Daily Review for February 1, 2021

Global market starts to rebound from Friday’s sharp fall. Traders are on the lookout for fundamental data that can mark a trend. The VIX is at -4.42%

Silver into the spotlight on Reddit and Wall Street Bets. It is currently up 10.96%

GBPUSD is rising, and awaiting UK manufacturing PMI data. Analysts expect the figure to be above 50

Crude oil manages to stay above USD$52 per barrel, but starts to feel pressure from the delay in covid-19 vaccines

FTSE 100 starts to recover from Friday’s fall. Traders look favorably on the agreement between AstraZeneca and the EU

| SILVER +10.22% |

| Silver started the week with a significant rise of 10.22% as a result of the army of retail traders, who along with social media, have been moving the market assets since last week. Silver is currently trading at USD$29.11. Retail traders, together have managed to move the prices of Gamestop and AMC shares, cryptocurrencies such as Dogecoin, and now Silver. |

|

| Support 1: 28.879 Support 2: 28.552 Support 3: 28.389 Resistance 1: 29.369 Resistance 2: 29.532 Resistance 3: 29.859 Pivot Point: 29.042 |

| Silver price has been in a period of consolidation for the last few months. Today, the USD$27 resistance was broken. At the moment the price is above the 15 and 25 day moving averages. Trading volume is increasing. Pivot point for trend change at 29.042. |

| GBPUSD +0.27% |

| The British pound against USD is currently up 0.27% and is trading at 1.3738. Traders are aware of the UK manufacturing PMI data. Analysts estimate the PMI at 52.9. On the other hand, the currency is also reacting to the conflict between the UK and the European Union, caused by the delay of AstraZeneca’s vaccines. However, it seems that an agreement has already been reached, and the laboratory has decided to concede part of its production to the EU. |

|

| Support 1: 1.3737 Support 2: 1.3734 Support 3: 1.3729 Resistance 1: 1.3745 Resistance 2: 1.3750 Resistance 3: 1.3753 Pivot Point: 1.3742 |

| The currency is trying to form an upward channel with slight dips at supports and subsequent bounces. The price is above the 15 and 25 day moving averages. Bulls continue to gain ground. Their next target is 1.3800. |

| CRUDE OIL +0.88% |

| Crude oil price is currently up 0.88% and is trading at USD$52.61. WTI is starting to feel the pressure from the delay of the covid-19 vaccines globally, as the oil market needs the industry to start back to pre-covid production levels for demand to rebound. However, new variants of the coronavirus have kept crude oil at the USD$52 support level. |

|

| Support 1: 52.40 Support 2: 52.19 Support 3: 52.04 Resistance 1: 52.76 Resistance 2: 52.91 Resistance 3: 53.12 Pivot Point: 52.55 |

| Bulls are trying to gain momentum and are targeting the USD$56 resistance. Bears are targeting USD$52.04 support. Expected trading range between 52.04 and 53.12. Pivot point for change in trend at 52.55. |

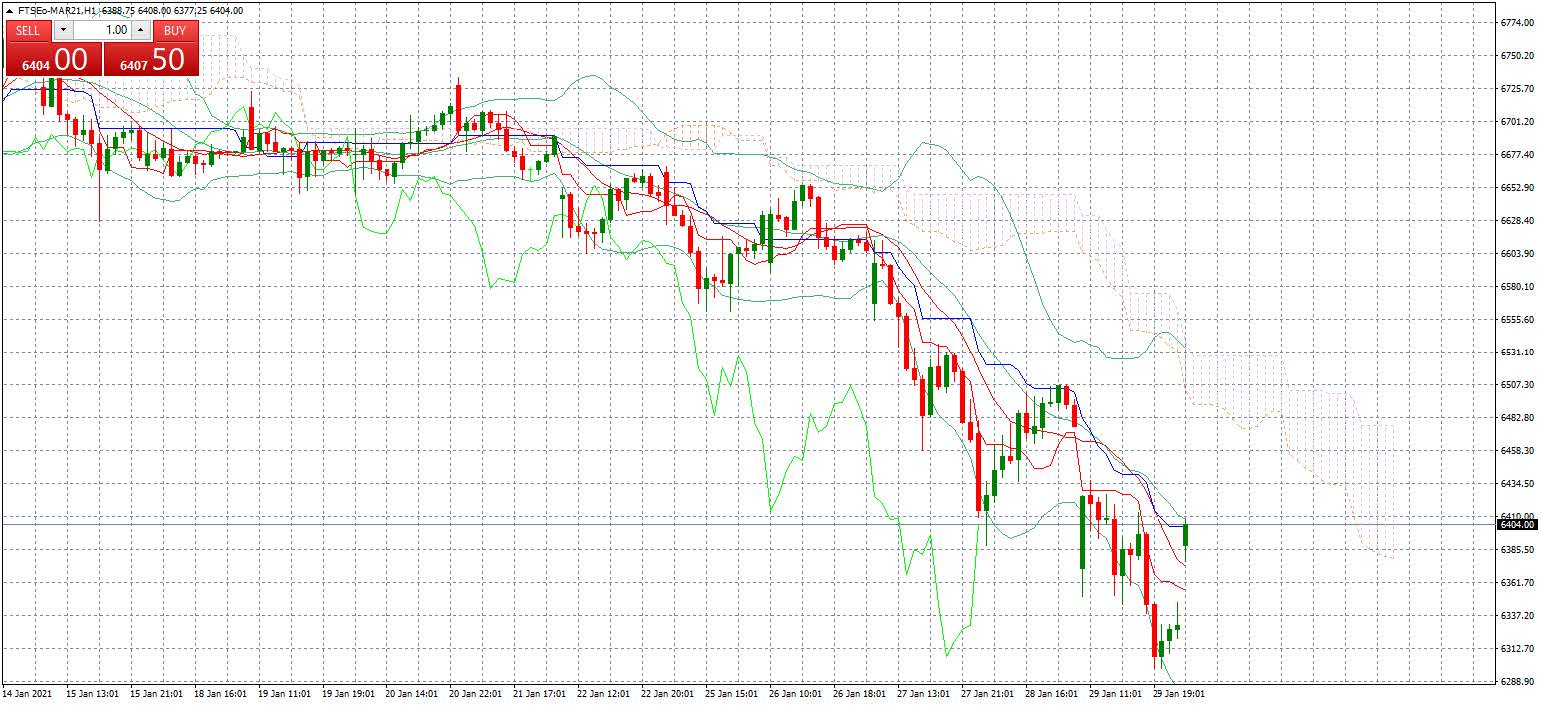

| FTSE 100 +1.21% |

| The British index is up 1.21% and is currently trading at 6,404. The index is rebounding from last week’s Friday close, where it lost 1%. Traders took buying positions on news of a possible agreement between AstraZeneca and the European Union. Among the British companies set to report Q4 2020 results this week are: BP, Vodafone, BT, Shell, among others. |

|

| Support 1: 6,378.4 Support 2: 6,353.7 Support 3: 6,340.9 Resistance 1: 6,415.9 Resistance 2: 6,428.7 Resistance 3: 6,453.4 Pivot Point: 6,391.2 |

| Last week the index reached 6,322 support. At the moment, the price is between the 38.2% and the 50% Fibonacci retracement level. It is also below the 25 and 50 day moving average. Pivot point at 6,391. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.