Daily Review for February 9, 2022

Metals show sideways movement as traders take positions depending on the U.S. Congress on extending the government’s funding needs.

Bitcoin corrects. The Russian central bank and the government have accepted the crypto as a currency. KPMG continues to present Bitcoin and Ethereum as digital currencies with significant potential for current and future transactions.

WTI and commodities in general maintain sideways and bullish movements, mainly due to geopolitical tensions. Bulls are looking for USD$100 per barrel.

Global stock indices are bouncing and looking for a positive day. Traders are looking forward to the FOMC statement.

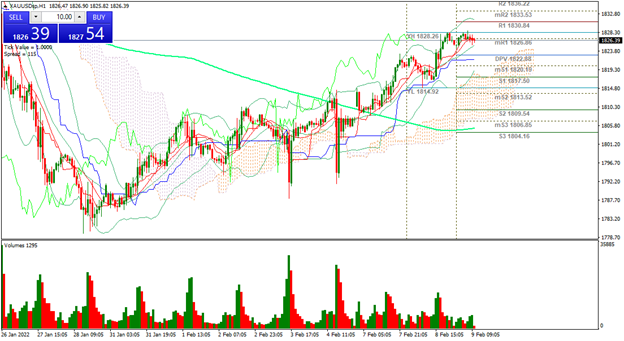

| GOLD +0.01% |

| In the United States, Congress is working to increase the funds until March 11, 2022. In the meantime, traders are holding gold in portfolios, in order to mitigate the risk of volatility in equities. At the moment the price of gold is up 0.01% and is trading at USD$1,828 per Troy ounce. Metals may also present upward movements, driven by geopolitical tensions between Ukraine and the United States. This may also have an effect on commodities, due to the scarcity effect caused by trade restrictions in the event of an armed conflict. |

|

| Support 1: 1,826.49 Support 2: 1,825.32 Support 3: 1,823.99 Resistance 1: 1,828.99 Resistance 2: 1,830.32 Resistance 3: 1,831.49 Pivot Point: 1,827.82 |

| The price is at resistance 1. Gold is above the 200-day moving average. Expected trading range between USD$1,823 and USD$1,831. Pivot point for trend change at USD$1,827. Neutral RSI coming out of the overbought zone. |

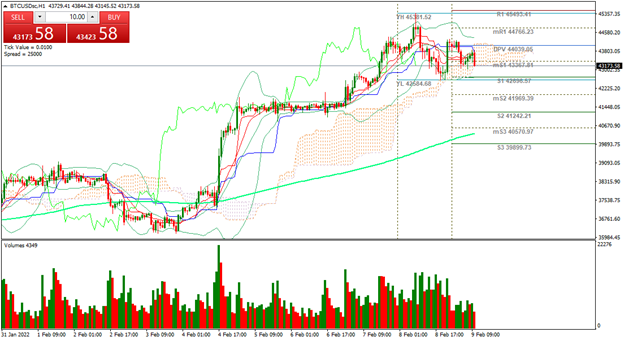

| BITCOIN -1.78% |

| The price of Bitcoin and cryptos in general are correcting at the moment. The crypto is down 1.78% and is trading at USD$43,307. On the other hand, the Russian government and the Central Bank of Russia have agreed to accept Bitcoin as a currency. Similarly, KPMG in recent days accepted and included Bitcoin and Ethereum in the balance sheet. According to JP Morgan, due to Bitcoin’s limited supply protocol, the cryptocurrency could reach a price of USD$150,000 in the long term. |

|

| Support 1: 43,600.4 Support 2: 43,303.7 Support 3: 43,153.4 Resistance 1: 44,047.4 Resistance 2: 44,197.7 Resistance 3: 44,494.4 Pivot Point: 43,750.7 |

| The price is above the 200-day moving average. Bitcoin is at support 1, so there could be a further decline to support 2, before changing the trend. Pivot point at USD$43,750. RSI neutral. |

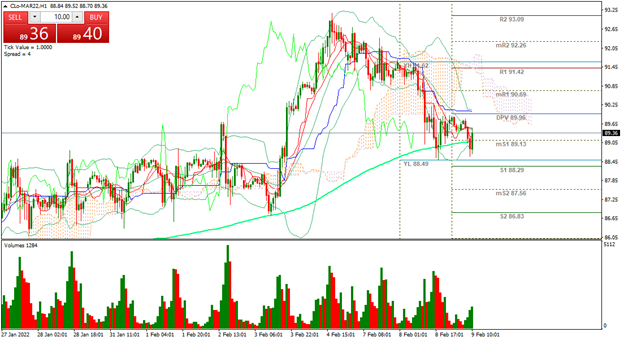

| WTI +0.01% |

| Traders are watching the U.S. crude oil inventories report. Analysts expect an increase of 369,000 barrels. At the moment, the price of WTI crude oil is up 0.01% and is trading at USD$89.38 per barrel. Benchmark Brent crude oil is up 0.11% and is trading at USD$90.85 per barrel. Traders are evaluating a possible rebound towards USD$100 per barrel, driven by the increase in demand due to geopolitical tensions. |

|

| Support 1: 88.46 Support 2: 88.21 Support 3: 87.80 Resistance 1: 89.12 Resistance 2: 89.53 Resistance 3: 89.78 Pivot Point: 88.87 |

| The price is at support 1, at the same level of the 200-day moving average. Expected trading range between USD$87.80 and USD$89.78. Pivot point for trend change at USD$88.87. Neutral RSI coming out of the oversold zone. Possible rebound towards the level of USD$90 per barrel. |

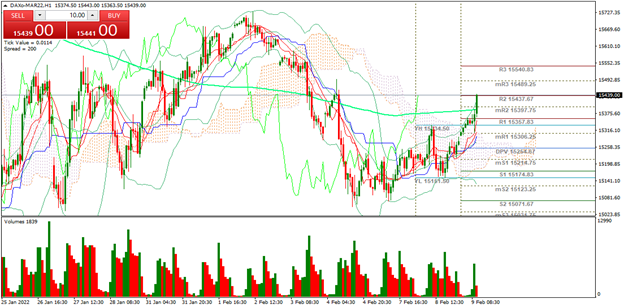

| DAX 40 +1.32% |

| European stock markets start the day in positive territory. Wall Street stock indexes are also bouncing back, boosted by the recovery of technology stocks. At the moment, the DAX 40 is up 1.32% and is trading at 15,433 points. The TecDAX is up 2.22% and is trading at 3,437 points. Traders are paying close attention to the development of geopolitical tensions and also to Bowman’s statements as a member of the FOMC. They are also watching the inflation and unemployment rate in Russia, which depends that hedge funds take positions in the Russian stock market index and the Ruble. |

|

| Support 1: 15,298.4 Support 2: 15,271.7 Support 3: 15,235.4 Resistance 1: 15,361.4 Resistance 2: 15,397.7 Resistance 3: 15,424.4 Pivot Point: 15,334.7 |

| The price is at the double top of resistance 2. If the upward momentum continues, the index could reach the level of 15,540 points. Expected trading range between 15,235 and 15,424. Pivot point for trend change at 15,334. RSI in overbought zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.