Daily Review for April 14, 2022

Corporate earnings season has begun. Today Well Fargo, Morgan Stanley, Goldman Sachs, Citigroup and others present results.

The ECB stopped buying bonds. The bank expects an interest rate hike soon. The economic impact of inflation and the war continues to be the focus of analysis.

U.S. crude oil inventories increased by 9.38 million barrels.

Bitcoin looks to consolidate the USD$41,000 zone. Bulls look to regain the 200-day moving average zone.

The Dow Jones is moving sideways. Traders are watching the corporate results of the financial sector in the United States.

| EUROSTOXX 50 +0.37% |

| In view of the high level of inflation in Europe, the European Central Bank continues to withdraw economic stimulus. High inflation and the war in Ukraine could lead to an economic recession. The ECB has not raised interest rates for the moment, maintaining the strategy of supporting the market in the midst of the recovery from the pandemic and now with the war. Among the bank’s measures, it is putting an end to bond purchases and raising interest rates. Inflation in the Euro Zone is at 7.5%, well above the 2% annual inflation target. |

|

| Support 1: 3,764 Support 2: 3,761 Support 3: 3,756 Resistance 1: 3,772 Resistance 2: 3,777 Resistance 3: 3,780 Pivot Point: 3,769 |

| The index is below the 200-day moving average. The price is between support 2 and resistance 1. Expected trading range between 3,756 and 3,780. Pivot point for trend change at 3,769. RSI neutral, so the index could continue the upward movement towards resistance 1. |

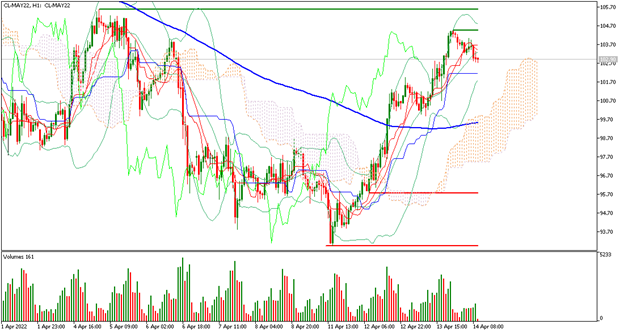

| WTI -1.33% |

| Commodity traders are watching Libya’s investment plan, which could increase its natural gas production by 30%, with a focus on supplying European markets. Physical commodity traders have announced the termination of crude oil purchases from Russia as of May 2022. Russia continues to sell higher volumes of crude oil to China. In the U.S. inventories report, inventories increased by 9.38 million barrels, exceeding market expectations. |

|

| Support 1: 102.73 Support 2: 102.49 Support 3: 102.20 Resistance 1: 103.26 Resistance 2: 103.55 Resistance 3: 103.79 Pivot Point: 103.02 |

| The price is above the 200-day moving average. WTI started to take the USD$102 per barrel area, after reaching the resistance 1. Expected trading range between USD$102.20 and USD$103.79. Pivot point for trend change at USD$103.02. RSI neutral so the current correction may be extended. |

| BITCOIN +2.65% |

| Following the U.S. inflation report, which reported a 6.5% annualized inflation, traders started buying Bitcoin. Gold is considered the traditional safe haven asset in the face of inflation. However, Bitcoin is also emerging as a hedging instrument, attracting the attention of hedge funds. Bitcoin is currently up 2.65% and is trading at USD$41,186. According to MicroStrategy’s CEO, Michael Saylor, it is only a matter of time before Bitcoin is accepted globally. |

|

| Support 1: 41,136.6 Support 2: 41,057.7 Support 3: 40,952.5 Resistance 1: 41,320.7 Resistance 2: 41,425.9 Resistance 3: 41,504.8 Pivot Point: 41,241.8 |

| The price is below the 200-day moving average, however it is trading near resistance 1, so if the Bulls overcome it, the next upward move could be above the moving average line. Expected trading range between USD$40,952 and USD$41,504. Pivot point at USD$41,241. RSI near the overbought zone. |

| DOW JONES +0.09% |

| Corporate earnings season has begun. Yesterday JP Morgan presented its results, where it did not exceed the market’s earnings per share expectations. However, in revenues it presented USD$30.72 Billion against USD$30.63 Billion expected. Today Well Fargo, Morgan Stanley, Goldman Sachs, Citigroup, among others, present their results, that is to say, a day of results from the financial sector. At the moment the Dow Jones is up 0.09% and is trading at 34,605. |

|

| Support 1: 34,583.3 Support 2: 34,565.8 Support 3: 34,530.9 Resistance 1: 34,635.7 Resistance 2: 34,670.6 Resistance 3: 34,688.1 Pivot Point: 34,618.2 |

| Price is at the same level of the 200-day moving average. Important bounce from support 2. Expected trading range between 34,530 and 34,688. Pivot point for trend change at 34,618. RSI neutral, so the sideways trend could hold. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.