Daily Review for February 21, 2022

Holiday in the USA. Traders are focused on European markets. Geo-political tensions continue. Biden seeks to meet with Putin to clarify interest in de-escalating tensions. European stock indices start the week in positive territory.

Commodities start the week with mixed movements. Metals and oil prices correct. Meanwhile, Natural Gas continues to rise. The price is approaching USD$5 per BTU.

Cryptos bounce. Ethereum is up close to 5%. Bitcoin seeks to regain USD$40,000. Warren Buffett invested a billion USD in a Neo Bank.

Silver corrects about 1%. However, metals remain on traders’ radar due to geo-political tensions.

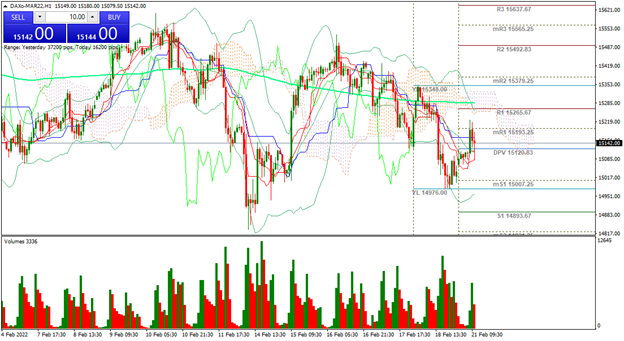

| DAX 40 +0.65% |

| Holiday in the United States, corresponding to President’s Day. Traders are thus concentrating on the European stock exchanges. Meanwhile, geo-political tensions continue. President Biden is arranging a face-to-face meeting with Putin. However, it seems that this could not take place before Thursday of this week. Italy, for its part, commented that it would exclude the energy market from the sanctions against Russia. Meanwhile, the president of the European Commission, Ursula Von der Leyen, announced that Russia would be banned from the global financial market if it decide to invade Ukraine. |

|

| Support 1: 15,145.0 Support 2: 15,103.0 Support 3: 15,062.5 Resistance 1: 15,227.5 Resistance 2: 15,268.0 Resistance 3: 15,310.0 Pivot Point: 15,185.5 |

| The index is at the pivot point, where a change of trend could occur. Expected trading range between 15,062 and 15,310. Pivot point at 15,185. The ichimoku cloud projects the price above 15,219. RSI neutral, however, if the trend changes, the price could enter the descending channel. |

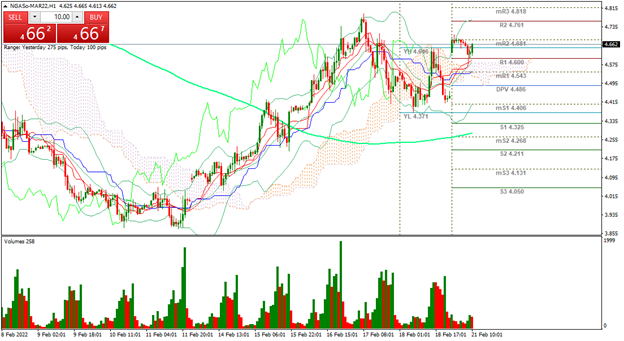

| NATURAL GAS +4.68% |

| Commodities start the week with mixed movements. At the moment, metals and oil are showing bearish movements. Natural Gas is up 4.68% and is trading at USD$4.58 per BTU. The geo-political tensions continue, and one of the main issues in focus is the impact that could be generated in the energy markets due to the implementation of sanctions against Russia. For example, one of Europe’s most ambitious energy projects, Nordstream 1 and 2, would be shut off. Meanwhile, US LNG exports to Europe continue to increase. |

|

| Support 1: 4.525 Support 2: 4.506 Support 3: 4.492 Resistance 1: 4.558 Resistance 2: 4.572 Resistance 3: 4.591 Pivot Point: 4.539 |

| The price is above the 200-day moving average. At the moment it is at resistance 2, where it could present sideways movement, before generating more buying volume to reach USD$4.81 per BTU. Pivot point at USD$4.53. RSI neutral, approaching the overbought zone. |

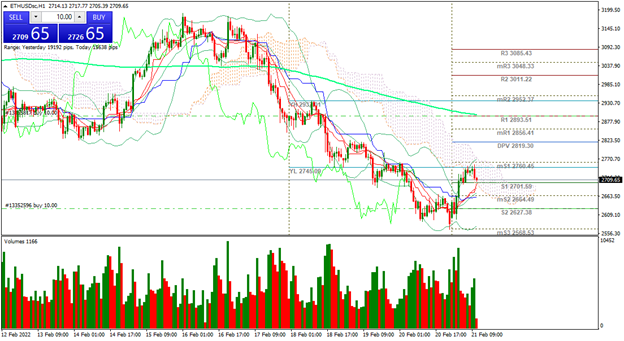

| ETHEREUM +4.19% |

| Continued pressure on the crypto market, mainly stemming from geo-political tensions. The correlation between cryptos and equities is high. Ethereum is currently up 4.19% and is trading at USD$2,396. In terms of business moves, Warren Buffet invested USD$1 billion in Nubank, a Neo bank with a high exposure to Bitcoin. Bitcoin is up 2.15% and is trading at USD$39,050. |

|

| Support 1: 2,384.56 Support 2: 2,374.34 Support 3: 2,354.12 Resistance 1: 2,415.00 Resistance 2: 2,435.22 Resistance 3: 2,445.44 Pivot Point: 2,404.78 |

| The price is at support 1. The crypto started to bounce from support 3. However, the price is below the 200-day moving average. Bearish channel. Bulls are looking to turn the market around. However, traders are still holding metals instead of cryptos. Funds may start buying at these levels, looking for a rebound in Bitcoin towards USD$60,000. |

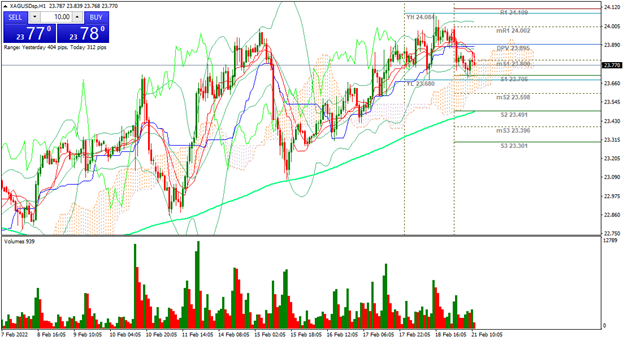

| SILVER -0.85% |

| The week begins and metals show bearish movements, derived from the upward trend that the equity market is showing at the moment. The price of silver is down 0.85% and is trading at USD$23.78 per Troy ounce. Gold is down 0.12% and is trading at USD$1,897 per Troy ounce. Traders remain attentive to the development of geo-political tensions. For the time being, the portfolio allocation includes metals and energy commodities. |

|

| Support 1: 23.776 Support 2: 23.735 Support 3: 23.693 Resistance 1: 23.859 Resistance 2: 23.901 Resistance 3: 23.942 Pivot Point: 23.818 |

| The price remains in the bullish channel, above the 200-day moving average. Expected trading range between USD$23.69 and USD$23.94. Pivot point at USD$23.81. RSI neutral. The Ichimoku cloud projects the price towards USD$23.76 per Troy ounce. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.