Daily Review for February 11, 2022

Gold prices are correcting at the moment, as traders identify the best buying level. Inflation in the U.S. came in at 7.5%, which is the highest in 40 years.

WTI returns to USD$90 per barrel. Market expects further price rally driven by geopolitical risk premium.

Bitcoin corrects. Traders evaluate crypto as a safe haven from inflation. Fitch Rating downgraded El Salvador’s credit rating.

European stock indexes correct. Selling continues in the market due to inflation in the US. In Germany, inflation stood at 0.4% monthly for the month of January.

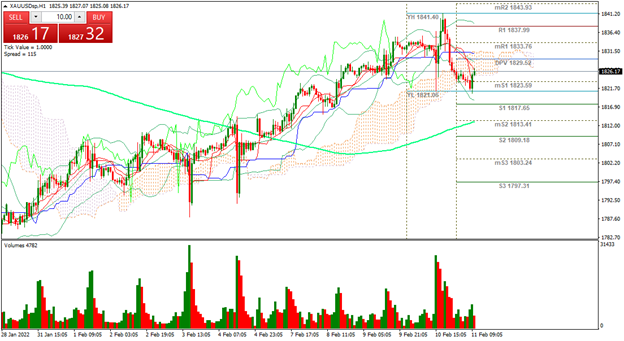

| GOLD -0.54% |

| The United States reported the highest level of inflation in 40 years. Inflation stood at 7.5%. As a result, there was a massive sell-off in stocks and stock market indexes globally. The Nasdaq 100 fell 2.10%, while the S&P500 fell 1.81% and the Dow Jones fell 1.47%. At this time, the stock market indices remain in negative territory. In Europe, the IBEX 35 fell 1.10%, as did the Eurostoxx 50. Traders are seeking to hedge from inflation, mainly in gold. The metal is currently down 0.54% and is trading at USD$1,827 per Troy ounce. Traders are looking forward to the first rate hike scheduled for March. |

|

| Support 1: 1,823.11 Support 2: 1,819.48 Support 3: 1,817.61 Resistance 1: 1,828.61 Resistance 2: 1,830.48 Resistance 3: 1,834.11 Pivot Point: 1,824.98 |

| The metal is above the 200-day moving average. The price is at the level of support 1, where it could start to gain interest from investors. Expected trading range between USD$1,817 and USD$1,843. Pivot point at USD$1,824. RSI neutral. |

| WTI +0.17% |

| Traders are watching the monthly report from the IEA. At the moment, WTI is at a record high, up 0.17% and trading at USD$90.10 per barrel. The geopolitical risk premium is increasing, which is pushing the price of crude oil towards USD$120 per barrel. On the other hand, OPEC analysts are positive about the rebound in demand during 2022. Traders continue to keep an eye on the development of geo-political tensions. Brent crude oil is trading at USD$91.37 per barrel. |

|

| Support 1: 89.40 Support 2: 88.98 Support 3: 88.74 Resistance 1: 90.06 Resistance 2: 90.30 Resistance 3: 90.72 Pivot Point: 89.64 |

| The price is at the pivot point, which could confirm or present a change of trend. Likewise, it is slightly above the 200-day moving average line. Expected trading range between USD$88.74 and USD$90.72. Pivot point at USD$89.64. RSI neutral. |

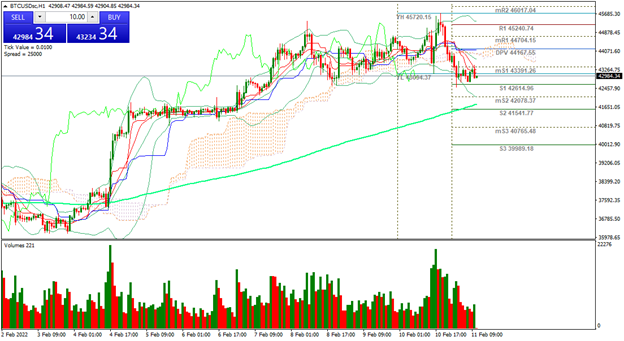

| BITCOIN -2.82% |

| The risk rating company Fitch, reduced El Salvador’s rating to junk category, due to the country’s significant exposure in Bitcoin. Due to the inflation data in the United States, cryptos started to drop points, as the correlation with stocks has increased during the last months. Bitcoin is currently down 2.82% and is trading at USD$43,256. Despite the above, the crypto is still in a sideways channel, which could lead to a change in trend and a continuation of the rally. |

|

| Support 1: 42,931.6 Support 2: 42,760.3 Support 3: 42,432.6 Resistance 1: 43,430.6 Resistance 2: 43,758.3 Resistance 3: 43,929.6 Pivot Point: 43,259.3 |

| The price remains above the 200-day moving average, which is a bullish signal for Bitcoin. Expected trading range between USD$42,432 and USD$43,929. Pivot point for trend change at USD$43,259. Neutral RSI, which could lead to higher trading volume. |

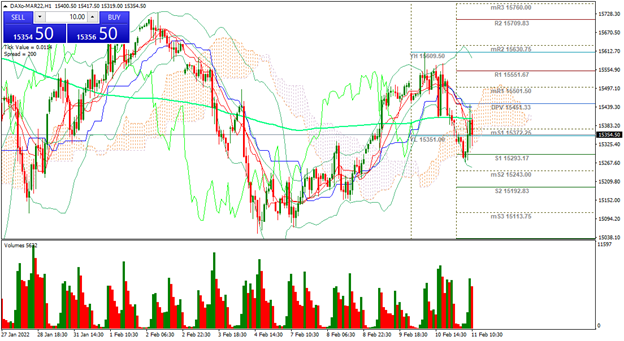

| DAX 40 -1% |

| European stock indices are correcting at the moment, showing continued selling due to the US inflation data. The DAX 40 is currently down 1% and is trading at 15,363. Traders are reacting to the German inflation data, where the market estimate of 0.4% per month for January was maintained. The market is now waiting for the ECB monetary policy statement. |

|

| Support 1: 15,283.4 Support 2: 15,234.2 Support 3: 15,152.4 Resistance 1: 15,414.4 Resistance 2: 15,496.2 Resistance 3: 15,545.4 Pivot Point: 15,365.2 |

| The index is slightly below the 200-day moving average. Expected trading range between 15,152 and 15,545. Pivot point for trend change at 15,545. RSI neutral. Possible rebound from support 2 and 3. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.