Daily Review for April 11, 2022

Energy commodity prices are correcting as a result of European Union sanctions on Russia’s energy sector.

The war in Ukraine continues. Russia initiates a new escalation. The United States and NATO maintain weapons and strategic support for Ukraine.

The Bitcoin Conference 2022 event in Miami came to an end. The event served to gain the attention of institutions, investors and countries. Bitcoin ETFs are expected to be created. Bulls maintain short-term outlook of USD$52,000.

WTI corrects more than 2%. The price discounted the level of USD$100 per barrel. Further correction is expected due to increased supply in the market stemming from the release of strategic reserves from the US and UK.

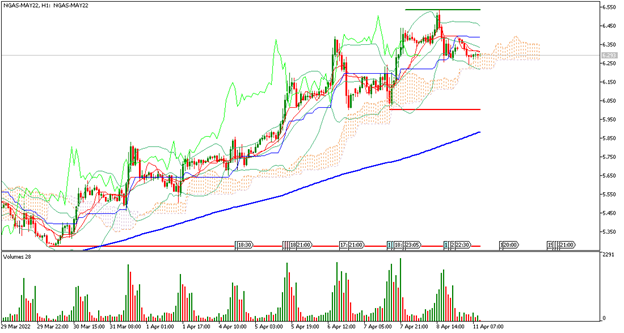

| NATURAL GAS -0.49% |

| The members of the European Union continue to develop strategies to replace natural gas imports from Russia. Italy, for its part, is closing new supply agreements with Algeria. At the moment the price of natural gas is falling 0.49% and is trading at USD$6.29 per BTU. Other EU members, such as Austria and Germany, have expressed their disagreement with the energy sanctions against Russia, and Germany is even seeking to support Gazprom’s subsidiary in the country to not declare insolvency. |

|

| Support 1: 6.280 Support 2: 6.267 Support 3: 6.257 Resistance 1: 6.303 Resistance 2: 6.313 Resistance 3: 6.326 Pivot Point: 6.290 |

| The price is above the 200-day moving average. Expected trading range between USD$6.25 and USD$6.32. Pivot point for trend change at USD$6.29. RSI neutral. Ichimoku cloud projects sideways trend above USD$6.28. |

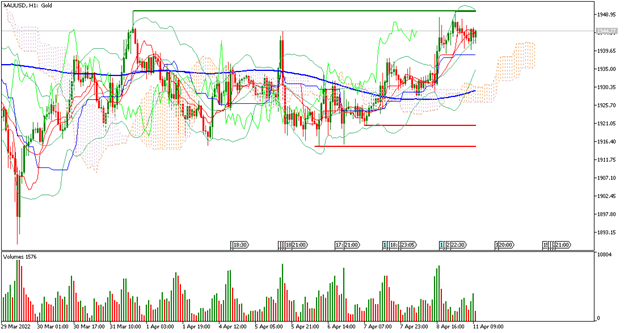

| GOLD -0.07% |

| At the moment gold continues to move sideways despite the new Russian military offensive in Ukraine. At the moment the price of gold is down 0.07% and is trading at USD$1,944 per Troy ounce. The United States declared that it will continuously supply arms to Ukraine, due to Russia’s new military offensive. Investors are attentive to the development of the war. Stock markets start the week in negative territory, with main falls in the Chinese stock exchanges and in the Russian RTS. |

|

| Support 1: 1,940.85 Support 2: 1,939.70 Support 3: 1,938.30 Resistance 1: 1,943.40 Resistance 2: 1,944.80 Resistance 3: 1,945.95 Pivot Point: 1,942.25 |

| The price is above the 200-day moving average and right at resistance 2, where it has formed a double top. Expected trading range between USD$1,938 and USD$1,945. Pivot point for trend change at USD$1,942. RSI near the overbought zone. |

| BITCOIN -0.82% |

| Bitcoin Conference 2022 in Miami ends, and the event generated the interest of investors, institutions and countries, for the adoption of the crypto in the long term. Bitcoin is currently down 0.82% and is trading at USD$42,263 which is the yearly low level. One of the main takeaways from the event is that it is vital that ETFs on Wall Street on Bitcoin are approved in order for the price to rebound from the current level. The Bulls maintain the short-term target of USD$52,000. |

|

| Support 1: 42,183.4 Support 2: 42,112.7 Support 3: 42,019.4 Resistance 1: 42,347.4 Resistance 2: 42,440.7 Resistance 3: 42,511.4 Pivot Point: 42,276.7 |

| The price is below the 200-day moving average, which is a bearish signal for Bitcoin. Expected trading range between USD$42,019 and USD$42,511. Pivot point for trend change at USD$42,276. RSI neutral, so Bitcoin may present a further correction towards the support points. |

| WTI -2.79% |

| European Union’s energy sanctions against Russia have begun. For the time being, restrictions have been imposed on coal imports. For its part, Russia is increasing its oil exports to India and China. The price of WTI is currently down 2.79% and is trading at USD$96.39 per barrel. The strategic reserves of the United States and the United Kingdom continue to try to balance prices. Brent is close to discounting USD$100 per barrel. |

|

| Support 1: 95.93 Support 2: 95.65 Support 3: 95.35 Resistance 1: 96.51 Resistance 2: 96.81 Resistance 3: 97.09 Pivot Point: 96.23 |

| The price is below the 200-day moving average. Expected trading range between USD$95.35 and USD$97.09. Pivot point for trend change at USD$96.23. RSI neutral. The price is close to support 1, where it could consolidate the area. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.