Daily Review for April 15, 2022

Equities, indexes and commodities markets are closed worldwide. Traders are focused on the performance of cryptocurrencies and the most volatile currency pairs.

Bitcoin corrects and remains sideways above USD$40,000. The Bitcoin conference called Baltil Honeybadger has been confirmed in Europe. Bulls are looking to increase buying volume at the current level, seeking USD$50,000.

Ethereum developers will decide by the end of April whether or not it is advisable to move forward to the Ethereum 2.0 merger.

After the European Central Bank’s announcement to keep interest rates stable, the Euro showed a significant drop. As did the British Pound.

| BITCOIN -2.74% |

| Today the stocks, commodities and indexes markets are closed, so traders have turned their attention to cryptocurrencies. In Europe, the Bitcoin conference called Baltil Honeybadger was announced, which will be held on September 3, 2022. At the moment, Bitcoin keeps sideways movement near USD$40,000. Bulls maintain interest in increasing long positions at this level, looking for resistance 1 and 2. At the moment the Bitcoin is down 2.74% and is trading at USD$40,072. |

|

| Support 1: 40,089.6 Support 2: 40,041.8 Support 3: 39,976.6 Resistance 1: 40,202.6 Resistance 2: 40,267.8 Resistance 3: 40,315.6 Pivot Point: 40,154.8 |

| Bitcoin is looking to bounce from support 1. However, the sideways trend remains in place. On the other hand, the rise in support from USD$39,462 to supports 1 and 2, evidence that buyers are starting to gain ground. Pivot point for trend change at USD$40,154. RSI neutral. |

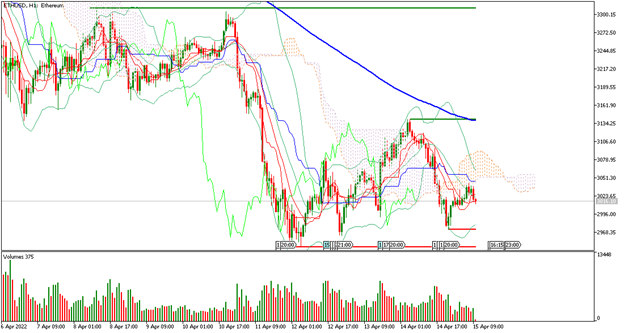

| ETHEREUM -2.78% |

| Ethereum developers will decide by the end of April whether or not it is advisable to move forward to Ethereum 2.0 merger. The announcement date is April 29, 2022. Because of the above, the market estimates that by June the platform update will not be available. Ethereum is currently down 2.78% and is trading at USD$3,020. |

|

| Support 1: 3,030.10 Support 2: 3,022.81 Support 3: 3,015.99 Resistance 1: 3,044.21 Resistance 2: 3,051.03 Resistance 3: 3,058.32 Pivot Point: 3,036.92 |

| The price is below the 200-day moving average. Expected trading range between USD$3,015 and USD$3,058. Pivot point for trend change at USD$3,036. RSI neutral. The Bulls are looking for the target at resistance 1, in order to climb towards USD$3,307. |

| EURUSD -0.18% |

| The EURUSD pair is showing bearish movements, dropping 0.18% and trading at 1.0808. Yesterday, after the European Central Bank’s announcement to keep interest rates stable, the Euro showed a significant drop. However, the bank’s goal is to continue to support the market and economic growth, but to remove economic stimulus such as bond purchases. Traders continue to watch the Euro Zone inflation rate, where analysts expect the next reading to be 7.5% per annum, which is above the 2% target. |

|

| Support 1: 1.0802 Support 2: 1.0799 Support 3: 1.0796 Resistance 1: 1.0807 Resistance 2: 1.0811 Resistance 3: 1.0813 Pivot Point: 1.0805 |

| Price is below the 200-day moving average. Expected trading range between 1.0796 and 1.0813. Pivot point for trend change at 1.0805. RSI neutral, so the price could continue to correct to the next support level of 1.0756. |

| GBPUSD -0.03% |

| The GBP/USD pair fell below the 1.3100 level as it weakened after the European Central Bank’s announcement. Traders continue to watch the Fed’s tightening monetary policy strategy. Interest rate hikes are expected to be faster than initially anticipated. Sterling may move sideways to the downside as the Bank of England is likely to be more dovish due to high inflation and economic growth risk. |

|

| Support 1: 1.3052 Support 2: 1.3043 Support 3: 1.3035 Resistance 1: 1.3069 Resistance 2: 1.3077 Resistance 3: 1.3086 Pivot Point: 1.3060 |

| The price is below the 200-day moving average. Expected trading range between 1.3035 and 1.3086. Pivot point for trend change at 1.3060. RSI neutral so the price could discount additional points. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.