Daily review for January 07, 2022

First NFP of 2022. The market expects the creation of at least 400,000 new non-farm jobs. The US unemployment rate is also expected to stand at 4.1%.

Traders continue to hold positions in fixed income and evaluate entry levels in metals.

Bitcoin continues to fall. Bears are looking for levels below USD$40,000. Mutual funds have not yet entered the market. They evaluate the best support level.

Energy demand in Europe and Asia continues to rise. Traders are watching the IEA report. Natural gas prices continue to rise.

Germany decreased the demand for its products globally. The trade balance continues to be positive but did not meet analysts’ expectations.

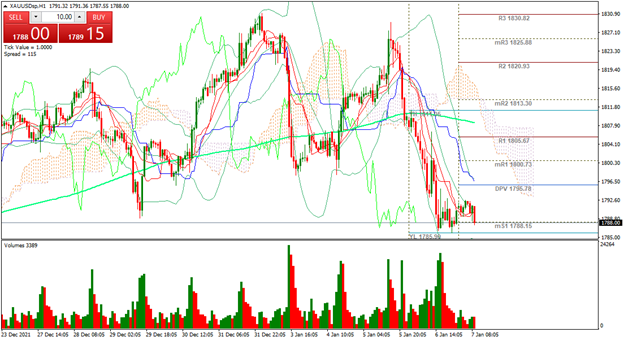

| GOLD -0.08% |

| Stock markets continue to be mixed globally, and traders are looking ahead to the U.S. Non-Farm Payrolls report. It is the first NFP of the year and could change or generate additional selling in the market. Analysts are expecting 400,000 new non-farm jobs and a U.S. unemployment rate of 4.1%. Fixed income positions continue to be bullish, mainly in the German 10-year bond. Gold price is currently down 0.08% and is trading at USD$1,787 per Troy ounce. |

|

| Support 1: 1,788.24 Support 2: 1,787.12 Support 3: 1,785.99 Resistance 1: 1,790.49 Resistance 2: 1,791.62 Resistance 3: 1,792.74 Pivot Point: 1789.37 |

| The price is at support 1, looking for the rebound zone towards the pivot point that will allow it to change the trend. Expected trading range between USD$1,787 and USD$1,792. Pivot point at USD$1,789. RSI neutral. |

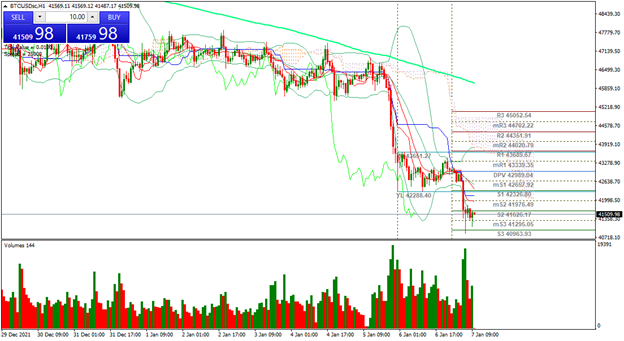

| BITCOIN -3.66% |

| Bitcoin continues to fall, this time, to levels seen in September 2021. The price is down 3.66% and is trading at USD$41,754. The week has been characterized by massive sell-offs in cryptos. China and Kazakhstan continue to push crypto miners out of their countries. Goldman Sachs, however, maintains the projection at USD$100,000, which could be generated by hedge funds. For the moment, retail investors are selling and the market is keeping an eye on Microstrategy, which is the company with the largest Bitcoin position globally. |

|

| Support 1: 41,361.6 Support 2: 41,191.7 Support 3: 40.954,4 Resistance 1: 41,768.8 Resistance 2: 42,006.1 Resistance 3: 42,176.0 Pivot Point: 41,598,9 |

| The price is below the 200-day moving average. Expected trading range between USD$40,954 and USD$42,176. Pivot point for trend change at USD$41,598. RSI in oversold zone. The price could fall to resistance 3 before gaining interest from the Bulls again. |

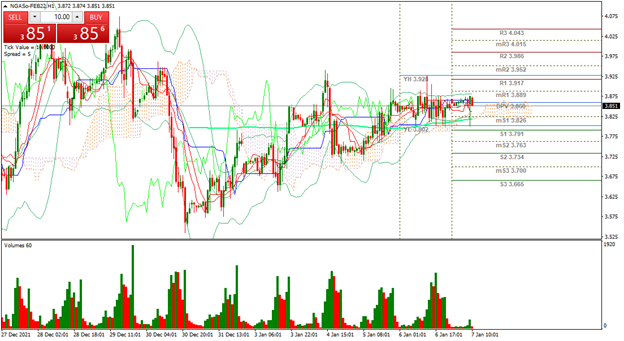

| NATURAL GAS +1.10% |

| According to Goldman Sachs, the commodity super cycle could last a decade. Backing up the analysis, V-shaped recoveries are expected, which will boost global commodity demand. At the moment the price of Natural Gas is up 1.10% and is trading at USD$3.85 per BTU. Traders are watching the IEA report. They are also watching the rebound in Asian LNG demand. Energy demand in Europe continues to rise. |

|

| Support 1: 3.824 Support 2: 3.774 Support 3: 3.747 Resistance 1: 3.901 Resistance 2: 3.928 Resistance 3: 3.978 Pivot Point: 3.851 |

| Sideways movement above resistance 1. Bulls are looking for more volume to reach USD$4.04 per BTU. Expected trading range between USD$3.74 and USD$3.97. Pivot point for trend change at USD$3.85. RSI neutral. |

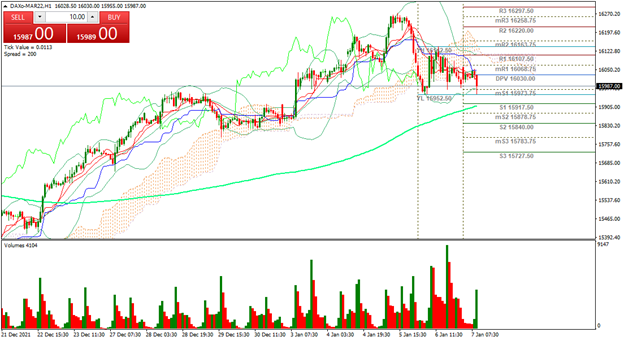

| DAX 40 -0.31% |

| Germany’s industrial production missed market expectations and came in at -0.2% vs. 1% expected. Similarly, the German Trade Balance remains in positive territory, however, lower than market expectations (10.9B vs. 12.8B). The above data shows economic slowdown in Germany and its export destinations. Traders are watching inflation in the Euro Zone, where 4.7% y/y is expected. Finally, the market is watching the NFP and its influence on European markets. |

|

| Support 1: 15,990.0 Support 2: 15,968.0 Support 3: 15,937.5 Resistance 1: 16,042.5 Resistance 2: 16,073.0 Resistance 3: 16,095.0 Pivot Point: 16,020.5 |

| The price is above the 200-day moving average. Expected trading range between 15,937 and 16,095. Pivot point for trend change at 16,020. RSI neutral. Sideways movement, pending macro data. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.