Daily review for January 04, 2022

Metals prices are trading higher, driven by portfolio hedging. Wall Street indexes are at record highs. Omicron dominates Covid19 variants globally.

Traders are looking ahead to the OPEC+ meeting. Analysts expect the institution to maintain its strategy of increasing production month by month.

The Chinese government continues to put pressure on cryptocurrency miners. Criticism continues due to the significant consumption of electricity.

European markets are trading higher, due to optimism about macroeconomic data in the Euro Zone.

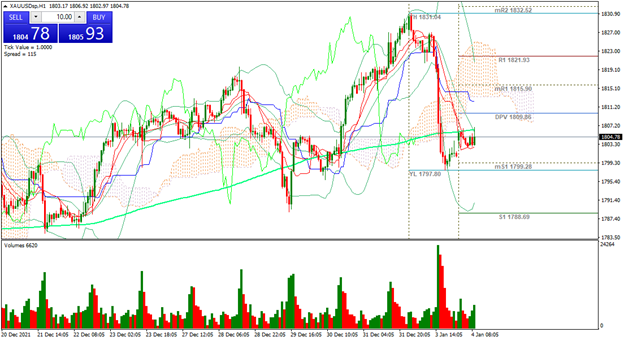

| GOLD +0.29% |

| Omicron has become the predominant variant of the coronavirus globally. Similarly, a new possible variant called Flurona is emerging, which includes Covid19 and influenza. Stock indices on Wall Street are at record highs, so traders are starting to hedge positions in metals, as the market could correct at any time. At the moment the price of gold is up 0.29% and is trading at USD$1,805 per Troy ounce. |

|

| Support 1: 1,803.41 Support 2: 1,800.83 Support 3: 1,798.81 Resistance 1: 1,808.01 Resistance 2: 1,810.03 Resistance 3: 1,812.61 Pivot Point: 1,805.43 |

| The price is between support 1 and the pivot point. It is slightly below the 200-day moving average. Possible bounce from the current level towards resistance 2. Pivot point for trend change at USD$1,805. RSI neutral. |

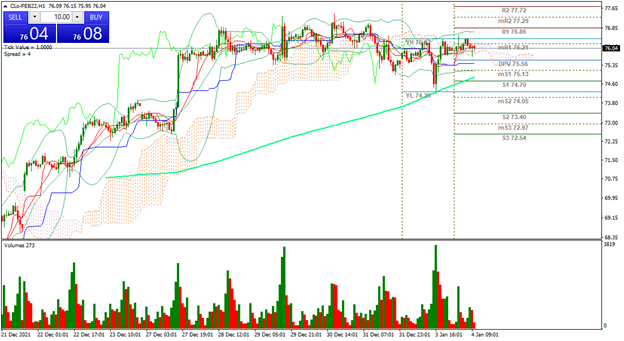

| WTI +0.03% |

| Traders are looking forward to the OPEC+ meeting. Analysts expect the institution to continue with its strategy of increasing production month by month, in order to take advantage of the current price level. However, the market balance could stabilize in Q1 2022. WTI is currently up 0.03% and is trading at USD$76.25 per barrel. Traders are assessing the impact of Omicron on the market, as physical trade could be affected in Q1. |

|

| Support 1: 75.75 Support 2: 75.49 Support 3: 75.28 Resistance 1: 76.22 Resistance 2: 76.43 Resistance 3: 76.69 Pivot Point: 75.96 |

| Bounce from support 1. Sideways movement at resistance 1. Expected trading range between USD$75.28 and USD$76.69. Pivot point for trend change at USD$75.96. RSI neutral. Bulls target is USD$80 per barrel. |

| BITCOIN -1.09% |

| The price of Bitcoin is currently down 1.09% and is trading at USD$46,591. The fall of the crypto market is being generated due to the continuous pressure from China, against crypto miners. On the other hand, according to Cointelegraph, Millennials prefer to hold positions in Bitcoin, rather than gold. Another fundamental factor affecting prices is that Bitcoin uses more electricity than Google and Facebook combined. |

|

| Support 1: 46,397.6 Support 2: 46,247.3 Support 3: 46,155.6 Resistance 1: 46,639.6 Resistance 2: 46,731.3 Resistance 3: 46,881.6 Pivot Point: 46,489.3 |

| The price is below the 200-day moving average, which is a bearish signal for Bitcoin. Expected trading range between USD$46,155 and USD$46,881. Pivot point at USD$46,489. RSI neutral. Possible rebound from the current area where it is marking a double bottom. |

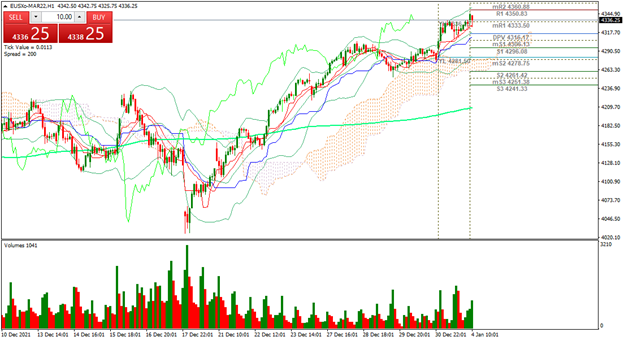

| EUROSTOXX 50 +0.31% |

| European markets are in positive territory as traders await macroeconomic data on German retail sales and unemployment rate, French inflation, UK PMI and Spanish unemployment rate. The market is positive at the moment, presented by the 0.31% rise in the Eurostoxx 50. The index is currently trading at 4,333. |

|

| Support 1: 4,334 Support 2: 4,327 Support 3: 4,323 Resistance 1: 4,345 Resistance 2: 4,349 Resistance 3: 4,356 Pivot Point: 4,338 |

| The index continues in the bullish channel. This time the price is at resistance 1. Expected trading range between 4,323 and 4,356. Pivot point for trend change at 4,338. RSI leaving the overbought zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.