Daily Review for April 26, 2022

Elon Musk secured a deal to buy Twitter. The company’s Board of Directors accepted the acquisition offer for a value of USD$44 billion.

Today Microsoft and Alphabet present their financial results.

Bitcoin is currently up 4.86% and is trading at USD$40,505, boosted by the Twitter acquisition deal.

Moody`s risk rating agency forecasts record earnings for Oil & Gas companies.

Traders continue to watch for the European Central Bank’s first interest rate hike.

| NASDAQ 100 -0.14% |

| Elon Musk secured a deal to buy Twitter. The company’s Board of Directors accepted the acquisition offer for a value of USD$44 billion. The company’s stock closed up 5.66% and traded at USD$51.70. After the close, the company has presented a rise of 0.44%. As for the index, the Nasdaq 100 is currently trading at 13,516 points, falling 0.14%. After the Board of Directors’ announcement to approve the offer, the equity market, mainly on Wall Street, recovered. Today, Microsoft and Alphabet present financial results. |

|

| Support 1: 13,539.3 Support 2: 13,523.7 Support 3: 13,507.5 Resistance 1: 13,571.1 Resistance 2: 13,587.3 Resistance 3: 13,602.9 Pivot Point: 13,555.5 |

| The index is below the 200-day moving average, just between support 2 and resistance 1. Expected trading range between 13,507 and 13,602. Pivot point for trend change at 13,555. RSI coming out of the overbought zone, so the index could correct some additional points. |

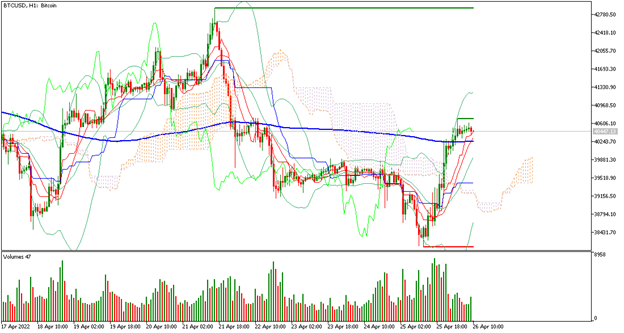

| BITCOIN +4.86% |

| Boosted by the Twitter buyout deal, the cryptocurrency market is reacting positively to Elon Musk’s deal. Bitcoin is currently up 4.86% and is trading at USD$40,505. According to cryptocurrency exchange Buda, the two million Bitcoins that remain to be mined could take 118 years to be mined. The Twitter transaction has generated a significant volume of purchases in Bitcoin, with which the Bulls begin to look for the first target of USD$50,000. |

|

| Support 1: 40,444.0 Support 2: 40,368.0 Support 3: 40,275.0 Resistance 1: 40,613.0 Resistance 2: 40,706.0 Resistance 3: 40,782.0 Pivot Point: 40,537.0 |

| The price is above the 200-day moving average, which is a bullish signal for Bitcoin. The price is close to resistance 1, so traders need more upward momentum to reach USD$42,800 and continue climbing. Pivot point for trend change at USD$40,537. RSI in overbought zone. |

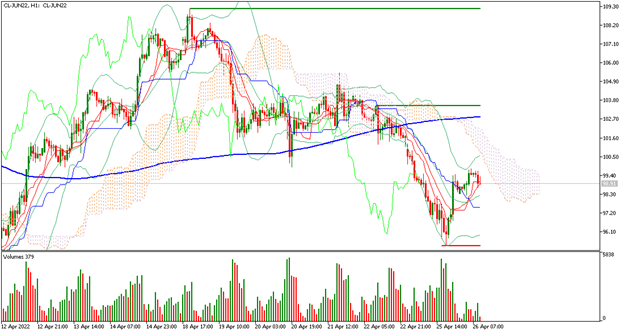

| WTI +0.24% |

| Moody’s risk rating agency forecasts record profits for Oil & Gas companies. On the other hand, economists warn of a possible economic recession in Europe, if the continent applies sanctions on natural gas from Russia. Natural gas prices in Europe are on the rise due to the windy season, which means less wind power generation. WTI is currently up 0.24% and is trading at USD$98.78 per barrel. |

|

| Support 1: 98.53 Support 2: 98.15 Support 3: 97.58 Resistance 1: 99.48 Resistance 2: 100.05 Resistance 3: 100.43 Pivot Point: 99.10 |

| The price is below the 200-day moving average, just between resistance 1 and support 2. Expected trading range between USD$97.58 and USD$100.43. Pivot point for trend change at USD$99.10. RSI neutral, so the price could start to climb towards resistance 1. |

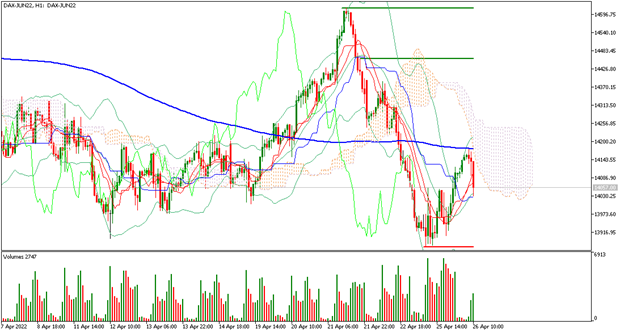

| DAX 40 +0.88% |

| The German stock index managed to recover on the back of Elon Musk’s takeover of Twitter. At the moment, the Dax 40 is up 0.88% and is trading at 14,046 points. Traders continue to keep an eye on the possible first interest rate hike by the European Central Bank. For the time being, the Bank has maintained a pro-growth monetary policy strategy. However, the level of inflation in Europe has started to generate a change in the Bank’s policy path. |

|

| Support 1: 13,577 Support 2: 13,199 Support 3: 12,438 Resistance 1: 14,321 Resistance 2: 14,603 Resistance 3: 14,925 Pivot Point: 14,108.1 |

| The price is below the 200-day moving average just between support 2 and resistance 1. Expected trading range between 12,438 and 14,925. Pivot point for trend change at 14,108. RSI neutral, so the index could continue the rebound. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.