.4 Support 2: 42,443.7 Support 3: 42,264.4 Resistance 1: 42,812.4 Resistance 2: 42,991.7 Resistance 3: 43,086.4 Pivot Point: 42,717.7 |

| The price is slightly above the 200-day moving average. Expected trading range between USD$42,264 and USD$43,086. Pivot point for trend change at USD$43,086. RSI neutral. The Bulls are looking to regain the USD$44,000 area again, in order to push for USD$46,000. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.