Daily review for December 21, 2021

Wall Street rebounds, traders continue to hold bullish positions in equities and metals. However, analysts assess the impact on the markets that Omicron’s expansion may continue to generate.

Commodities bounce, as physical traders look to deliver the most commodities before the end of 2021.

Former Twitter CEO Jack Dorsey, commented that Bitcoin will replace the dollar. Following the announcement, the crypto market began to rebound and change trend.

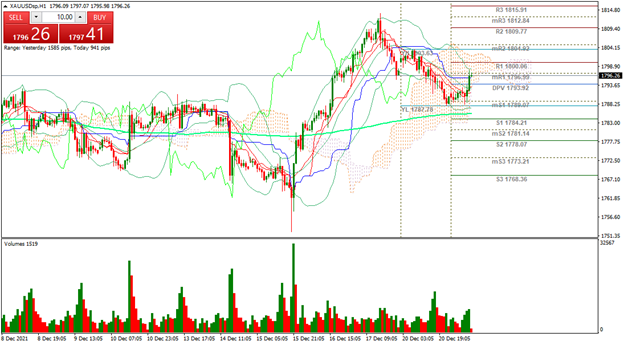

| GOLD +0.14% |

| Restrictions and the possibility of global confinements increase. Traders are taking hedge positions in metals in view of the possible increase in volatility in the markets at the end of the year. Gold is currently up 0.14% and is trading at USD$1,797 per Troy ounce. Hedge funds will soon be going on vacation, so trading volume will decrease considerably. For this reason, investors have opted to keep metals in their portfolios. |

|

| Support 1: 1,793.85 Support 2: 1,790.40 Support 3: 1,788.05 Resistance 1: 1,799.65 Resistance 2: 1,802.00 Resistance 3: 1,805.45 Pivot Point: 1,796.20 |

| Price is bouncing from support 1. Currently between the pivot point and resistance 1. Expected trading range between USD$1,788 and USD$1,805. |

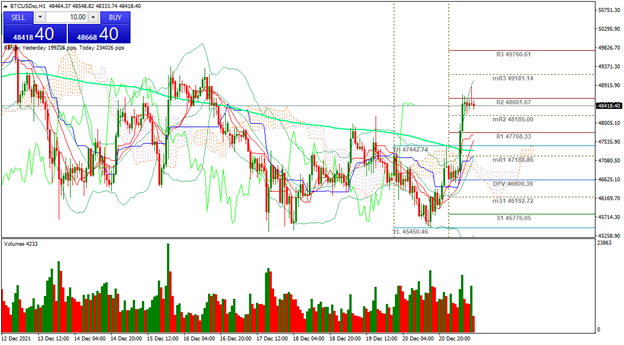

| BITCOIN +4.89% |

| Cryptos are currently bouncing back after two weeks of significant declines. In support of the bullish move, Jack Dorsey commented in the media that Bitcoin will replace the dollar. The former Twitter CEO has been a strong advocate of Bitcoin, so many traders are following Dorsey’s comments to take positions in cryptos. Bitcoin is currently up 4.89% and is trading at USD$48,418. |

|

| Support 1: 48,449.4 Support 2: 48,299.7 Support 3: 48,038.4 Resistance 1: 48,860.4 Resistance 2: 49,121.7 Resistance 3: 49,271.4 Pivot Point: 48,710.7 |

| The price is at resistance 2. It is also back above the 200-day moving average. Expected trading range between USD$48,038 and USD$49,271. Pivot point for trend change at USD$48,710. RSI in overbought zone. |

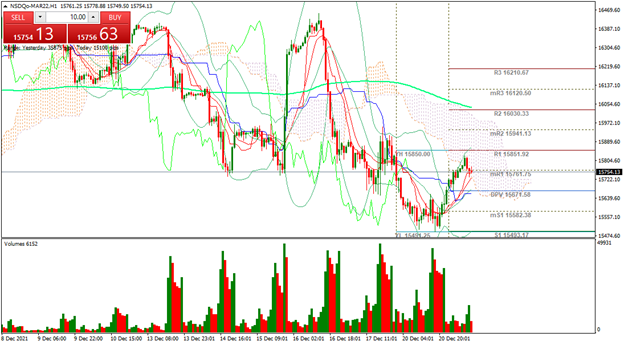

| NASDAQ 100 +0.88% |

| Wall Street indices are in positive territory. The Dow Jones is recovering 225 points. The Nasdaq 100 is up 0.88% and is trading at 15,770 points. Traders are paying attention to the fiscal policy in the United States. The infrastructure plan will generate investment, employment and household consumption. However, the focus is on the level of debt. The main focus of analysis is on the December 2021 macro data on the economy. |

|

| Support 1: 15,744.2 Support 2: 15,718.1 Support 3: 15,696.9 Resistance 1: 15,791.5 Resistance 2: 15,812.7 Resistance 3: 15,838.8 Pivot Point: 15,765.4 |

| Expected trading range between 15,696 and 15,838. Pivot point for trend change at 15,765. Price bounced from support 1, and Bulls are looking for a rally to resistance 3. RSI neutral. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.