Daily Review for August 18, 2021

Significant turbulence in yesterday’s stock market.

Bulls are looking for a rebound. At the moment, the indices are turning positive. Commodities are also looking for a rebound. Major upward movements in palladium and platinum.

Gold is looking for the upward channel again. Bulls look for USD$1,800.

Traders are waiting for the Euro Zone inflation data and the Fed’s monetary policy minutes.

Analysts expect a reduction in crude inventories by 1 million barrels. The market is alert to the decline in retail sales in the US, which may indicate a decrease in oil demand.

The DAX 30 is looking to reach the 16,000 area. Bulls are looking to consolidate the index above this mark.

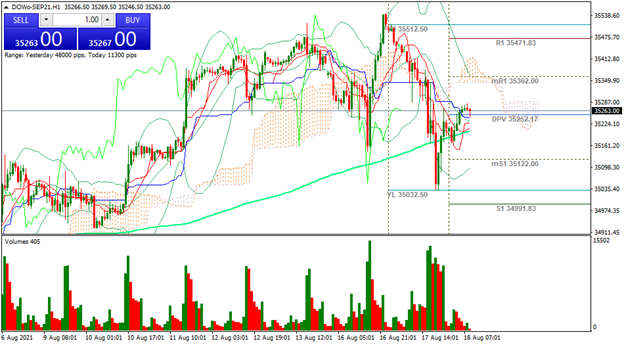

| DOW JONES -0.05% |

| The market closed yesterday with a significant drop in every asset class. Equities, commodities, futures, FX, presented bearish movements as a consequence of multiple factors. Among them, the Taliban in Afghanistan, the Delta Variant, the closure of ports in China and retail sales in the United States. For the time being, the market is starting to recover. The Dow Jones is down 0.05% and is trading at 36,366. The Fed seems to have calmed the markets. The monetary policy minutes will be released today. |

|

| Support 1: 35,331.1 Support 2: 35,323.6 Support 3: 35,311.6 Resistance 1: 35,350.6 Resistance 2: 35,362.6 Resistance 3: 35,370.1 Pivot Point: 35,343.1 |

| The index dropped to the 35,035 support. From this point it rebounded to the actual level, reaching to the pivot point. Sideways movement could occur before the macro data in Europe. Pivot point at 35,343. RSI neutral. |

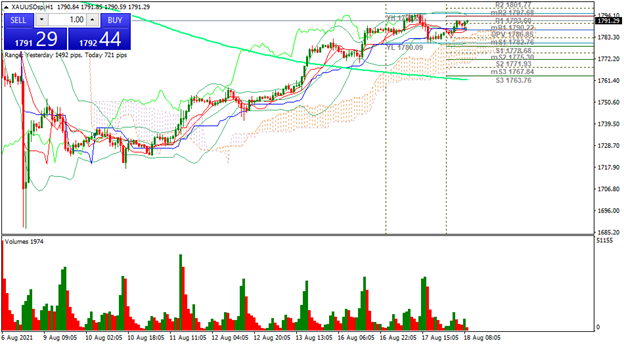

| GOLD +0.34% |

| After yesterday’s turmoil, gold has resumed the bullish channel. Investors have regained interest in the metal, mainly due to geopolitical and fundamental events. At the moment the gold price is up 0.34% and is trading at USD$1,791 per Troy ounce. Traders are awaiting the Euro Zone inflation data. In annual terms, the market is expecting a 2.2%. Traders are also aware of the U.S. building permits data, which may give an indication of the U.S. economy. |

|

| Support 1: 1,790.41 Support 2: 1,788.48 Support 3: 1,787.41 Resistance 1: 1,793.41 Resistance 2: 1,794.48 Resistance 3: 1,796.41 Pivot Point: 1,791.48 |

| Gold resumed the bullish channel. The price is between resistance 1 and 2. Expected trading range between USD$1,787 and USD$1,796. Pivot point for trend change at USD$1,791. RSI approaching the overbought zone. |

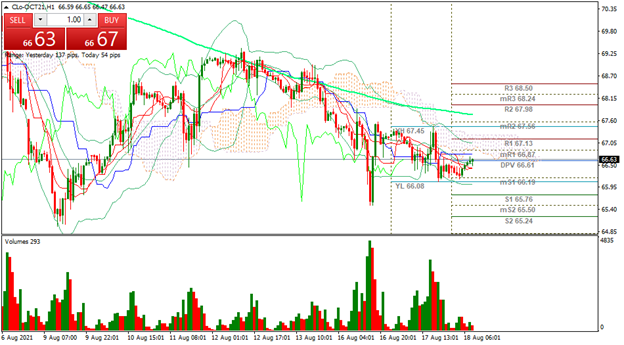

| CRUDE OIL +0.45% |

| Crude oil price is currently up 0.45% and is trading at USD$66.67 per barrel. Today we will have the inventories report from the IEA. Analysts expect a reduction of 1 million barrels. If the above is confirmed, the price could confirm the upward trend. However, the decrease in demand, given the events at the ports in China, and the decrease in retail sales in the United States, may continue to put pressure on the price of crude oil in the short term. |

|

| Support 1: 66.54 Support 2: 66.48 Support 3: 66.40 Resistance 1: 66.68 Resistance 2: 66.76 Resistance 3: 66.82 Pivot Point: 66.62 |

| The price is below the 200-day moving average. Expected trading range between USD$66.40 and USD$66.82. Pivot point at USD$66.62. Crude oil is between resistance 1 and the pivot point. Sideways trend while inventories are published. |

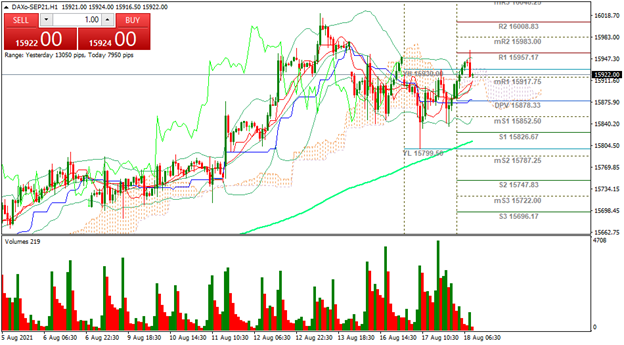

| DAX 30 +0.24% |

| Stock futures in Europe are mixed. The DAX 30 is showing upward movements of 0.24% as well as the FTSE100. Main downward movements in the IBEX 35 -0.19% and in the ATX -0.62%. After a day of high volatility, the DAX 30 has started to regain its upward trajectory. Traders are analyzing Eurozone inflation. Positive and controlled inflation generates upward movements in equities, which is why investors are aware of it. On the other hand, DAX 30 companies are being audited in terms of transparency. |

|

| Support 1: 15,941.5 Support 2: 15,935.5 Support 3: 15,932.5 Resistance 1: 15,950.5 Resistance 2: 15,953.5 Resistance 3: 15,959.5 Pivot Point: 15,944.5 |

| The price is above the 200-day moving average. The index remains near 16,000 points, which is the Bulls’ target. If the market rebounds, the price could exceed this level. Expected trading range between 15,932 and 15,959. Pivot point at 15,944. RSI neutral. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.