Daily review for January 10, 2022

The equity market starts the week with mixed movements in global stock indices.

Natural Gas opens with a bullish gap, reaching USD$4 per BTU. The demand for energy in the United States increases significantly, which boosts the consumption of energy commodities.

The crypto market opens mixed this week. Ethereum tries to bounce back, while Bitcoin, starts to give up some points. Analysts see the support level in Bitcoin at USD$35,000.

Traders start to evaluate the new corporate earnings season. The focus is on the shares of technology companies, which have presented good results during the pandemic.

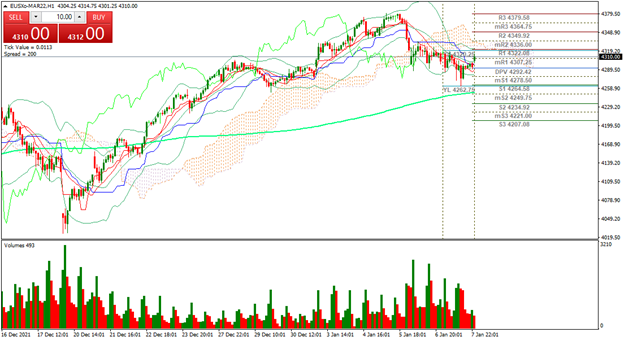

| EUROSTOXX 50 +0.50% |

| The week begins in the stock markets, with bullish movements in the indices. In Europe, the Eurostoxx 50 is rising +0.50% and is trading at 4,311. Italy’s MIB 40 is up 0.57% and is trading at 27,635. Traders are keeping an eye on the Euro Zone unemployment data. Analysts expect at least 7.2%. Goldman Sachs, meanwhile, expects at least 4 interest rate hikes from the Fed this year. |

|

|

| Expected trading range between 4.291 and 4.312. Pivot point for trend change at 4.301. RSI neutral. Price remains above the 200-day moving average. Possible rebound towards resistance 3. |

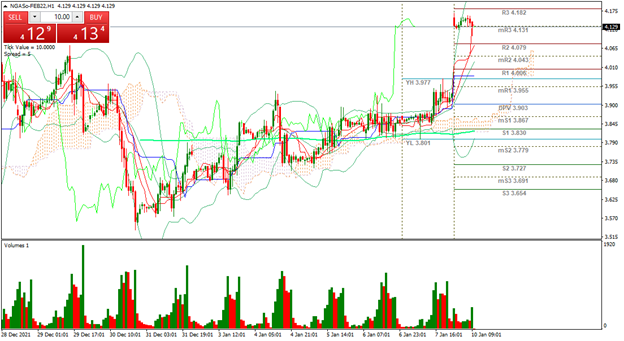

| NATURAL GAS +5.29% |

| Natural Gas futures are up 5.29% and are trading at USD$4.12 per BTU. Domestic electricity prices in the U.S. are on the rise, which is the reason for the rebound in natural gas prices. Traders are looking forward to the IEA’s full report on the energy market. In terms of fundamental events, the market continues to watch Russia’s moves on Ukraine, which may generate important changes in the energy market in Europe and globally. |

|

|

| The price is at resistance 3. Natural Gas opened with a bullish gap, going from USD$3.95 to USD$4.18 per BTU. Sideways movement over this zone. Expected trading range between USD$4.06 and USD$4.19. Pivot point at USD$4.12. RSI in overbought zone. |

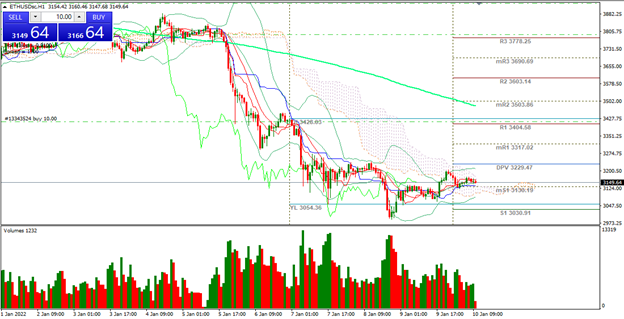

| ETHEREUM +0.90% |

| Ethereum is currently up 0.90% and is trading at USD$3,150, while Bitcoin is up 0.19% and is trading at USD$41,898. Bears have gained ground during the early 2022. Analysts see immediate support in Bitcoin at USD$35,000. However, a price rebound could occur, as current levels gain the attention of hedge funds. In addition, according to Pantera Capital, one of the hedge funds focused on Cryptos, indicated that 50% of global financial transactions could be made through Ethereum within 10 years. |

|

|

| Sideways movement in the area of support 1. Expected trading range between USD$3,135 and USD$3,191. Pivot point at USD$3,163. The price is below the 200-day moving average. RSI neutral. Possible rebound. |

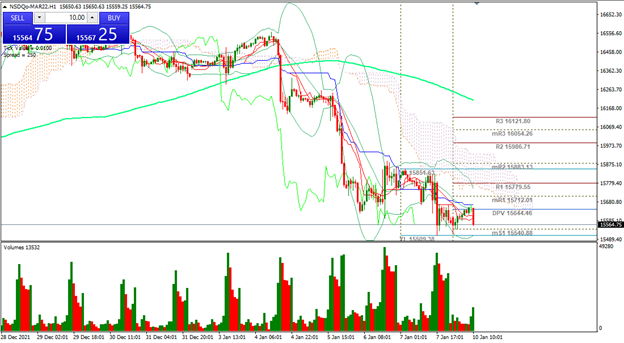

| NASDAQ 100 -0.29% |

| Wall Street stock indexes are turning into negative territory. At the moment, traders are watching for the start of the corporate earnings season. At the moment the Nasdaq 100 is down 0.29% and is trading at 15,540. The pandemic continues, and traders are evaluating the performance of technology companies. The new variants could lead to further lockdowns and restrictions. As a result, demand for e-commerce could continue to increase. |

|

|

| The price is falling towards support 1. The index is below the 200-day moving average. Expected trading range between 15,607 and 15,717. Pivot point at 15,662. RSI neutral, approaching the oversold zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.