Daily Review for February 15, 2022

Global stock indexes bounce and change trend after Interfax announced that some Russian troops started to return. The RTS Russian Stock Exchange index is up 4.96%.

Traders are looking ahead to the Eurogroup meeting, where the economic outlook, geopolitical tensions, inflation and interest rates will be discussed.

Nasdaq 100 rebounds, and seeks to recover part of the losses incurred during the past week. Airbnb reports results.

Natural Gas futures look for USD$4.50 per BTU, after European demand for the commodity continues to rise.

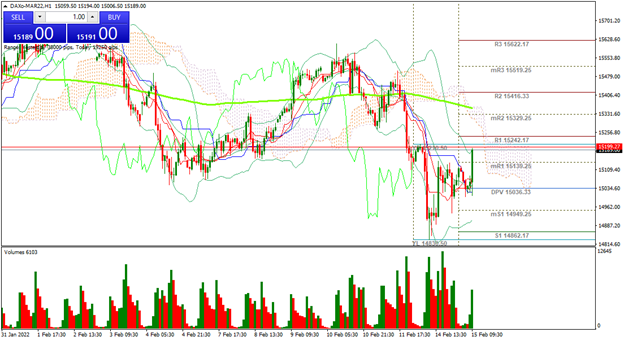

| DAX 40 +1.18% |

| Traders continue to pay close attention to the development of geo-political tensions between Ukraine and Russia. At the moment, everyone is watching the meeting between German Chancellor Olaf Shcholz and Vladimir Putin. There are several important points at this meeting. Among them are the possible economic sanctions against Russia and Nordstream 2. On the other hand, it seems that Russia is returning some troops, after the drilling they were carrying out. At the moment the DAX 40 is up 1.18% and is trading at 15,254 points. The TecDAX is currently up 0.38% and is trading at 3,313 points. |

|

| Support 1: 15,018.0 Support 2: 14,987.0 Support 3: 14,953.5 Resistance 1: 15,082.5 Resistance 2: 15,116.0 Resistance 3: 15,147.0 Pivot Point: 15,051.5 |

| The index is below the 200-day moving average line. Bulls have started buying from the pivot point. Price is at resistance 1, looking to break above this level towards 15,416. RSI neutral, so buying volume could be maintained. |

| EURUSD +0.26% |

| Today we will have the Eurogroup meeting, where important issues related to economic outlook, geopolitical tensions, inflation and interest rates will be discussed. At the moment the EURUSD is up 0.26% and is trading at 1.1341. Traders are watching for tapering and rate hikes. The first-rate hike of the year by both the ECB and the FED is expected in March. In the meantime, central banks continue to analyze the level of inflation. Likewise, scenarios are on the table under geo-political tensions. Traders are also keeping an eye on the Eurozone GDP data. |

|

| Support 1: 1.1306 Support 2: 1.1301 Support 3: 1.1290 Resistance 1: 1.1322 Resistance 2: 1.1333 Resistance 3: 1.1339 Pivot Point: 1.1317 |

| The currency is below the 200-day moving average. Expected trading range between 1.1290 and 1.1339. Pivot point for trend change at 1.1317. RSI neutral. Bulls start looking for 1.1408. |

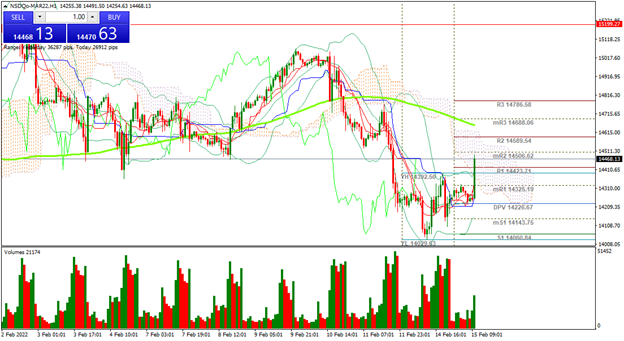

| NASDAQ 100 +1.42% |

| Global stock indices are starting to turn positive, due to Interfax’s announcement that Russia started to return some of its troops after the drilling they were carrying out on the Ukrainian border. At the moment the Russian Stock Exchange index RTS is up 3.94%. The Nasdaq 100 is up 1.42% and is trading at 14,456 points. On the other hand, traders are paying attention to Airbnb’s corporate results. |

|

| Support 1: 14,245.9 Support 2: 14,221.6 Support 3: 14,190.7 Resistance 1: 14,301.1 Resistance 2: 14,332.0 Resistance 3: 14,356.3 Pivot Point: 14,276.8 |

| The index is bouncing and reaching the resistance 2 level. If the trend continues, the price could break above the 200-day moving average line. Expected trading range between 14,190 and 14,356. Pivot point at 14,276. RSI neutral, approaching the overbought zone. |

| NATURAL GAS +4.08% |

| Natural gas futures are up after Russia and China started to negotiate deliveries of the commodity in order to replace exports to the European Union. At the moment Natural Gas is up 4.08% and is trading at USD$4.36 per BTU. On the other hand, LNG exports from the United States to Europe continue to rise. Demand levels remain stable for the time being. |

|

| Support 1: 4.323 Support 2: 4.285 Support 3: 4.264 Resistance 1: 4.382 Resistance 2: 4.403 Resistance 3: 4.441 Pivot Point: 4.344 |

| The price reached the line of the 200-day moving average and the Bulls are looking to overcome the level of resistance 3, to place the price above USD$4.54 per BTU. Expected trading range between USD$4.26 and USD$4.44. Pivot point for trend change at USD$4.34. RSI in overbought zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.