Daily review for December 30, 2021

Wall Street indexes are trying to close the year in positive territory. The focus is now on 2022, Omicron, inflation and monetary policy.

Energy demand in Europe and the northern hemisphere continues to rise. WTI, Brent and Natural Gas prices trade higher.

Metals bounce driven by traders hedging for the close of 2021 and early 2022.

Bitcoin closes the year with the worst month of 2021. Traders are attentive to regulation, consolidation of NFT projects and industry traceability. The above to build confidence.

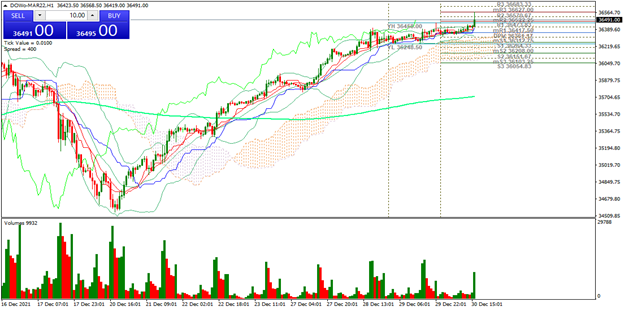

| DOW JONES +0.29% |

| Stock markets close the year with a positive outlook driven by global GDP growth of 3.2%. 2021 was an interesting year for the markets. While the real sector showed significant recovery peaks, the financial sector, together with the technology sector, were the best performers throughout the year. The pandemic drove demand through e-commerce, as well as non-physical cash transactions. The world’s largest economy showed a V-shaped recovery curve, which boosted all economic sectors globally. Now 2022 presents challenges such as inflation and the monetary policy strategy of central banks. Whether the world turns to recession or continued economic growth depends on the strategies implemented. |

|

| Support 1: 36,527.6 Support 2: 36,510.3 Support 3: 36,495.1 Resistance 1: 36,560.1 Resistance 2: 36,575.3 Resistance 3: 36,592.6 Pivot Point: 36,542.8 |

| The index maintains the bullish channel, this time the Bulls are looking for the target of 36,683 points. Expected trading range between 36,495 and 36,592. Pivot point for trend change at 36,542. RSI leaving the overbought zone. The price continues above the 200-day moving average. |

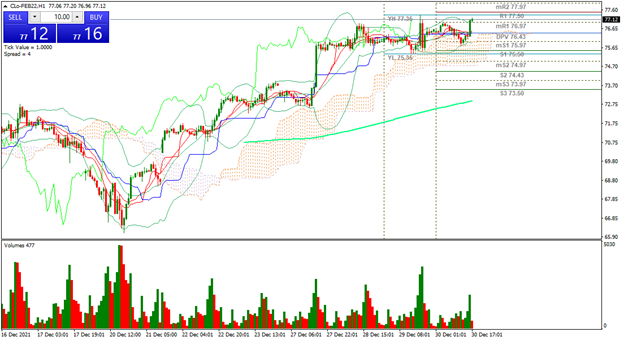

| WTI +0.90% |

| According to the Dallas FED Energy Survey, production costs per barrel in the United States are on the rise. In this sense, producers are trying to negotiate as many deals as possible to take advantage of the current price level. At the moment, WTI is up 0.90% and is trading at USD$77.30 per barrel. On the other hand, traders are keeping an eye on the energy outlook for 2022. The commodity market in the energy segment is rebounding, driven by energy demand from Europe and the Northern Hemisphere. |

|

| Support 1: 76.43 Support 2: 75.83 Support 3: 75.50 Resistance 1: 77.36 Resistance 2: 77.69 Resistance 3: 78.29 Pivot Point: 76.76 |

| The price is still above the 200-day moving average. It is currently between resistance 1 and 2. If the Bulls maintain the bullish volume, the price could reach USD$80 per barrel. Pivot point for trend change at USD$76.76. RSI approaching the overbought zone. |

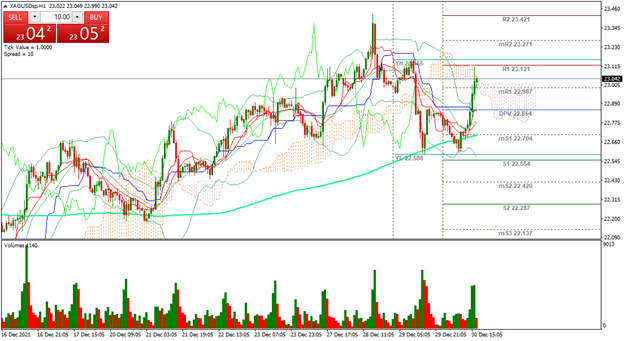

| SILVER +0.96% |

| Metals are trading higher driven by the strength of the USD. Silver is currently up 0.96% and is trading at USD$23.06 per Troy ounce. Traders continue to hedge their portfolios against the volatility that may be generated at the end of 2021 and early 2022. The price of gold shows a sideways movement above the USD$1,807 per troy ounce zone. Silver, due to its industrial use, could present continuity in the rally, even reaching the zone of USD$24 per troy ounce. |

|

| Support 1: 22.940 Support 2: 22.849 Support 3: 22.745 Resistance 1: 23.135 Resistance 2: 23.239 Resistance 3: 23.330 Pivot Point: 23.044 |

| Expected trading range between USD$22.74 and USD$23.33. Pivot point for trend change at USD$23.04. RSI approaching the overbought zone. The Bulls are looking for USD$23.42. If they succeed and overcome this resistance, the next target is USD$23.68. |

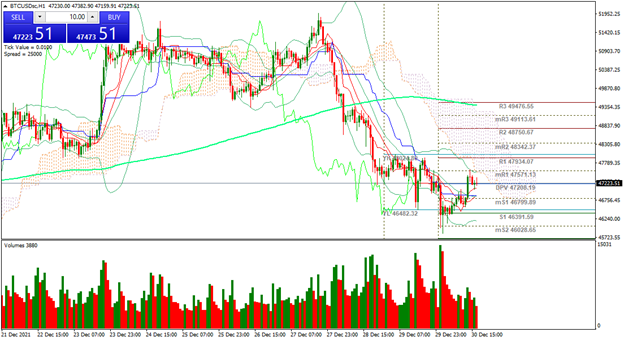

| BITCOIN -1.04% |

| The crypto market closes the year with the worst month of 2021. Despite the significant rebound in prices over the course of the year, December 2021 presented a price behavior characterized by a significant volume of sales, which did not allow cryptos to close the year at record highs. Bitcoin is currently down 1.04% and is trading at USD$47,224. Ethereum is down 1.98% and is trading at USD$3,719. The outlook for 2022 is the consolidation of the industry in terms of regulation and definition of NFT projects and their traceability to provide confidence to investors. |

|

| Support 1: 47,213.4 Support 2: 47,083.7 Support 3: 46,967.4 Resistance 1: 47,459.4 Resistance 2: 47,575.7 Resistance 3: 47,705.4 Pivot Point: 47,329.7 |

| The price is between the pivot point and resistance 1. Expected trading range between USD$46,967 and USD$47,705. Pivot point for trend change at USD$47,329. Possible sideways movement to close the year. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.